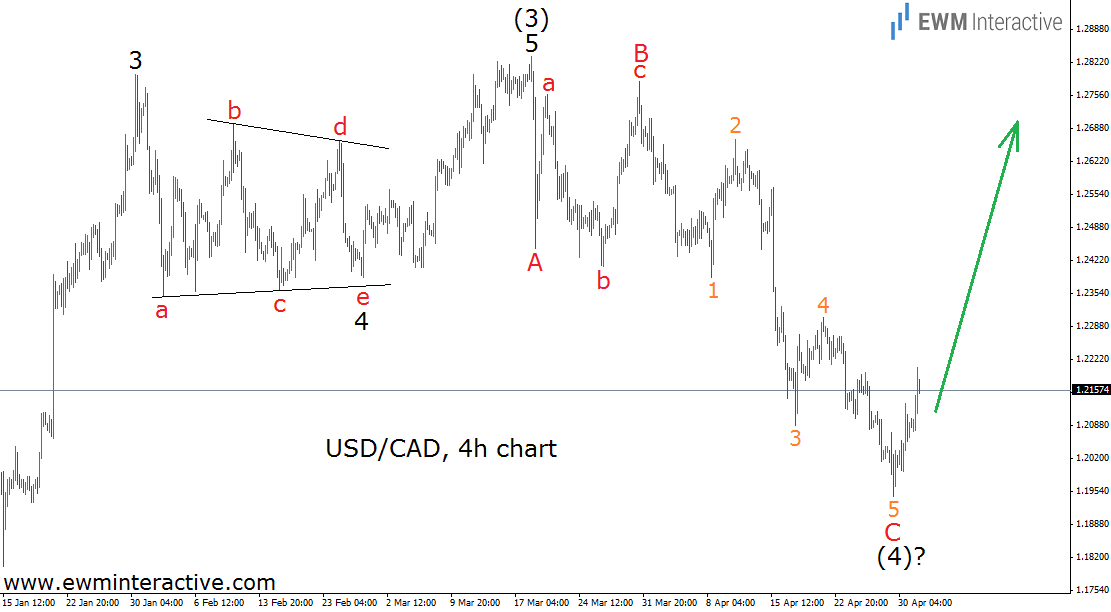

April was not the best of months for the bulls on USDCAD. Not only the March top of 1.2835 remained untouched, but the pair fell much lower to 1.1945 last week. What to expect from now on? Should the buyers abandon ship? Well, the Elliott Wave Principle suggests things are not that bad, because the larger uptrend is still in progress. However, it has to be looked at from the proper angle. The weekly chart of USDCAD can help.

According to the theory, trends move in five-wave sequences, called impulses. As you can see, the impulse in USDCAD is not complete yet. It appears to be in wave (4) of III, which means wave (5) to the north should begin soon. In addition, fourth waves tend to retrace around the 38.2% Fibonacci level of the third wave. This is exactly where the bulls on USDCAD decided to wake up and form that nicely-looking hammer weekly candle you see on the chart. But let’s go deeper into the wave structure to gain a more precise outlook.

In order to be qualified as a correction, the decline from 1.2835 to 1.1945 has to consist of three waves. And it does. USDCAD has drawn an A-B-C zig-zag, where wave B is an expanding flat correction. That is why we can prepare for a significant recovery in the near future. However, this three-wave decline might turn out to be just wave (A) of a wave (4) triangle. Nevertheless, the bears are not supposed to test 1.1945 again any time soon.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD clings to small gains above 1.2550

Following Friday's volatile action, GBP/USD edges highs and trades in the green above 1.2550. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold price rebounds on downbeat NFP data, eyes on Fedspeak

Gold price (XAU/USD) snaps the two-day losing streak during the European session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Fed.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.