Silver presents a buy the dip opportunity

-

Geopolitical tensions may drive demand for silver as a safe-haven asset in 2024.

-

The technical analysis shows bullish patterns for silver and the dips are strong buying opportunities.

-

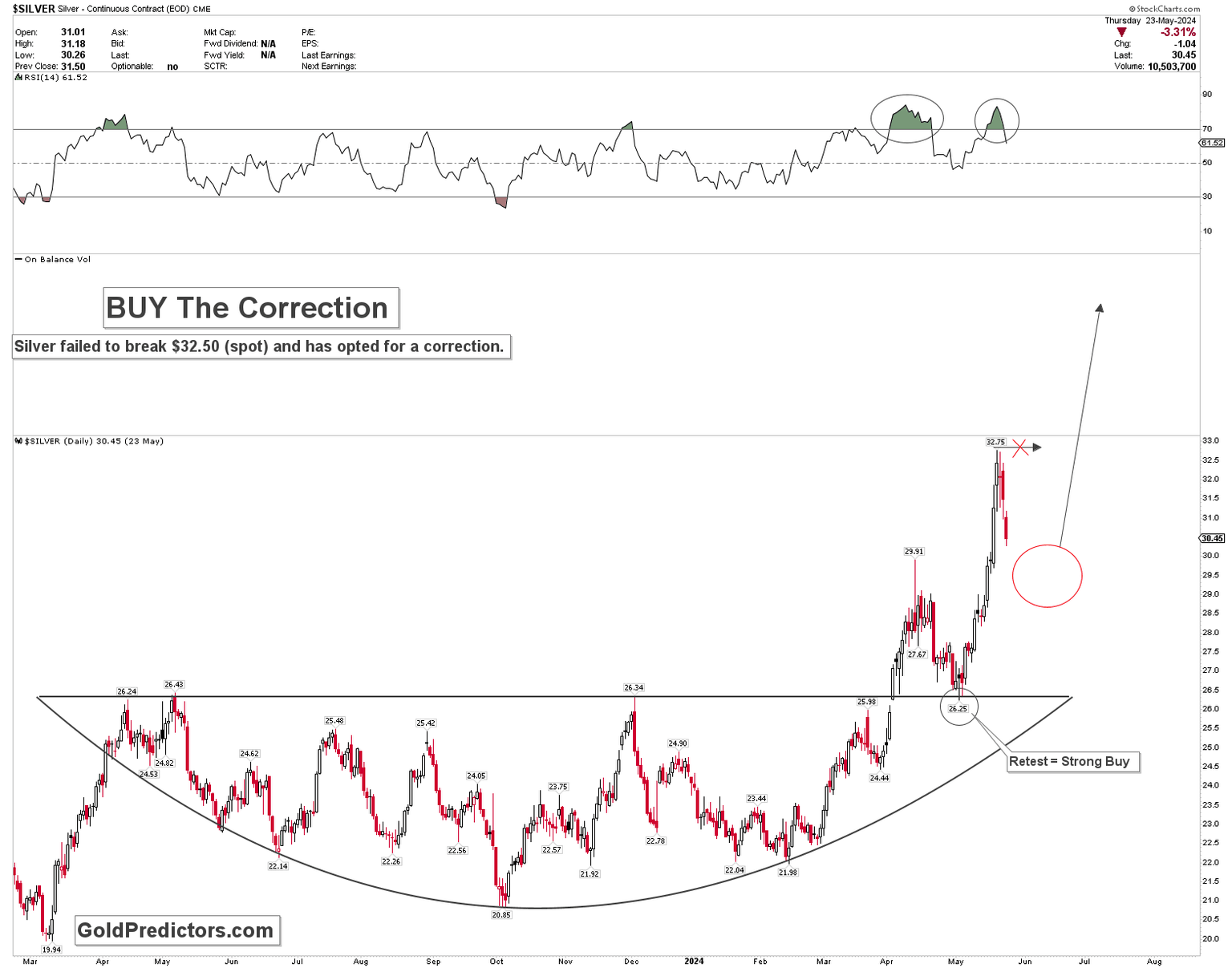

The emergence of cup formation highlights the long-term bullish structure.

