Both the euro and the Australian dollar fell victims to the US dollar, but it is interesting to see the perspective, when they face each other. The charts of the EURAUD exchange rate could provide some very clear patterns. It is always wiser to start an Elliott Wave analysis from the big picture. So, Let’s start with the weekly chart.

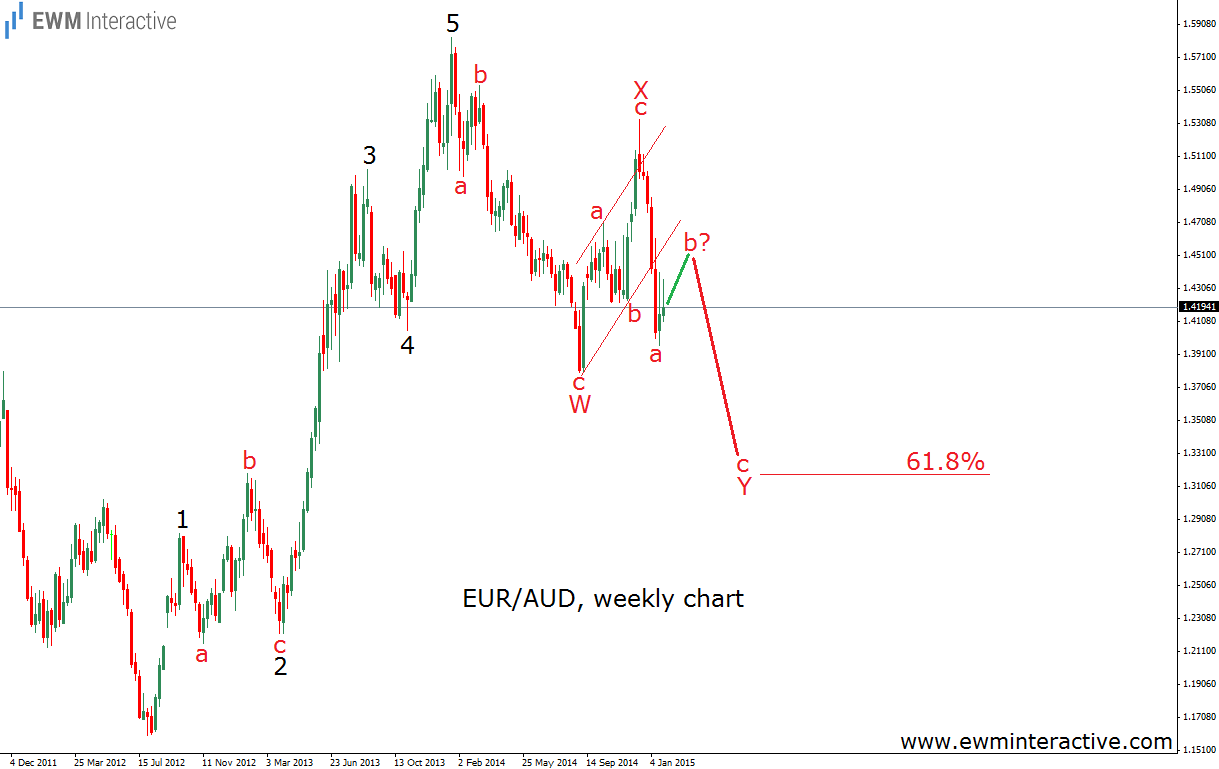

EURAUD rose from 1.16 in August 2012 to 1.5830 in January 2014. The important thing here is the five-wave impulsive structure of this rally. According to the Wave Principle, after a five-wave sequence we should expect a three-wave retracement in the opposite direction. As visible, this is exactly what happened. EURAUD declined to 1.38 in three waves marked with “W”. This was the minimum requirement for a corrective pull-back. However, it looks like the market has decided to stay in corrective mode, because the advance to 1.5330 was also limited to three waves for X. This brings to mind the idea of a W-X-Y double zig-zag, where wave Y is still unfolding. In order to find out what is left of it, we need to move to a smaller time-frame. The hourly chart comes in handy.

