Daily Forecast - 05 April 2016

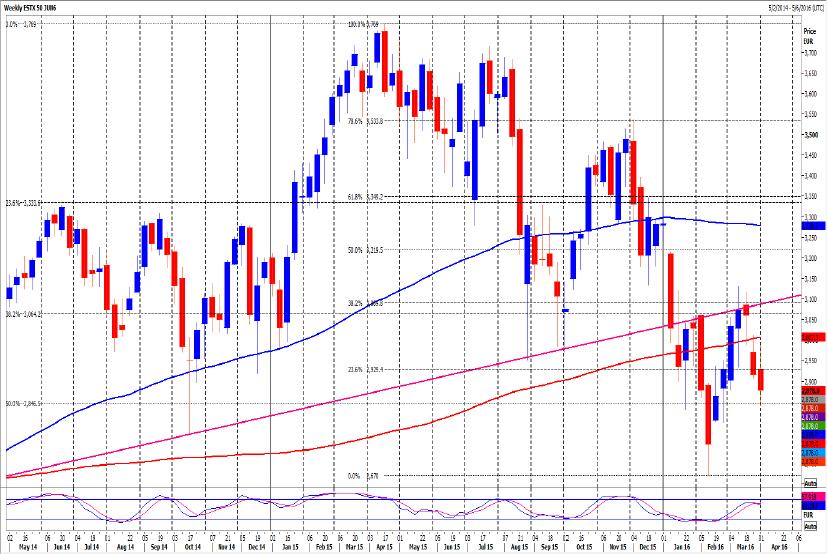

Eurostoxx June contract

EuroStoxx first resistance at 2905. Shorts need stops above 2920!! Further gains target 2925 then strong resistance at 2950/55.

Holding below 2880 however risks a retest of minor support at 2846/42. A break below last week's low at 2840 reinforces the 1 year bear trend & targets 2831/27, 2817/15 & mid-late February lows at 2803/2799.

Ftse June contract

FTSE first resistance at 6100 but above 6105 targets 6126/30, perhaps as far as minor resistance at 3 week highs of 6155/63. On a break higher this week look for a gap to fill at 6190/95 then strong 200 day moving average resistance at 6205/10.

Failure to hold above 6095 targets good support at 6058/53. A break below 6040 however could re-target 6018 before last week's low at 6010 & important support at the March low at 6000/5999. A break below 5990 this week risks a slide good support at 5945/40.

Dax June contract

Dax must hold above 9815/05 today to remain stable. Minor resistance at 9875 but above here targets 9925 then stronger resistance at 9965/75 & the main challenge for bulls today. Shorts need stops above 10000. A break higher targets 100 day moving average resistance at 10070/1080. Try shorts with stops above 10145. Only a daily close above the 100dma turns the short term outlook more positive.

Failure to hold above 9800 is more negative & targets 9740/35 then last week's low at 9713. Further losses this week target 9675/70 then good support at 9600/9590. This is the best chance of a low for the week but longs need stops below the gap at 9550.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.