Silver's recent price decline to around $30.30 per troy ounce, coupled with a hawkish Federal Open Market Committee (FOMC) outlook on interest rates due to persistent inflation, initially caused a dip in silver. Geopolitical tensions may also drive demand for silver as a safe-haven asset in 2024. Moreover, the technical analysis shows bullish patterns for silver, including a breakout from the $26 level and a cup formation, suggesting potential price targets of $50 if it secures a monthly close above $30. This article discusses the technical evaluation of the silver market to find the buying opportunity for medium and long-term investors.

Silver's potential amid price decline and hawkish FOMC outlook

Silver presents a compelling investment opportunity despite its recent price decline to around $30.30 per troy ounce. The Federal Open Market Committee (FOMC) Meeting Minutes revealed a hawkish outlook on interest rates due to persistent inflation issues, which initially caused a dip in non-yielding assets like silver. However, with inflation continuing to challenge economic stability and the Federal Reserve hesitating to reduce interest rates, silver’s role as a hedge against inflation could heighten its attractiveness. Moreover, escalating geopolitical tensions following Lai Ching-te's assumption of office as Taiwan's new president and China's aggressive military posturing in the region could fuel demand for silver as a safe-haven asset. These factors, combined with the uncertainty over future rate cuts indicated by traders and the CME FedWatch Tool, suggest that silver could see increased investor interest in the near term as both a protective and speculative investment.

Silver next buying point

The technical outlook for silver is currently showing a strongly bullish trend, as evidenced by the chart patterns. The prices have formed a cup formation before notably breaking out from the $26 level. This breakout propelled silver prices above the critical $30 threshold, a significant pivot point on weekly, monthly, and quarterly charts. The ability of silver to sustain a weekly close above $30 suggests that prices could skyrocket, maintaining strong upward momentum. However, for a more robust surge towards the $50 mark, silver prices need to secure a monthly close above the $30 level. Despite this bullish setup, silver has failed to surpass the $32.50 mark in spot trading, correcting lower following a hawkish tone from the Federal Reserve. Many investors view this pullback as a prime buying opportunity, targeting price levels of $35-$37, and potentially reaching $50.

