Outlook:

We are so accustomed to the US economy being the most robust among G7 that it’s quite a shock to be falling behind supposedly sclerotic Europe. While we can blame some of the first quarter’s lousy 0.2% growth rate on the Q1 cyclical effect, weather, the port strike and the dollar, this time Q1 is one-third the rate of the other first quarters since 2010 of 0.6%.

Moreover, we might have had any growth at all were it not for inventory-building, and “nonresidential fixed investment,” aka capital spending, was a sloppy 3.4% (from 4.7% in Q4). So, yes, the US may well have a growth problem, even if the Fed put a brave face on it and called the issues “transitory.”

Worse, the PCE price index fell at 2% annualized when the Fed wants +2%. Core prices were 0.9%, half the Q4 number and the lowest since 2010.

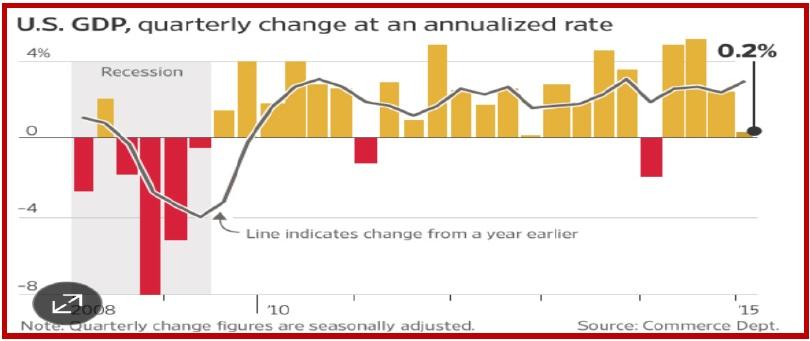

See the GDP chart below (from the WSJ). While the US economy staggers along just over stall speed, we are dismayed by the variability of the quarterly data. We have had only four quarters over the 4% growth “norm” since the 2008 recession. You have to wonder if there is some structural deficiency at work, and if there is, are the critics correct that it’s income inequality?

Meanwhile, Europe is looking pretty springy. Yesterday private sector lending was higher for the first time in 3 years, even if it was a by a ridiculously low 0.1%. Today inflation at zero is “good” because it’s no longer negative, and HIS says Q1 growth could be 0.5% or 2% annualized, beating the US. Well, we have seen this picture before—Europe beating the US in growth—and unfortunately, it tends to have a lasting effect. Higher growth in the US is seen as natural and fails to benefit the dollar, while higher growth in Europe is exceptional and does support the euro. Go figure.

The funny thing is what is going on behind the scenes in the tippy-top of the financial markets. We had a hard time wrapping our heads around zero and negative interest rates in Europe and now we are having a hard time grasping the rise in European yields from near zero to 0.33% (Bunds) in under two weeks.

The FT explains it thus: “’With European borrowing costs among the world’s very lowest with strong visibility that this would be maintained, the euro has become a key funding currency for leveraged risk or ‘carry’ trades,’ said Citi Private Bank. ‘Thus, the inverse correlation between the euro and risk assets has picked up, exposing some hedgers to an adverse near-term trend of both falling equities and a rising euro.’ The yield on the 10-year German Bund climbed another 6 basis points early on Thursday to 0.36 per cent, the highest level since ECB president Mario Draghi launched QE on March 9. Just two weeks ago the benchmark yield was flirting with zero per cent.”

Got that? It seems to mean the euro rally is based almost entirely on hedging by Europeans that was not matched by a parallel hedging by US fund managers and multinationals. The Market News FX reporters writes that the usual relationship between the EUR/USD and the yield spread “was not the case for the euro Wednesday, where U.S. Treasury yields rose in line with German Bund yields, but the magnitude of the Bund yield rise carried more clout and thus supported the euro. Ten-year U.S. Treasury yields were closing near 2.047%, in the middle of the day's wider than usual range of 1.98% to 2.08%. Traders were happy to see 10-year yields decisively break out of the 1.85% to 2.0% range seen in recent weeks.

But “Ten-year German Bund yields ended the day near 0.283%, down from an earlier high of 0.288% and compared to the record low yields near 0.0485% seen April 17. Sales of German Bunds and the German DAX also was said to lead to unwinds of currency hedges put on in prior months. This led to extra euro demand which exacerbated the fast-paced dollar selling already being seen.”

Hardly anybody saw it coming. The rising euro scenario was given a low probability, especially given the sheer size of the record short position. But everything lined up to favor the euro rally—the shifting Bund yield, month-end positioning, and technical events on the chart. Just about everybody had to scramble, and now the chart-mavens are reviving longer-dated charts to seek out the topside. See the monthly chart below. We have to entertain the possibility of 1.3240 (the 50% retracement) or at least the 25% retracement at 1.1842.

We can imagine the 1.1842 but not much more for the correction, but you never know. The billions of dollars of unwinds to come could give us a bizarrely abnormal rising slope—plus, it looks like Greece is caving. The smart policy is to get out of the way. It won’t be a one-way street and choppiness could ensue.

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.