Daily Forecast - 19 February 2015

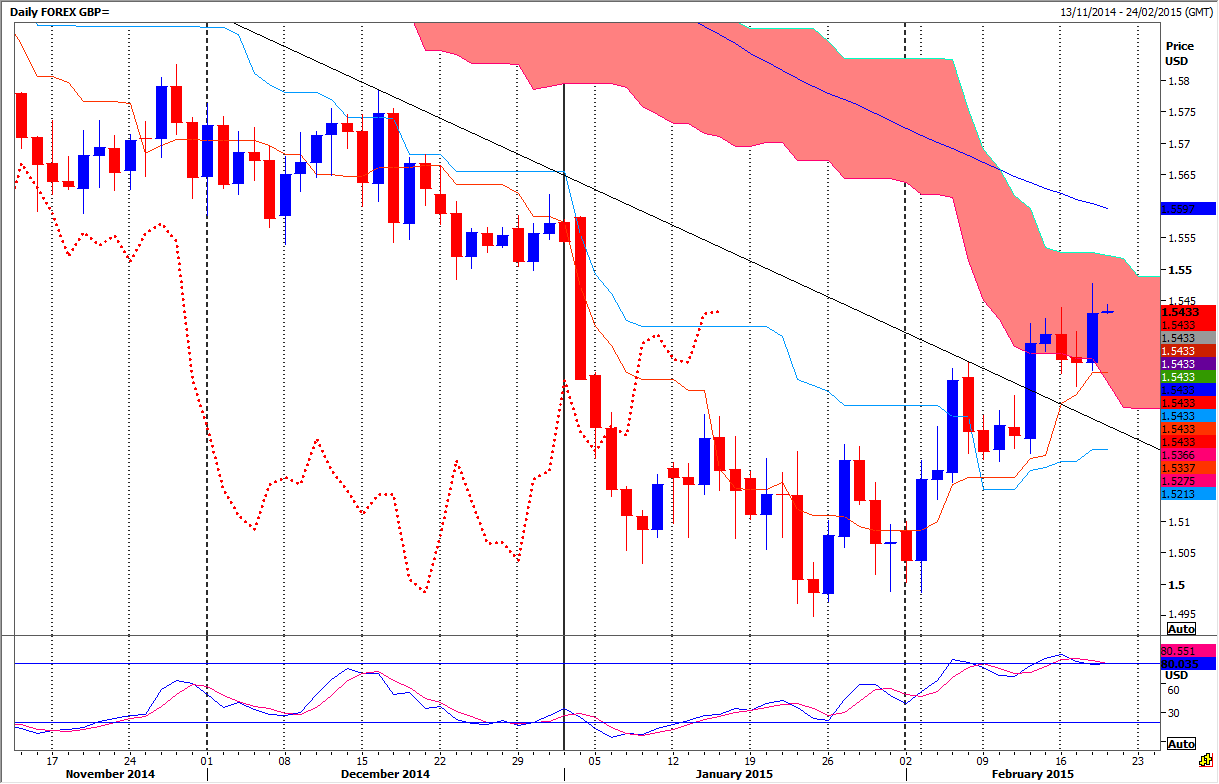

GBPUSD

GBPUSD failure to beat very strong resistance at 1.5475/85 is a warning after 3 weeks of gains. Bear in mind we are in a longer term negative trend and have become overbought. We are only experiencing a correction in a bear trend and sooner or later the bear trend should resume. It looks likely to be sooner. Watch first support at 1.5420/15. Be ready to go with a break lower to target the most important support of the day at 1.5370/65. A low is possible, but longs need a stop below 1.5345. A break below 1.5365 is a sell signal and indicates a resumption of the negative trend. We could quickly target 1.5315/10 then support at 1.5290.

Strong resistance at 1.5475/85 is an excellent selling opportunity again today with stops above 1.550. An unexpected break higher however is a buy signal to target 1.5525 & perhaps as far as resistance at 1.5555.

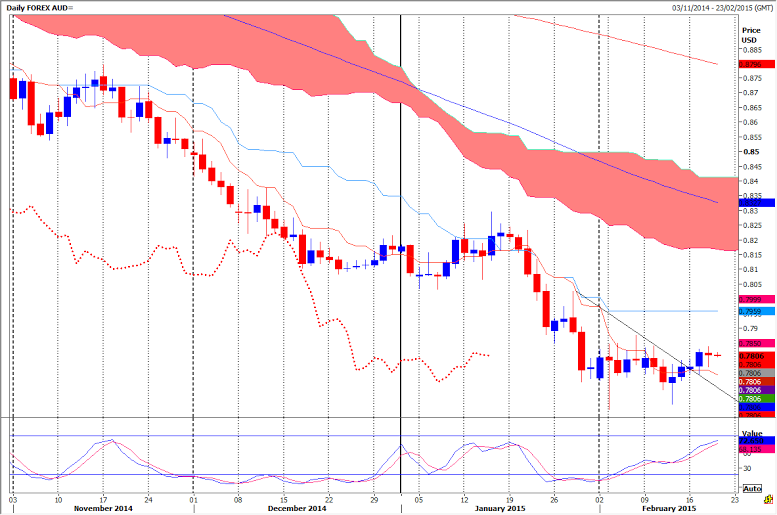

AUDUSD

AUDUSD same levels apply for today with first support at 7780. A bounce from here re-targets resistance at 7825/30. We should struggle here again but shorts need stops above 7850. Be ready to go with a break higher however to target strong resistance at 7875/80. A very good chance of a high for the day here and it should be worth trying shorts with a stop above 7900. An unexpected break higher however could go on to target 7935/7940.

First support at 7785/80 could now hold the downside but longs need a stop below 7765. A break lower is negative again and risks a retest of this week’s low at 7750/45. Failure here today would target 7735 then support at 7715/10. It could be worth trying longs here with a stop below 7695.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.