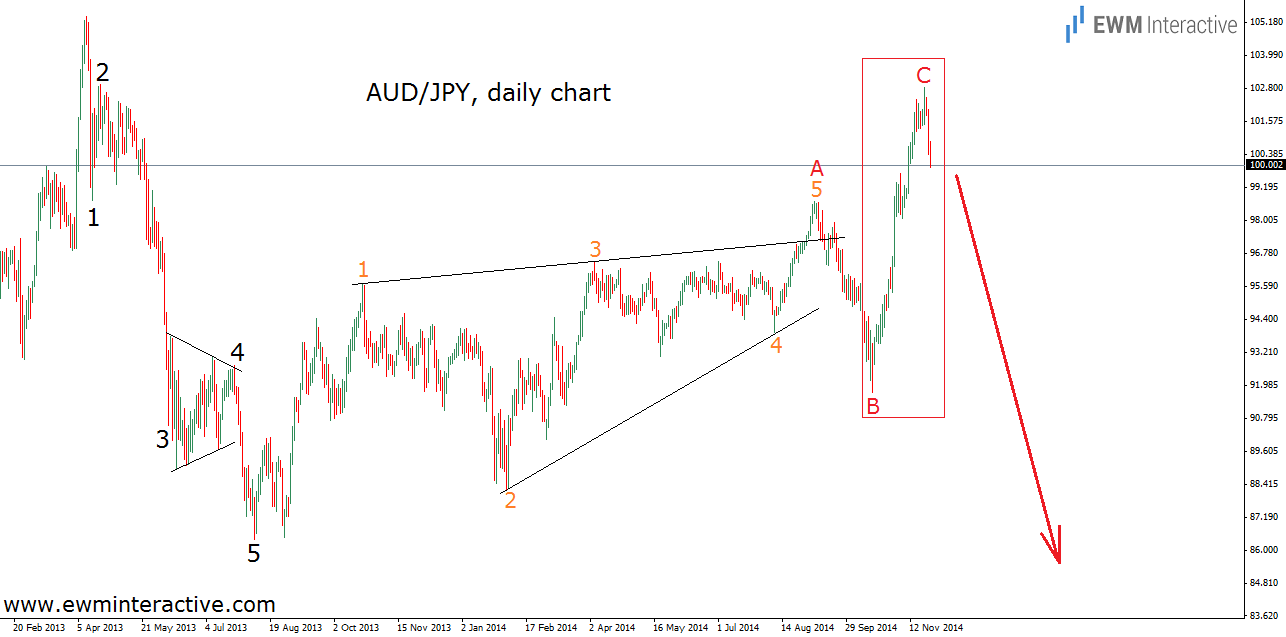

AUDJPY declined in five waves from 105.40 in April 2013 to as low as 86.30 four months later, but has been recovering ever since. Last week the pair went close to 103, but the bulls did not show enough persistence, which led to a sell-off below the 100.00 mark as of today. As always, what interests us is the wave structure of the price movement, visible on the charts.

The daily chart shows a complete 5-3 Elliott Wave cycle, which means the larger trend points to the downside and everything after the bottom of 86.30 is just a correction. To be more precise, it looks like an A-B-C simple zig-zag with a leading diagonal in wave A. Despite making a very deep retracement, the exchange rate did not reach the invalidation level of 105.40. As long as this figure stays untouched, the above-shown bearish scenario remains valid. Now let’s see if AUDJPY has really finished its wave C.

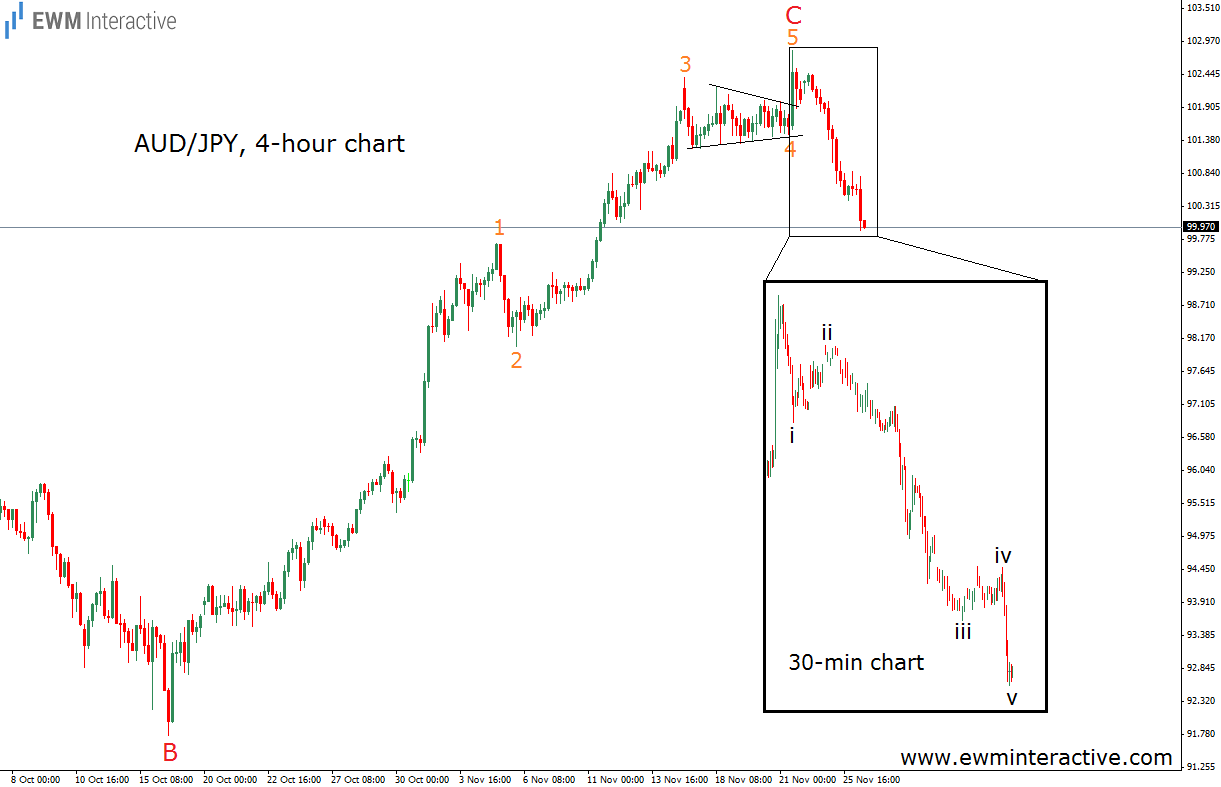

In theory, wave C is supposed to be a five-wave impulse. According to the 4-hour chart, it is. Furthermore, the latest decline that started from 102.84 also consists of five waves, thus confirming the reversal we are witnessing. In conclusion, if this is the correct count, 102.84 could turn out to be a major top, because AUDJPY may have just made the first step of a long journey to the south.

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.