Daily Forecast - 3 March 2015

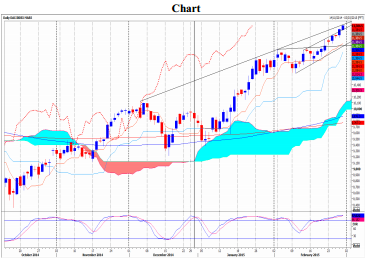

DAX

Dax first resistance at 11,456/60 of course but this should cause problems again today. I never recommend shorts in a Bull trend, but there is just a possibility that we can't beat this level today. If trying shorts use a stop above 11,475 and look for the next target of 11,489/95. If we continue higher look for 11,515 then 11,535/40. Any further gains this week could reach 11,570.

First support at 11,380/375 but below here risks a slide to good support at 11,330/320. Try longs with a stop below 11,290. On a break lower look for a buying opportunity at 11,255/45.

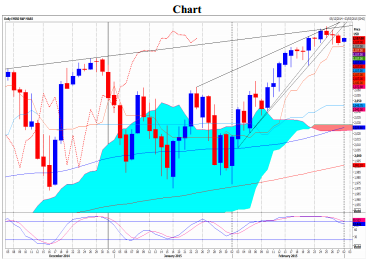

S&P

Emini S&P all time highs & trend line resistance at 2115/17 is obviously key to direction. On a break higher look for the next target of 5 & 19 week trend line resistance at 2127/2130 as a selling opportunity. Try shorts with stops above 2135. A break & close above 2135 would clear all important resistance & opens the door to 2141/42 then 2148/50.

Below 2110/2109 adds a little pressure today & re-targets support at 2104/2003. Any longs need stops below 2099. A break lower risks a slide to to support at 2095/94. A good chance of a bounce from here but if we continue lower look for a buying opportunity at 2089/88 this week. Longs need stops below 2083.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 after the data from the US showed that private sector employment rose more than expected in April. The Federal Reserve will announce monetary policy decisions later in the day.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar holds its ground after upbeat ADP Employment Change data and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold consolidates losses below $2,300, eyes on Fed policy decision

Gold price hovers below $2,300 as uncertainty ahead of the Fed’s policy announcements improves the appeal of the US Dollar and bond yields. The Fed is expected to hold the policy rate unchanged amid stubborn inflation.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

US Federal Reserve Decision Preview: Markets look for clues about interest rate cut timing

The Federal Reserve is widely anticipated to keep interest rates unchanged. Fed Chairman Powell’s remarks could provide important clues about the timing of the policy pivot.