Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook remains neutral, and our short-term outlook is neutral:

Intraday (next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

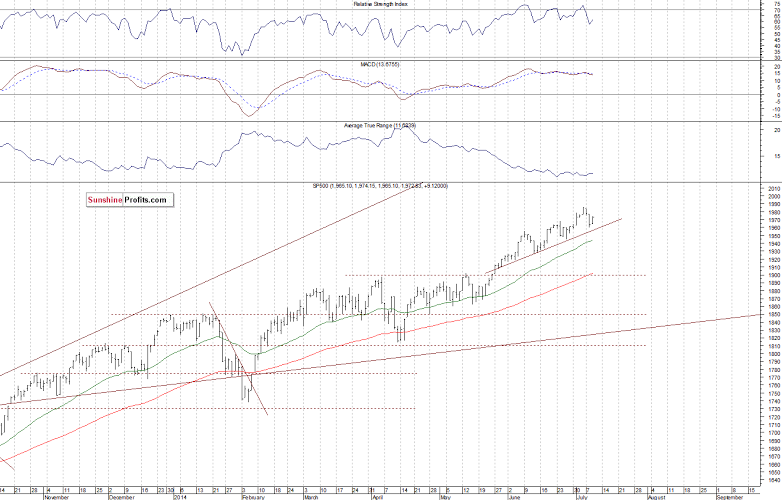

The main U.S. stock market indexes gained between 0.5% and 0.8% on Wednesday, retracing some of their recent decline, as investors reacted to FOMC Minutes data release, among others. The S&P 500 index continues to fluctuate below its July 3 all-time high of 1,985.59. The level of resistance is at around 1,980-1,985, and the next resistance is at the psychological level of 2,000. On the other hand, the nearest important support is at 1,950-1,960, marked by some of the recent local extremes. There have been no confirmed negative signals so far. The index remains above month-long upward trend line, as we can see on the daily chart:

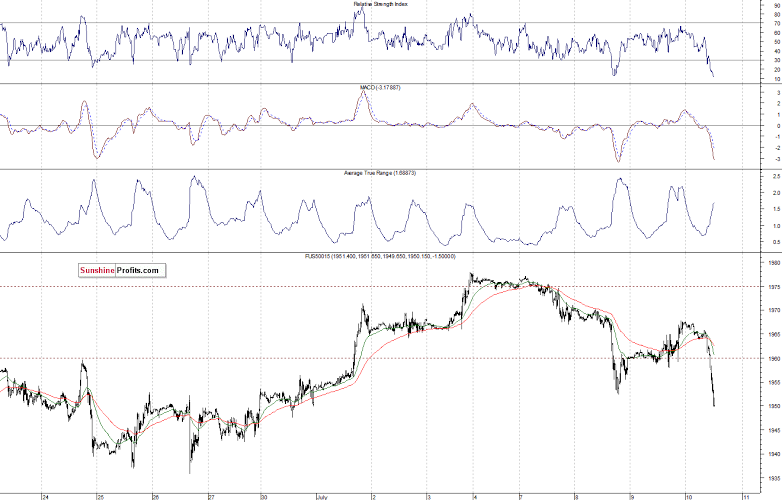

Expectations before the opening of today’s session are decisively negative, with index futures currently down 0.8%. The European stock market indexes have lost 0.7-1.4% so far. Investors will now wait for some economic data announcements: Initial Claims at 8:30 a.m., Wholesale Inventories at 10:00 a.m. The S&P 500 futures contract (CFD) is in an intraday downtrend, as it breaks below Tuesday’s local low. The resistance level remains at around 1,965-1,970. On the other hand, a potential level of support is at 1,935-1,940, marked by late June consolidation, as the 15-minute chart shows:

The technology Nasdaq 100 futures contract (CFD) sells off similarly this morning, however, it remains above Tuesday’s local low. The nearest level of support is at around 3,840, and the resistance level is at around 3,880-3,890:

Concluding, the broad stock market remains in a consolidation following month-long advance. There have been no confirmed negative signals so far. However, we can see some increased volatility, which may lead to a change of trend. Therefore, we think that it is better to stay out of the market at this moment. In other words, we will wait for some better risk/reward opportunity. In such a choppy market environment, the only winners are brokers with their commissions, and we care much more about your profits than we care about brokers’ commissions.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 even as USD struggles ahead of data

EUR/USD has erased gains to trade flat near 1.0700 in the European session on Thursday. The pair comes under pressure even as the US Dollar struggles, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD turns south toward 1.2500, US data eyed

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair struggles, despite the US Dollar weakness on dovish Fed signals. A mixed market mood caps the GBP/USD upside ahead of mid-tier US data.

Gold price pulls back as market sentiment improves

The Gold price is trading in the $2,310s on Thursday after retracing about three-tenths of a percent on reduced safe-haven demand. Market sentiment is overall positive as Asian stocks on balance closed higher and Oil prices hover at seven-week lows.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.