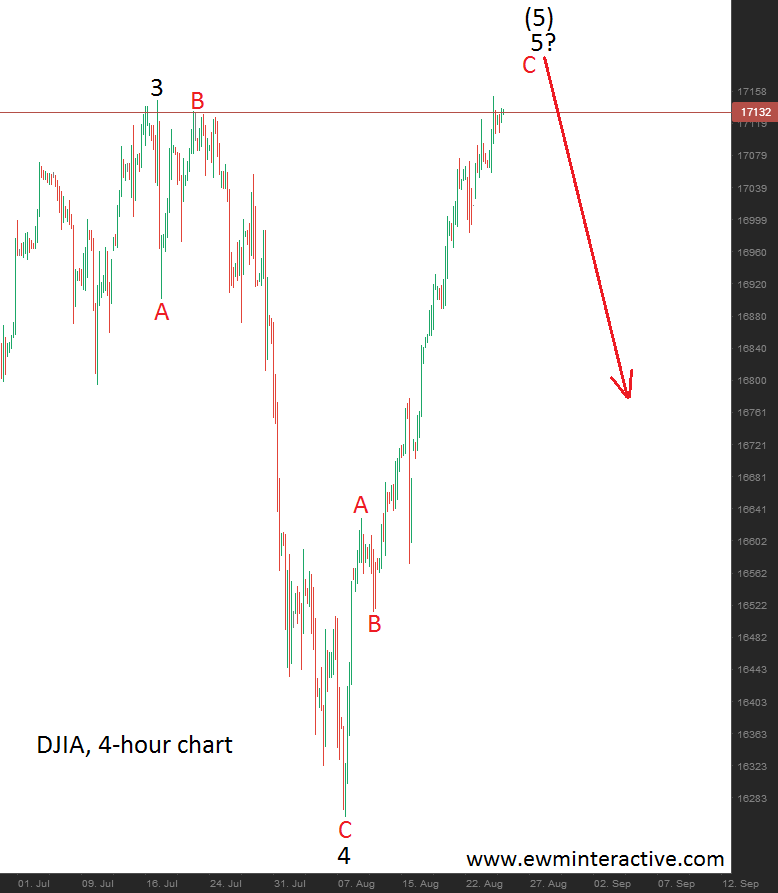

It was 6th August, when we published an article, called “Dow Jones could resume uptrend”. The Elliott Wave Principle suggested, that the strong decline from 17 145 may be over soon. The chart below will show you how the Dow Jones Industrial Average looked like, when that forecast was made.

On the chart you can see that the sell-off is in three waves, labeled A-B-C. According to the theory, three-wave movements do not represent the direction of the larger trend – they are only intervening corrective price swings. This brought us to the conclusion, that sooner or later the uptrend should resume and the whole decline compensated. The next chart can give you an update of the situation.

As visible, the Dow bottomed around 16 260 and then rocketed almost in a straight line to the upside. Yesterday, on 26th August, 20 days after our forecast, DJIA reached as high as 17 152, thus fulfilling the new-top requirement. Ironically, this new high probably brings more bad than good news for the bulls. If you want to find out why, read the recommended material below.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 even as USD struggles ahead of data

EUR/USD has erased gains to trade flat near 1.0700 in the European session on Thursday. The pair comes under pressure even as the US Dollar struggles, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD turns south toward 1.2500, US data eyed

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair struggles, despite the US Dollar weakness on dovish Fed signals. A mixed market mood caps the GBP/USD upside ahead of mid-tier US data.

Gold price pulls back as market sentiment improves

The Gold price is trading in the $2,310s on Thursday after retracing about three-tenths of a percent on reduced safe-haven demand. Market sentiment is overall positive as Asian stocks on balance closed higher and Oil prices hover at seven-week lows.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.