Five fundamentals for the week: French opinion polls, US Retail Sales and Bank of England eyed

- Politics is back, with elections in France rocking markets.

- US Retail Sales and flash PMIs will provide insights into America's slowdown.

- The Bank of England announces its decision after all-important CPI data.

Will France or England win? Regarding football, we'll know only in a few weeks, but when it comes to political attention, the French are stealing the show. Anxiety about the next government in Paris is weighing on markets, and opinion polls are set to compete with economic data.

Here are the main events for the week.

1) French opinion polls are set to rock markets

The candidates lists are closed, and the campaign officially begins. Will President Emmanuel Macron's party hold government, or will it be the far-right National Rally? Markets have a clear preference for the president and fear populistic, Euroskeptic policies led by Marine Le Pen.

The announcement of the snap elections caused the left to unite as well, and it is not a pretty sight for investors. As Europe's second-largest economy and a nuclear power, France matters on the global stage.

Macron's Renaissance is squeezed in the polls by both the right and the left, and if fresh surveys continue showing that trend, the Euro would struggle and global stocks would be pressured. A recovery for the embattled president would cheer markets. Every piece of news matters ahead of the first round of voting on June 30.

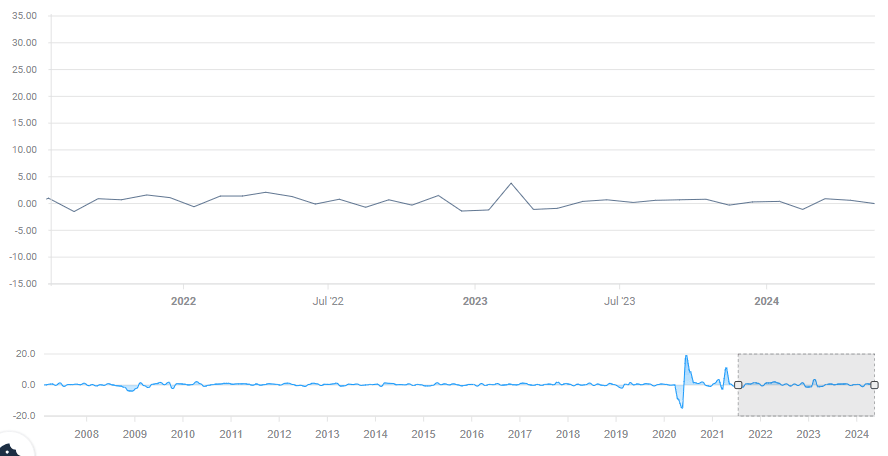

2) US Retail Sales to check the pulse of US consumer

Tuesday, 12:30 GMT. The US economy is the world's largest, and consumption is roughly two-thirds of it. While retail sales data are volatile – and suffer from significant revisions – it matters.

After stagnating in April, a modest increase is on the cards for May.

US Retail Sales. Source: FXStreet

For the US Dollar, a beat is positive and a miss is negative. For Gold, it is the other way around.

Things get complicated when it comes to stocks. On the one hand, "good news is bad news" – investors prefer weak data as it implies rate cuts are coming sooner. On the other hand, they seem more worried about a slowdown and could react negatively to indications company profits could suffer.

