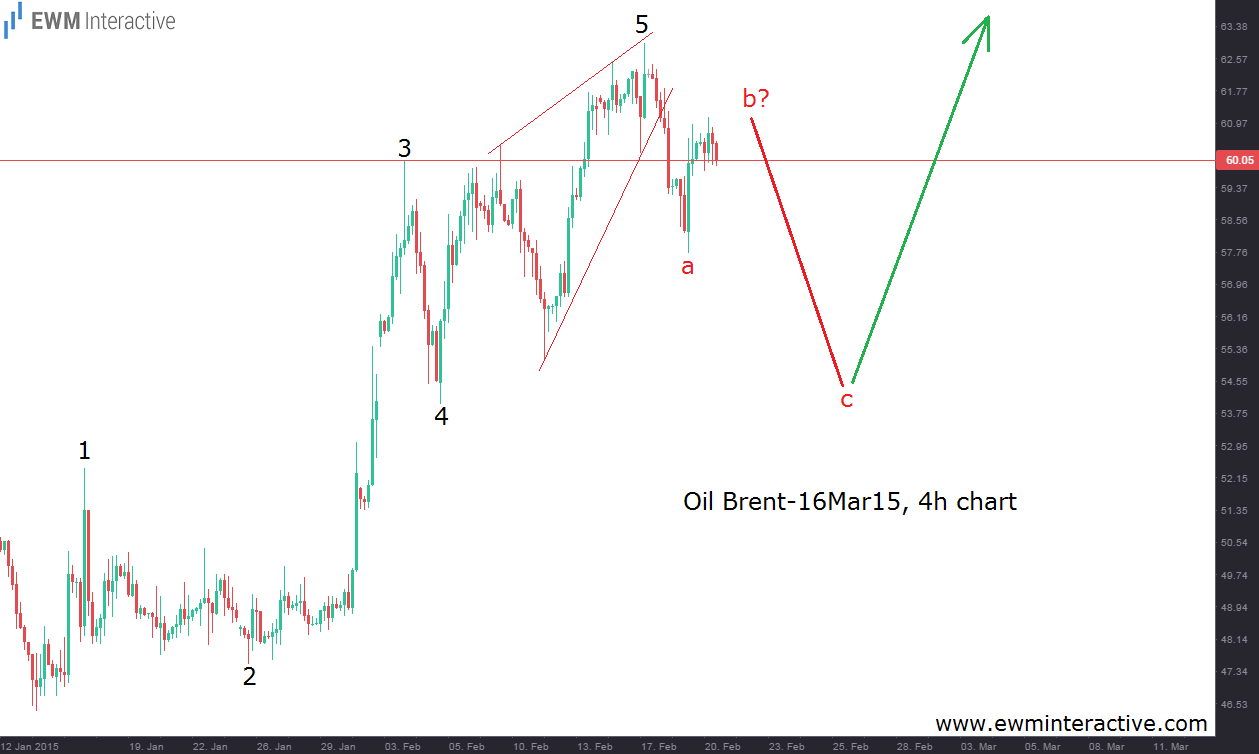

Almost two months ago, on February 21st, we said that brent oil is likely to get more expensive, but needs a downside correction first. We thought so, because there was a nicely-looking five-wave impulse to the upside on the 4-hour chart. The Elliott Wave Principle postulates, that there should be a three-wave retracement after every impulse. That is only the reason why our forecast looked like this:

As visible, we assumed brent was in wave B of an A-B-C zig-zag correction. So, wave C to the south was needed before the bulls could return. As the next chart demonstrates, the price of brent oil developed as a textbook example of the basic 5-3 wave cycle.

Wave C led prices as low as $52.50, which is precisely where the 61.8% Fibonacci level lies. Then the bulls came back and took the wheel. Yesterday, brent oil almost reached the $65 mark, thus making a new top, above the one left by wave 5 at $63. In terms of the Wave Principle, this is the minimum requirement for a successful forecast. However, if we stick to the big picture outlook, we will see there is room for much higher levels.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

EUR/USD extends sideways grind below 1.0900

EUR/USD stays in a consolidation phase below 1.0900 following the previous week's rally. In the absence of high-tier data releases, the US Dollar stays resilient against its rivals as investors scrutinize comments from central bank officials.

Gold pulls away from record highs, holds above $2,400

Gold rose sharply at the beginning of the week on escalating geopolitical tensions and touched a new all-time high of $2,450. With market mood improving modestly, XAU/USD erases a majority of its daily gains but manages to hold above $2,400.

GBP/USD holds steady near 1.2700, Fedspeak in focus

GBP/USD fluctuates in a narrow channel near 1.2700 on the first trading day of the week. The cautious market stance helps the US Dollar hold its ground, while market participants assess remarks from central bank officials ahead of this week's key events.

Ripple stays above $0.50 on Monday as firm backs research on blockchain and quantum computing

XRP price holds steady above the $0.50 key support level and edges higher on Monday, trading at 0.5130 and rising 0.70% in the day at the time of writing.

Week ahead: Nvidia results and UK CPI falling back to target

What a week for investors. The Dow Jones reached a record high and closed last week above 40,000, for the first time ever. This is a major bullish signal even though gains for global stocks were fairly modest on Friday, and European stocks closed lower.