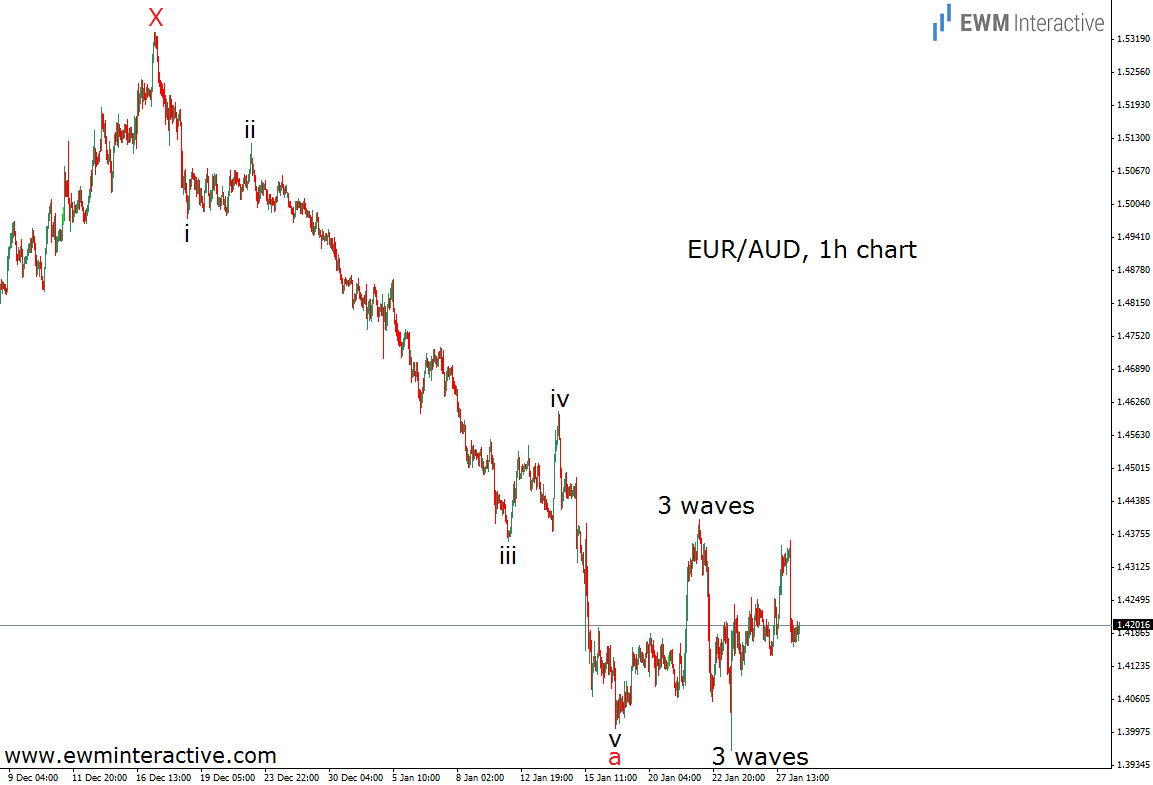

The top of wave X gave the start of another decline to 1.40, which, as the chart shows, can easily be counted as a five-wave impulse. We think it is wave “a” of Y. Since the bottom of wave “a”, EURAUD has been moving sideways, which is a characteristic only corrections posses. This means wave “b” could take the form of a triangle or an expanding flat. It is too early to say what it will be right now, but once it is finished, we will expect wave “c” of Y to the downside. It would probably lead EURAUD to the 61.8% Fibonacci level. In terms of price, this means the area around 1.32.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

Australian Dollar maintains ground amid subdued US Dollar, US Nonfarm Payrolls awaited

The Australian Dollar rises on hawkish sentiment surrounding the RBA prolonging higher interest rates. Australia’s central bank is expected to maintain its current rate at 4.35% until the end of September. US Nonfarm Payrolls is expected to print a reading of 243K for April, compared to 303K prior.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold bears take action on mixed signals from US economy

Gold price fell more than 2% for the second consecutive week, erased a small portion of its losses but finally came under renewed bearish pressure. The near-term technical outlook points to a loss of bullish momentum as the market focus shifts to Fedspeak.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.