Stocks face Wave of destruction/opportunity

Let's catch the Wave.

Good morning,

Not any old wave.

The wave to enrich our experiences and perhaps even our fortune.

By 'the wave', I mean this could be immense. Does anyone ever know for sure? Of course not. Wait a second, actually, yes I do!

Sincerely, I believe we are now in a bear market in US stocks.

The Australian stock market has a been going down for nearly four months now. We have been stubbornly bearish the whole way and it is paying off.

Please also note the technology sector as a whole is at grave risk. All great stuff, wonderful products and services, but the next phase will be that these companies have to firstly make actual profits, and secondly their valuations will become more reasonable. Not back to the old traditional multiples, but somewhere between there and the current peak. Yes, I do believe tech sector multiples are quite possibly at their all time highs right now.

Just on the basis of the first principle alone, I sold Afterpay at its highs. Uber is extremely vulnerable. So far, I think it has lost around $25 billion or more. Never made a profit. Yes, brand and market share have value, but only if you can do something with it? This is the hope of course. Though any turn to profit at some distant point in the future will be a low return on what has been lost.

All I am really trying to say is that 'reality' may be becoming popular again? Though it is more likely to be a forced popularity. A bit like vaccination.

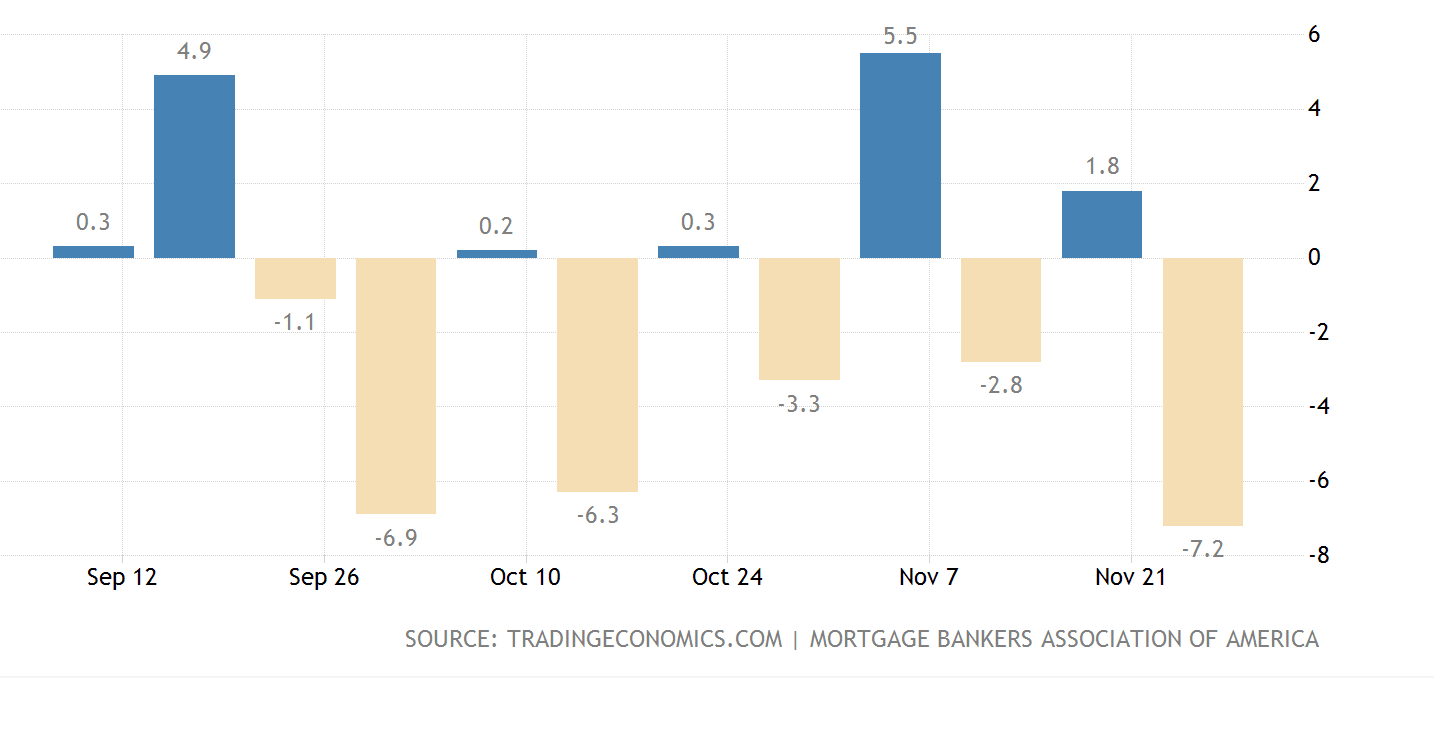

US Mortgage Applications Collapse.

Still seeing this as part of the second great US housing bubble of the century getting ready to burst. Leveraged long in US real estate is not a comfortable place to be.

US Construction is flat.

There are supply issues certainly, and this will keep construction pumping for the time being. Elongating the activity curve. Infrastructure spending will certainly help as it rather slowly comes into fruition in actual projects.

That there was so much fanfare about a partial catch up by the USA to where the rest of the world is already at, is a worry. Suggesting an entrenched staying behind the curve in this department. Though at least gaining some ground.

US Manufacturing firm.

This was stronger than I expected. There have been some significant stabilisation indications in the US data of late. Though there are now new threats to the outlook and we are certainly well down on the initial recovery.

First Thoughts.

What if: ASX200 5232.

This mornings sunrise comment on just how big this moment could be.

AUS200 Weekly

Wave Riding Direction Signals.

This will be a daily wave thought with levels. This is not advice as your circumstances are unique to yourself and you should seek independent financial advice. This is purely for the joy of riding the wave. One idea a day.

Well we have to get involved with this set. Please keep in mind we have been bearish from the top of these. The Australian dollar for instance: Calling 70 cents live on ausbiz TV at .7745.

Wave Direction Signal today,

US500 sell at market, 4513, direction signal stop loss (you get the idea), 4689. This is big wave riding. Not for the feint hearted.

AUS200 sell at market, 7157, direction signal stop loss, 7350.

EURUSD sell at market, 1.1318, direction signal stop loss, 1.1460.

AUDUSD sell at market, .7104, direction signal stop loss, .7275.

Gold buy at market, 1783, direction signal stop loss, 1763.

Expect to get it wrong. Losses are guaranteed.

Clifford Bennett personal only.

No other party involved.

May the markets be fair, even kind to you.

Author

Clifford Bennett

Independent Analyst

With over 35 years of economic and market trading experience, Clifford Bennett (aka Big Call Bennett) is an internationally renowned predictor of the global financial markets, earning titles such as the “World’s most a