Daily Forecast - 04 April 2016

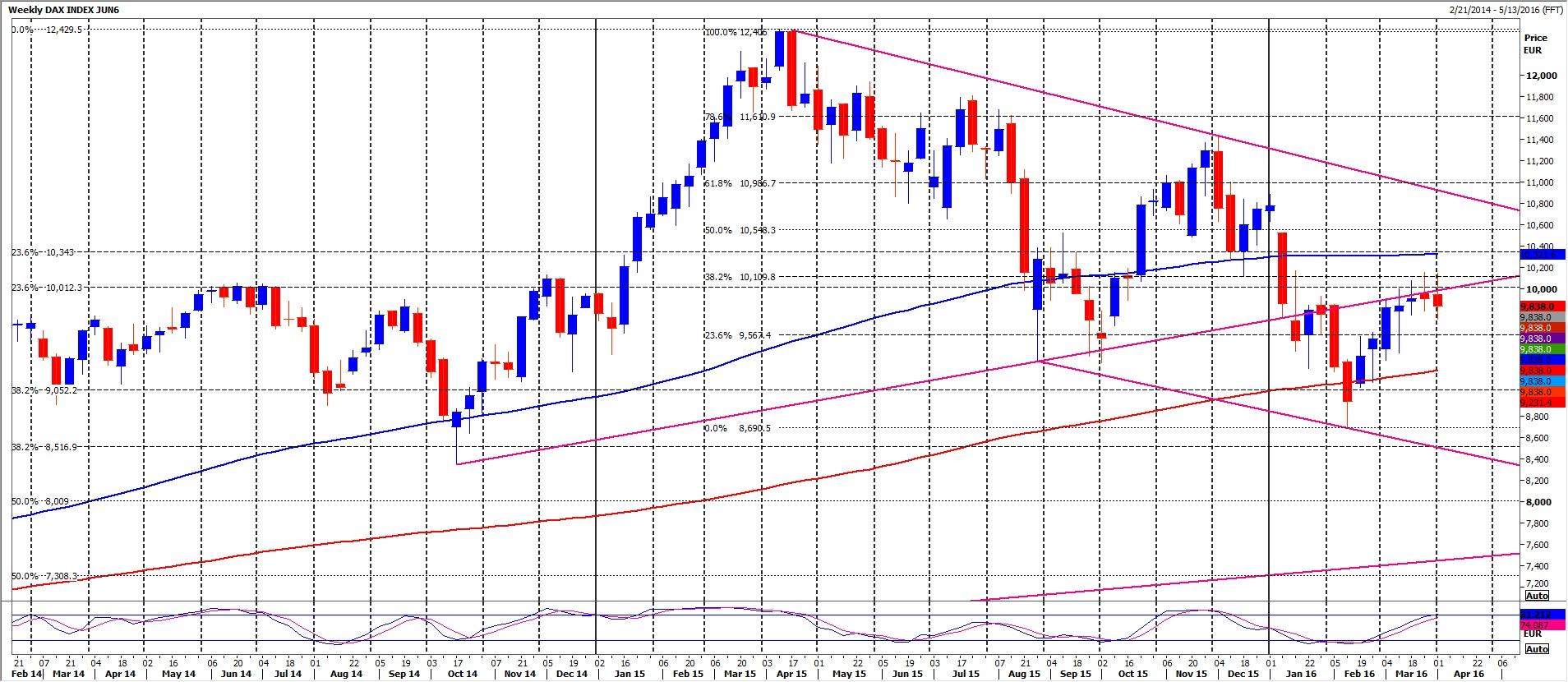

Dax June Contract

Dax must hold above 9815/05 today to remain stable. Minor resistance at 9875 but above here targets 9925 then stronger resistance at 9965/75 & the main challenge for bulls today. Shorts need stops above 10000. A break higher targets 10040/050 then 100 day moving average resistance at 10090/10100. Try shorts with stops above 10145.

Failure to hold above 9800 is more negative & targets 9740/35 then last week's low at 9713. Further losses this week target 9675/70 then good support at 9600/9590. This is the best chance of a low for the week but longs need stops below the gap at 9550.

Eurostoxx June Contract

EuroStoxx now oversold so a short term recovery is possible. Holding above 2880 targets resistance & the main challenge for bulls today at 2900/05. Shorts need stops above 2916. Further gains target 2922/25 then strong resistance at 2950/55.

Holding below 2875 however risks a retest of minor support at 2846/42. A break below last week's low at 2840 reinforces the 1 year bear trend & targets 2831/27, 2817/15 & mid-late February lows at 2803/2799.

