Daily Forecast - 12 February 2016

Gold Spot

Gold is very unlikely to beat 1260 for a long time. If we get anywhere near this level again it is an excellent selling opportunity but needs at least a 10 point stop. I would not really feel positive about Gold unless we broke above 1280.

Holding below 1240 sees further profit taking to first support at 1228/27. If we get a bounce from here we could be offered selling opportunities in the 1250/60 area if we are lucky. However a break below 1225 triggers further losses to 1218, 1213 & perhaps as far as support at 1207/08.

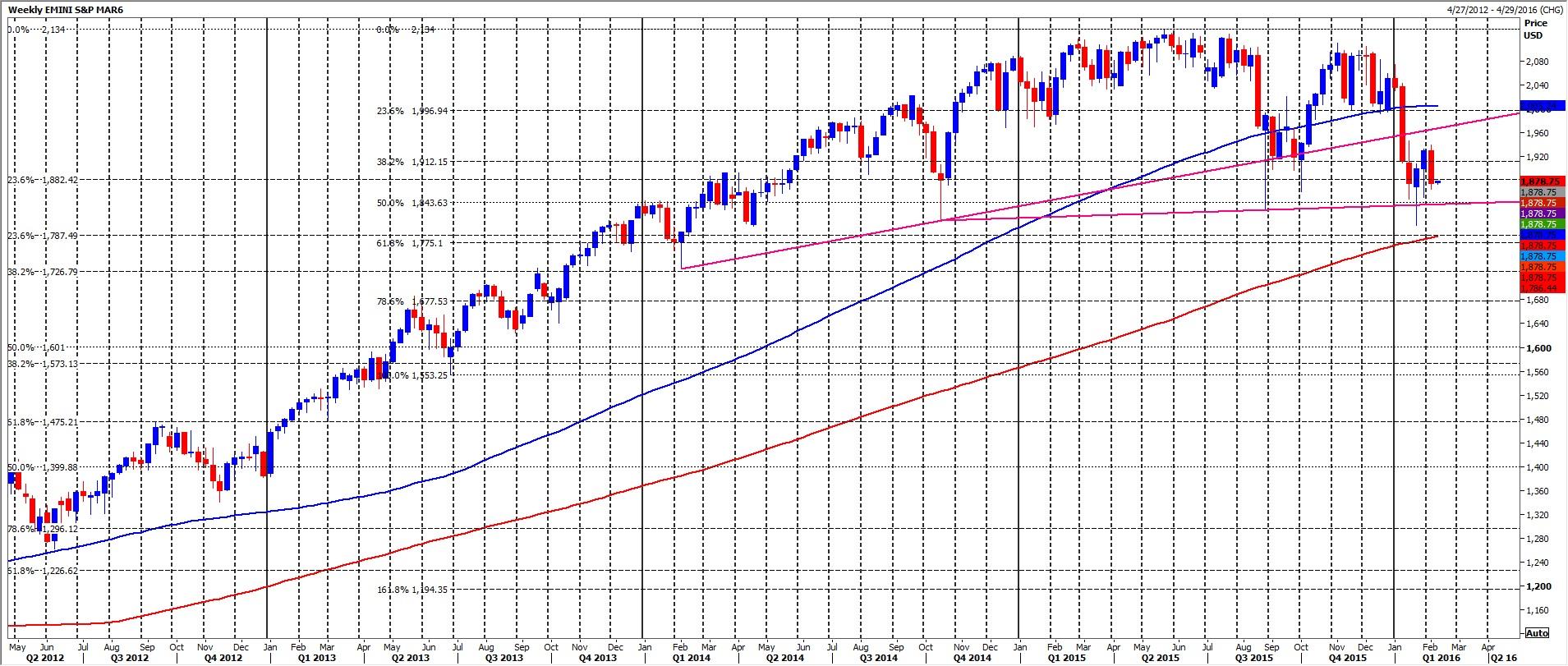

S&P March contract

Emini S&P failure to beat 1833/31 re-targets 1825/22 then 1814/13. The downside does look more limited but January lows at 1805/04 are obviously key. A break below here this week risks a slide to very VERY important longer term support at 1788/86. If this breaks it should trigger more panic selling & very steep losses in to next week.

I do believe in the double bottom & think there is so much focus on the big head & shoulders that there could be too many shorts which could get squeezed today. Above 1835 allows a recovery to first resistance at 1846. Above here re-targets 1855, 1863 then strong resistance at 1868/70. Shorts need stops above 1880. A break above here is a buy signal to target 1890.

EURGBP Spot

EURGBP in need of profit taking with first support at 7810/06. A break below targets 7785/81 & support at 7760/55. A bounce from here expected initially at least but below here targets 7710.

Holding first support at 7810/06 targets 7850/54 then 7874 & 7897. A break above 7905/10 however targets a selling opportunity at 7940/45.

AUDUSD Spot

AUDUSD resistance at 7140/45 remains the most important of the day. Above 7150 is more positive & targets trend line resistance at 7180/85. We could stall here initially but above here targets 7215/20.

Failure to beat first resistance at 7140/45 re-targets 7105 then support at 7088/83. A break below 7075 risks a retest of support at 7035. If we continue lower look for 7018/15 before support at 6985/80. A break below here today targets 6960/55 then 6920/15.

USDJPY Spot

USDJPY looks like it has ended the big move to the downside for now. Holding 111.00 is severely oversold conditions should trigger a further recovery. We must hold above 112.50/55 to target 113.14 then strong resistance at 113.47/52. This the main challenge for bulls today & could see a peak. If you want to try shorts use stops above 113.80. A break higher targets quite strong resistance at 114.25. We should struggle here but if we continue higher look for a selling opportunity at 115.00/10.

Failure to beat 112.50/55 targets 111.80 then 111.55. Look for strong support at 111.20/111.00. Try longs with stops below 110.65. A break lower (we need a weekly close to confirm) is a sell signal & targets 110.10/00 today.

EURUSD Spot

EURUSD collapsed from the highs & it looks like the risk is to the downside today. NOTE: A weekly close tonight below 1.1290 would be quite negative for the start of next week. Holding below 1.1325 today adds pressure targeting 1.1295/90. Below here is more negative again & targets 1.1268/65 then good support at 1.1245/40. We look for a low for the day but longs need stops below 1.1210. Just be aware that further losses target a buying opportunity at 1.1165/60.

Holding above 1.1325 could target 1.1337 then 1.1353/55. Yesterday's high at 1.1375 is a big challenge but a break above 1.1385 should target trend line resistance at 1.1420/25.

GBPUSD Spot

GBPUSD below 1.4450 risks a slide to 1.4410 then support at 1.4375. This could hold the downside but longs need stops below 1.4350. A break lower targets support at 1.4310/05.

Above 1.4490 allows a recovery to resistance at 1.4520/30. If we continue higher look for a retest of 2 day highs at 1.4563/77. A break higher today targets 1.4585/88 then 1.4610/14. If we continue higher look for 1.4646/49 before last week's high at 1.4665/68.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

AUD/USD gains ground on hawkish RBA, Nonfarm Payrolls awaited

The Australian Dollar continues its winning streak for the third successive session on Friday. The hawkish sentiment surrounding the Reserve Bank of Australia bolsters the strength of the Aussie Dollar, consequently, underpinning the AUD/USD pair.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.