Daily Forecast - 28 October 2014

Mini Russell 2000 December contract

Mini Russell unable to beat 1120 for the last 3 sessions as we become overbought. Sooner rather than later we expect the bear trend to resume. Downside pressure today targets 1110/09 then good support at 1101/00. This held the downside perfectly yesterday & could do again today. Failure here however then targets 1095 & 1089/88. A good chance of a low for the day if we fall this far but longs need stops below 1084. Just be aware that a break lower targets 1081/79.

An unexpected break higher today through 1120 however targets 1124/25 & possibly 1130/31. Exit longs & try shorts expecting a high for the bounce in the bear trend, with stops above 1137.

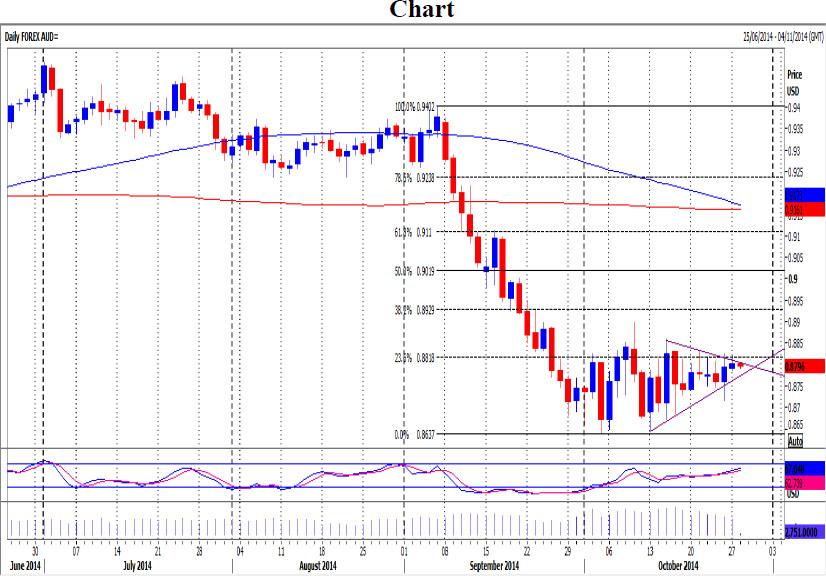

AUDUSD

AUDUSD continues to be directionless so far in October. Again yesterday we held immediate resistance at 8810/20. It looks like this is a pause in the bear trend before it resumes. Now the oversold conditions have unwound we expected this to occur sooner rather than later. Until then we can only trade the range & wait for a breakout. Same levels apply for today. Immediate support at 8750/45 but below here a retest of support at Friday's low of 8720/15. Below here today confirms more weakness for a move towards 8685/75. If we continue lower look for a retest of October lows & support at 8650/40.

Immediate resistance at 8810/20 for a selling opportunity with stops above 8835. However be ready to go with a break higher to target 8860 then 8888/98 & a high for the day likely. If however we continue higher, look for a selling opportunity at 8930/35 with stops above 8950.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.