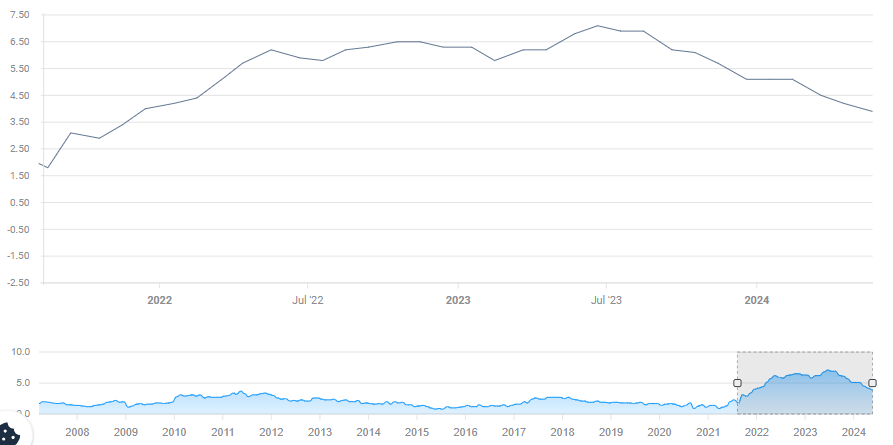

3) UK CPI serves as a preview to the BoE

Wednesday, 6:00 GMT. One day before the Bank of England’s (BoE) decision, the release of the Consumer Price Index (CPI) for May is key. Inflation has fallen significantly in recent months, hitting 2.3% year-over-year in April.

While that is almost in line with the central bank's 2% target, the data came out above expectations. Another small decline is on the cards now. Investors will be watching the more stubborn core CPI, which was at 3.9% last month and is now expected to drop to 3.5%.

UK core CPI. Source: FXStreet

The data will impact the Pound, but also other assets. A drop in global inflation will be welcome everywhere.

4) Bank of England to slip a message despite the elections

Thursday, 11:00 GMT. When will the Bank of England cut interest rates? Not now, and if only for one reason – Brits go to the polls two weeks after the decision, and policymakers do not want to be seen as intervening.

However, the Monetary Policy Committee's meeting minutes will give a peek into the bank's thinking. Apart from inflation, Governor Andrew Bailey and his colleagues will also consider the rise in unemployment, which would increase pressure to slash borrowing costs.

Markets are unsure if the "Old Lady" will cut interest rates in August or September. Last time, two members voted for a cut, but seven others opted for holding ground. If a third member urges lower rates, the Pound and also the Euro – suffering collateral damage – will retreat.

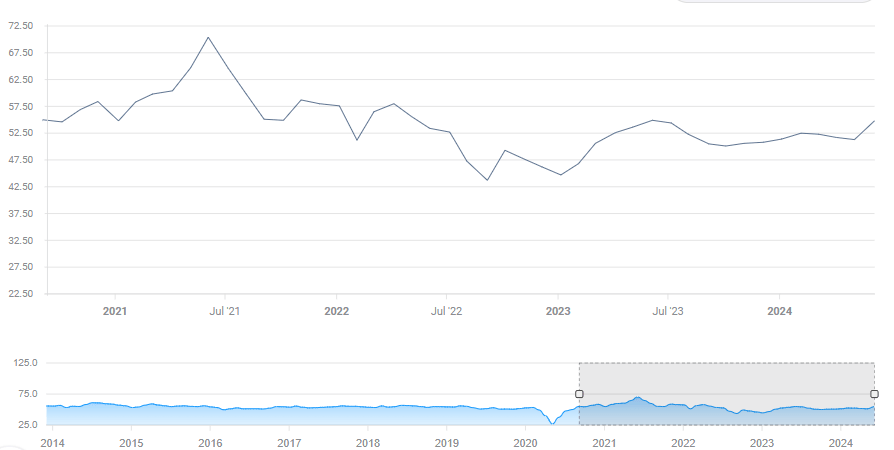

5) US Flash PMIs may show some moderation

Friday,13:45 GMT. S&P Global's June purchasing Managers' Indexes (PMI) are released early, providing insights into the economy's state. They also have the last word of the week, giving them more impact despite not being as important as the Institute for Supply Management’s (ISM) PMI.

The June figures are set to show weaker growth, with both the Manufacturing PMI and the Services PMI falling closer to 50 points, the threshold separating expansion from contraction.

US S&P Global Services PMI. Source: FXStreet

Like with Retail Sales, upbeat data would hurt Gold and support the US Dollar, while soft figures would have the opposite impact. Stocks might follow the US Dollar if the data is weak – I expect investors to take profits off the table ahead of the weekend.

Final Thoughts

The return of politics as a source of influence on markets adds to volatility – news can come out at any moment. Trade with care and watch France.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.