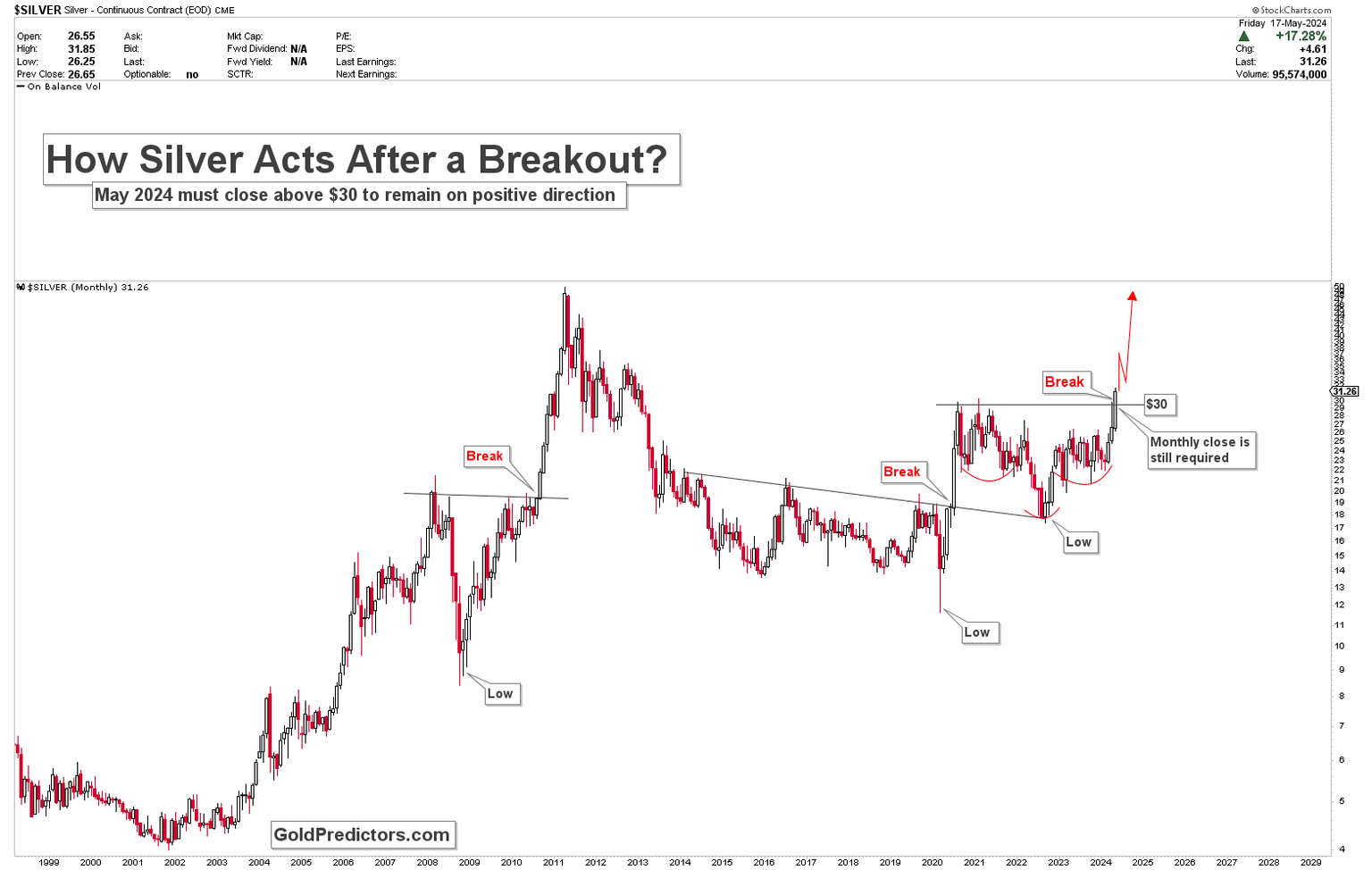

The behavior of the silver market following key breakouts can be further understood by examining the monthly chart. Historical patterns from 2010 and 2020 show that significant breakouts in silver prices typically occur after marking a low on the chart, leading to sharp price spikes. Silver has recently formed an inverted head and shoulders pattern with a critical neckline at $30, a pattern also evident on weekly and quarterly charts. Although Silver managed to close the week above $30, the price needs to maintain this level monthly to solidify the breakout. With the monthly candle set to close this week, prices fluctuate around the $30 mark, contributing to the failure to hold above $32.50 as the price retreated to around $30.

Investors are keenly watching to see if spot silver prices will close above $30 in May 2024, as this would confirm a strong breakout. Given the positive technical patterns and strong price action observed, this correction is increasingly being seen as a strategic buying opportunity for long-term investors aiming for a target of $50 or beyond. This potential move could offer substantial returns for those positioned to capitalize on these dynamics.

Bottom line

In conclusion, the current landscape for silver investment is ripe with potential, underscored by a combination of fundamental and technical signals. On the fundamental side, ongoing inflation concerns, the Federal Reserve's cautious stance on interest rates, and heightened geopolitical tensions notably increase silver's attractiveness as a safe-haven and inflation-hedging asset. Technically, silver's price actions, including the formation of the cup formation and the inverted head and shoulders, signal upward solid momentum with targets potentially reaching as high as $50. The confluence of these factors and the market's anticipation of a confirmed breakout above the $30 mark create a compelling case for investors to consider silver as a protective asset. Investors can consider buying silver at around $29-$30 to target higher levels.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.