Cable fell to intraday low in early US trading on Tuesday, following another failure at 1.33 barrier (spike to session high at 1.3310 was short-lived) as concerns about hard Brexit start to rise.

Unexpected dissonant tones came from France, on raising question about the reason the EU should grant Brexit talks extension.

Tensions rise as 21 Mar EU summit approaches and the third vote on PM May’s plan may end like two previous votes, as there are no substantial changes in the plan and stalled talks about Irish backstop additionally weigh, showing very little chances that the plan will be approved in MV3.

However, the possibility of extending the 29 Mar deadline exists, but requires PM May to do her homework and show progress in plan adjustment.

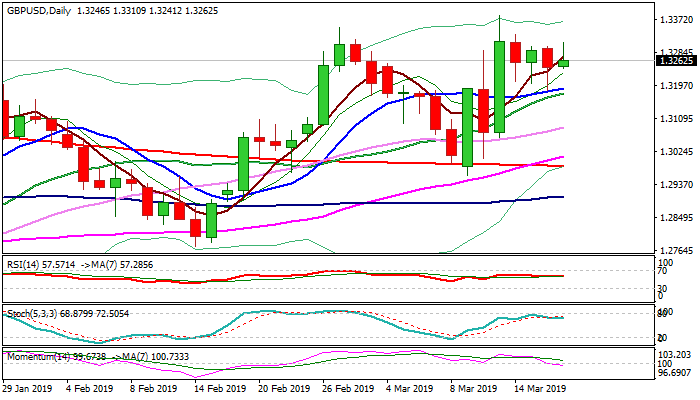

Technical studies show mixed signals, as bearish momentum is building on daily chart, but MA’s are still in bullish configuration and partially offset negative signal.

Pivotal supports, provided by converging 10/20SMA’s (1.3189/75) are so far intact, but break lower would weaken near-term structure and risk stronger bearish acceleration which would expose key 200SMA support (1.2985).

Conversely, sustained break above 1.33 barrier would ease existing downside risk, but extension through key barriers at 1.3381/86 (new 2019 high, posted on 13 Mar / 50% retracement of 1.4376/1.2397 fall) is needed to neutralize and shift focus higher.

Res: 1.3273; 1.3310; 1.3330; 1.3349

Sup: 1.3241; 1.3189; 1.3175; 1.3120

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.