Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook is now neutral, and our short-term outlook is neutral:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): bearish

Long-term outlook (next year): bullish

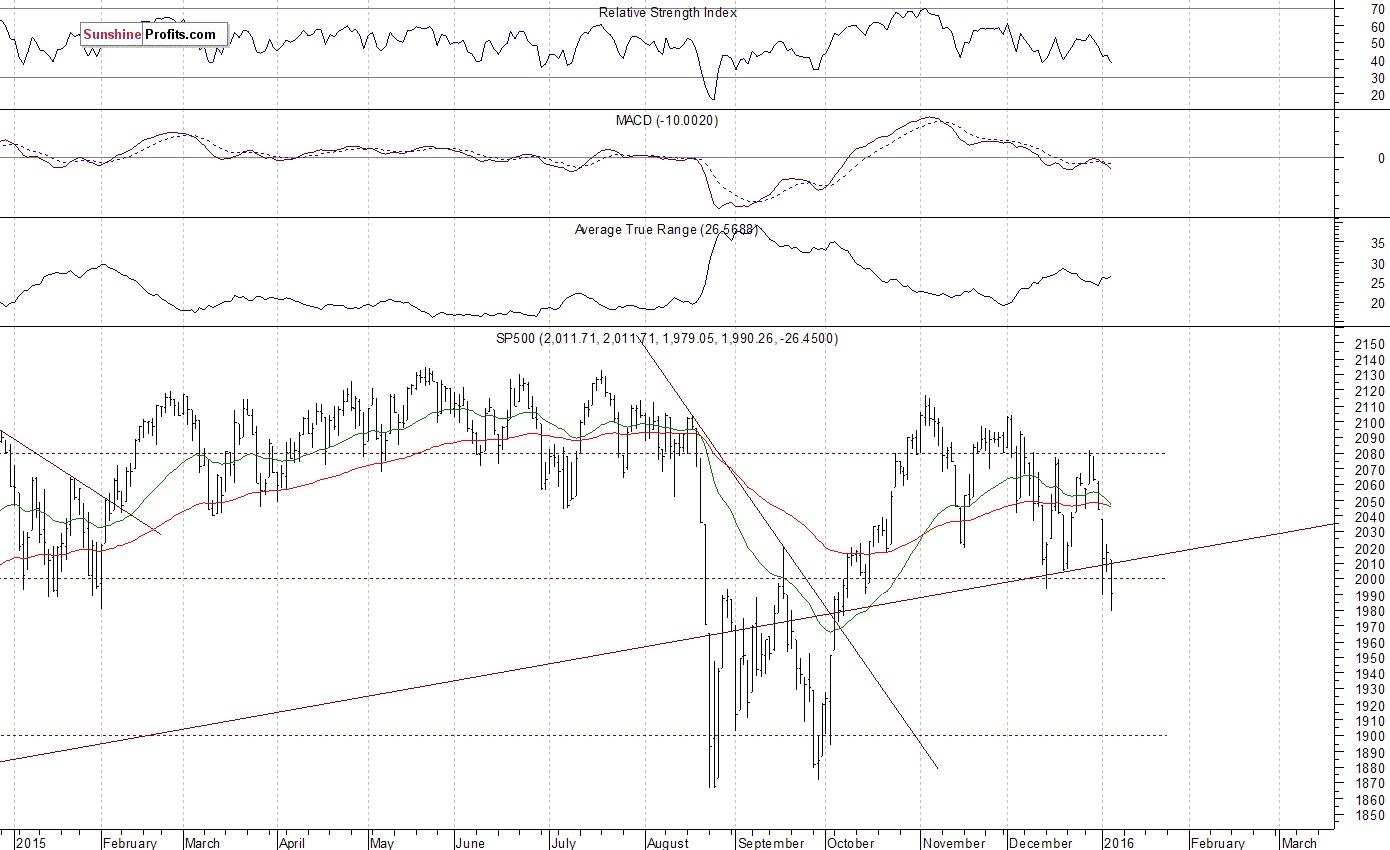

The U.S. stock market indexes lost 0.9-1.5% on Wednesday, extending their recent move down, as investors reacted to economic data releases, oil prices decline. The S&P 500 index broke below 2,000 mark. The nearest important level of support is at 1,990-2,000, and the next potential support level is at around 1,950, marked by early October daily gap up, among others. On the other hand, level of resistance is at 2,000 mark, and the next important resistance level is at around 2,040, marked by Monday's daily gap down of 2,038.20-2,043.62. There have been no confirmed positive signals so far. However, we can see some short-term oversold conditions which may lead to an upward correction at some point:

Expectations before the opening of today's trading session are very negative, with index futures currently down 2.2-3.0%, as investors react to Chinese stock market, oil prices sell-off. The main European stock market indexes have lost 2.7-3.3% so far. Investors will now wait for the Initial Claims number release at 8:30 a.m. The S&P 500 futures contract trades within a sharp intraday downtrend, as it extends its recent sell-off. The nearest important level of resistance is at around 1,950-1,970, marked by previous local lows. On the other hand, potential support level is at 1,910-1,930, marked by some last year's local highs. There have been no confirmed positive signals so far. However, we can see short-term oversold conditions:

The technology Nasdaq 100 futures contract follows a similar path, as it accelerates its short-term downtrend. It currently trades close to 4,300 mark. The nearest important level of resistance is at around 4,350-4,400. There have been no confirmed short-term positive signals so far. The market broke below yesterday's intraday consolidation, as we can see on the 15-minute chart:

Concluding, the broad stock market is expected to open much lower today, as the index futures are down more than 2% right now. However, we can see some short-term technical oversold conditions. Therefore, we decided to close our profitable speculative short position (2,077.34, S&P 500 index) at the opening of today's cash market trading session. As of this morning, we prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD clings to small gains above 1.2550

Following Friday's volatile action, GBP/USD edges highs and trades in the green above 1.2550. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold price rebounds on downbeat NFP data, eyes on Fedspeak

Gold price (XAU/USD) snaps the two-day losing streak during the European session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Fed.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.