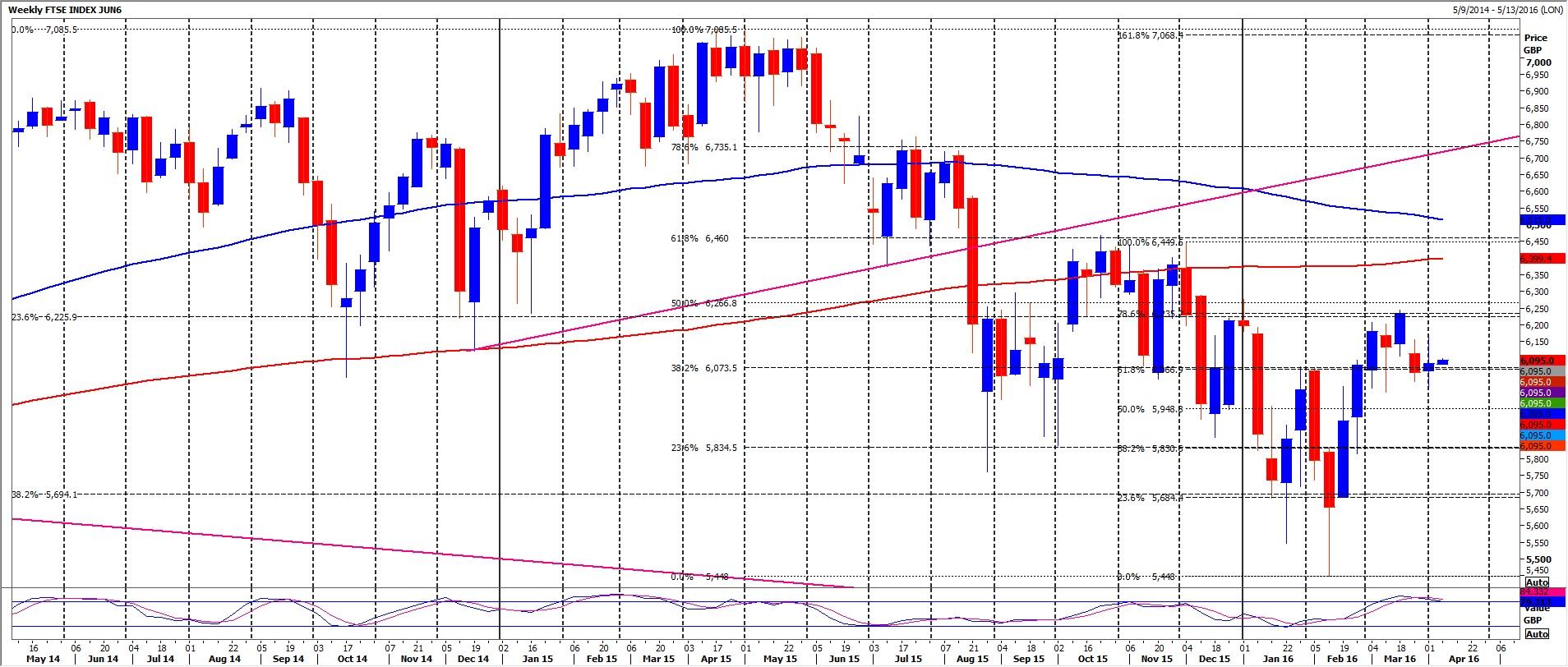

Ftse June Contract

FTSE first resistance at 6100 but above 6105 targets 6126/30, perhaps as far as minor resistance at 3 week highs of 6155/63. On a break higher this week look for a gap to fill at 6190/95 then strong 200 day moving average resistance at 6205/10.

Failure to hold above 6095 targets good support at 6058/53. A break below 6040 however could re-target 6018 before last week's low at 6010 & important support at the March low at 6000/5999. A break below 5990 this week risks a slide good support at 5945/40.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 during the early Monday. The softer US Dollar provides some support to the major pair. Traders await the HCOB Purchasing Managers’ Index (PMI) data from Germany and the Eurozone, along with the Eurozone PPI.

GBP/USD rises to near 1.2550 due to dovish sentiment surrounding Fed

GBP/USD continues its winning streak for the fourth consecutive day, trading around 1.2550 during the Asian trading hours on Monday. The appreciation of the pair could be attributed to the recalibrated expectations for the Fed's interest rate cuts in 2024 following the release of lower-than-expected US jobs data.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.