Impact on foreign currency market of the Fed's policy shift

It is a fact that the Fed has entered the end of its tightening cycle. However, in currency markets, even after the March meeting in which dovishness prevailed, the demand for the dollar dropped sharply on the second day.

The main reasons for this phenomenon are the expected repair and peer foils:

Expected repairs: The Fed's plan to keep the size of its balance sheet "above precrisis levels" was not a decision made in 2019. The document "Policy Normalization Principles and Plans," published in September 2014, and the supplemented document released in June 2017 stated, "The Fed's reserve balance will eventually be higher than before the crisis." Prior to the March meeting, several senior officials of the Fed gave speeches to inform the market to a certain extent. As a result, on the eve of the March meeting, a number of institutions expected the Fed to release details of changes to the size of its contraction, although most of them failed to expect the pause to be the end of the third quarter. In other words, there is no "reversal" in market expectations of the Fed's monetary policy. Market pricing only needs some adjustments and repairs.

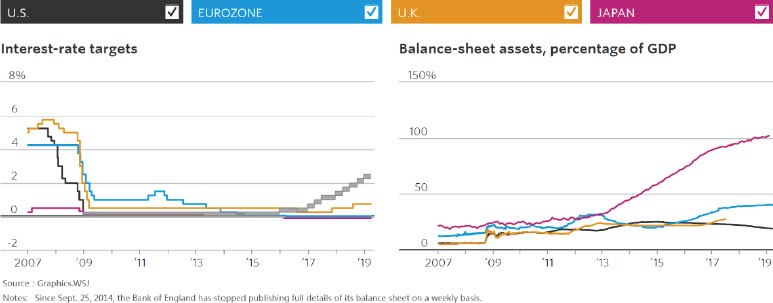

Peer foil: As of March 2019, the size of the Fed's balance sheet as a percentage of the U.S. GDP has dropped to 19.0% from its peak of 25.3% in December 2014, well below the Eurozone's 40.4%, and far lower than the Bank of Japan in the pursuit of its easing policy, in which the balance sheet now stands at 102.2% of GDP. Additionally, the Fed started to raise interest rates at the end of 2015. By March 2018 it had raised interest rates nine times, totaling 225 BPS, leaving other central banks far behind.

It is now more than ten years since the financial crisis, and central banks around the world have come to the point where their monetary policy is to be changed, including the BOJ, which has followed an easing policy alone; the ECB, which has drawn up plans for a new round of TLTRO; the Bank of England, which is caught in the Brexit whirlpool; the RBA, which has explicitly opened its options for a rate cut; and the Bank of Canada, which has been described as "practically surrendered." The Fed has certainly gone farther than other major central banks in its post-crisis normalization of monetary policy, a move that was strongly supported by the relatively stronger fundamentals of the U.S. economy. Thus, the dollar continues to be attractive at the end of the Fed's tightening cycle.

The information contained in this website is of general nature only and does not take into account your objectives, financial situation or needs. Please ensure that you read the Financial Services Guide (FSG), Product Disclosure Statement (PDS), and Terms and Conditions which can be obtained on our website https://www.aetoscg.com.au, and fully understand the risks involved before deciding to acquire any of the financial products listed on this website.

AETOS Capital Group Pty Ltd is registered in Australia (ACN 125 113 117; AFSL No. 313016) since 2007 and is a wholly owned subsidiary of AETOS Capital Group Holdings Ltd, carrying on a financial services business in Australia, limited to providing the financial services covered by the Australian financial services licence.

Trading margin FX and CFDs carries a high level of risk and may not be suitable for all investors. You are strongly recommended to seek independent financial advice before making any investment decisions.

This commentary is owned by AETOS, and copying, reproduction, redistribution and/publishing of this material for any purpose in whole or in part without the prior written consent of AETOS is prohibited.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.