The start of this week was not the best possible for crude oil, since the price fell as low as 35.95 dollars a barrel on March 15th. However, the bulls managed to regroup and take the commodity to new highs near 39.63 so far. Some might explain oil’s price swings with the OPEC supply freeze negotiations. Others may add that the reports about the inventories, imports and exports caused the market to move in this particular way. But all the post-factum explanations are a bit useless. In our opinion, traders are far more interested in whether the development in the price of crude oil could have been predicted. Our answer is YES and we can prove it with the chart below.(some of the marks have been removed for this article).

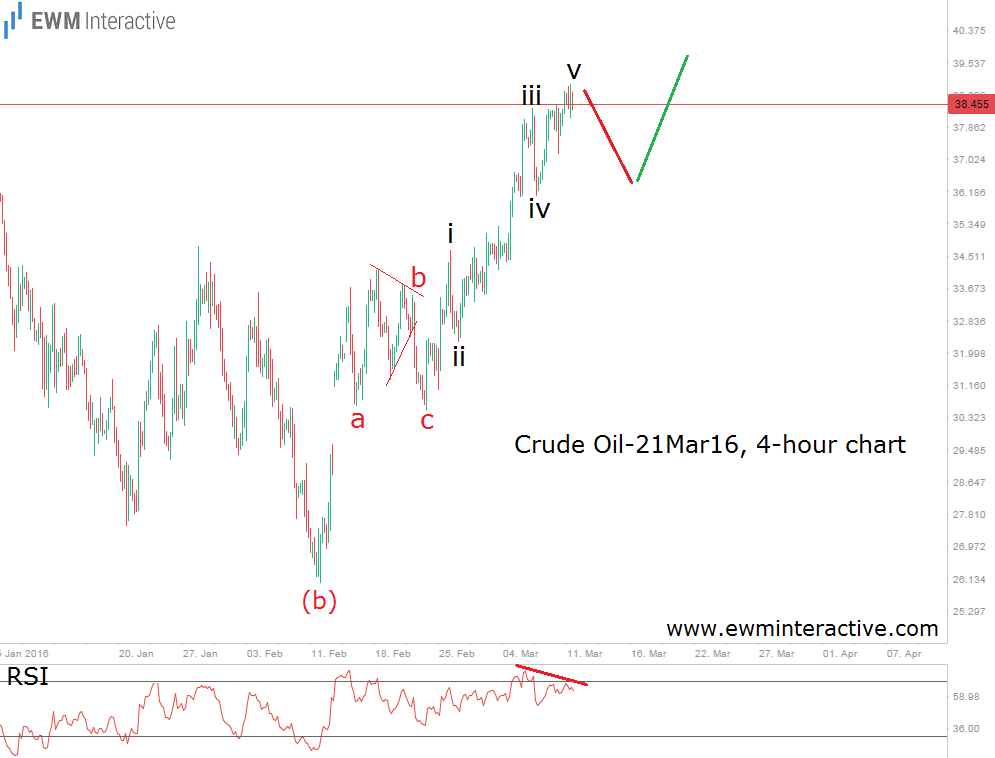

Our premium clients received this chart on Monday, March 14th. As visible, the Elliott Wave Principle suggested we should expect a decline to around 36.00, before the bulls return to take oil to a new high. The relative strength index also helped us prepare for the weakness at the start of the week, by showing a bearish divergence between the last two swing highs. Now let’s see an updated chart, which will show us how crude oil has been developing during the last four days.

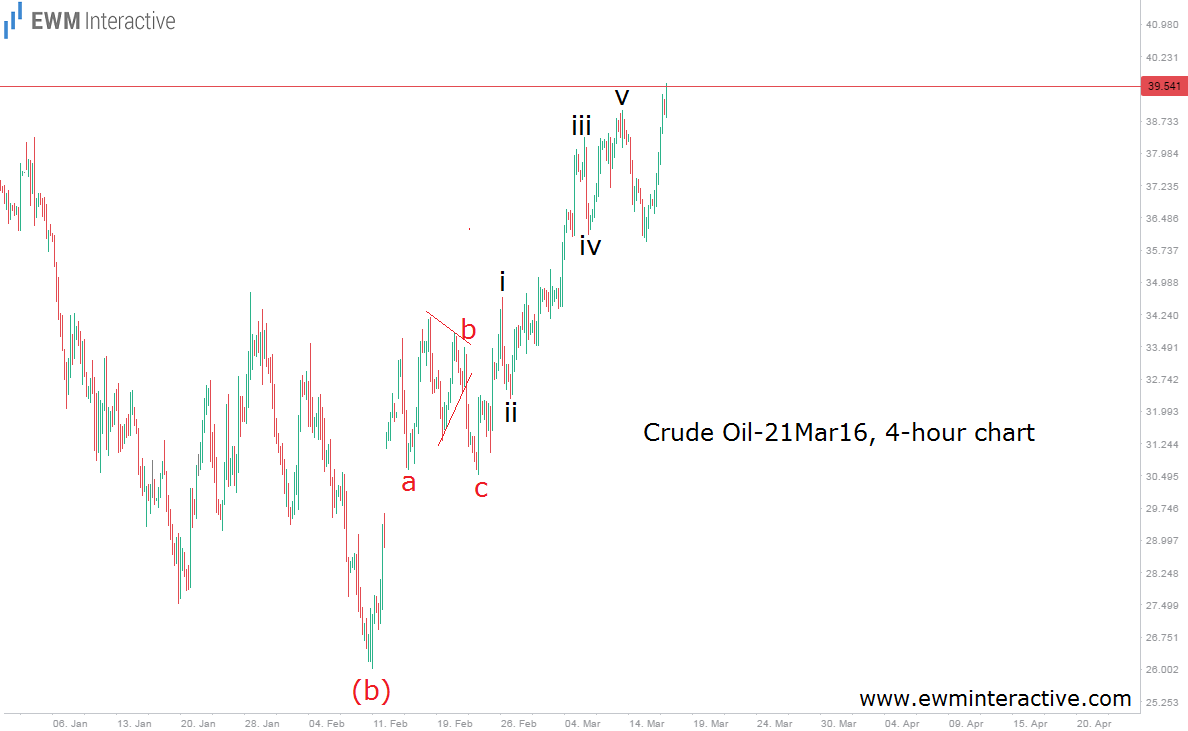

It turns out everything has been going according to plan. This is an excellent example of the fact, that the Wave principle can help you predict not only just one single, but two consecutive price moves in the opposite directions, without caring about all the explanations afterwards. That is one of the many reasons this forecasting method is our favorite. And we believe it deserves your trust too.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD clings to small gains above 1.2550

Following Friday's volatile action, GBP/USD edges highs and trades in the green above 1.2550. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold price rebounds on downbeat NFP data, eyes on Fedspeak

Gold price (XAU/USD) snaps the two-day losing streak during the European session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Fed.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.