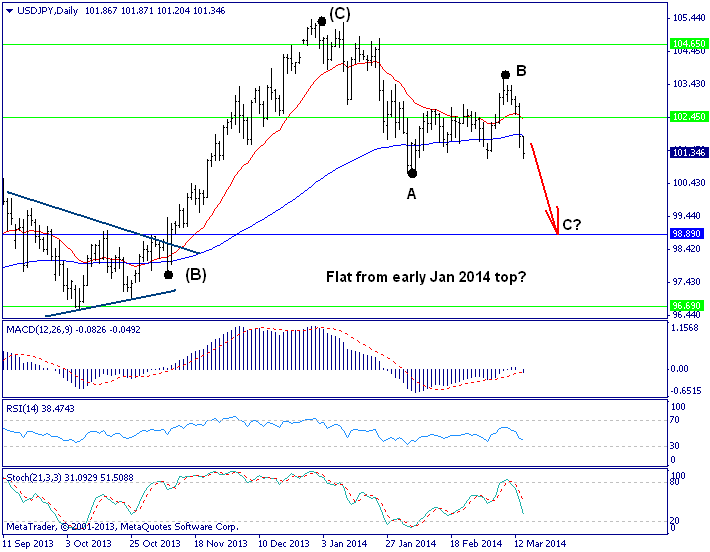

USDJPY: 101.34

Short-Term Trend: weak downtrend

Outlook:

A week ago the outlook was bullish but the pair failed to hold abv the 102.45 level and declined sharply on Thursday and Friday of last week. That shifts the odds in favor of the bearish scenario that I had previously followed. This scenario suggest that wave (C) has already ended and the market now is in a bigger correction of the entire rally from Sept 2012 low to Jan 2014 top. If that's the case, weakness twd 98.90 Fibo level is expected.

Only a firm and sustained move back abv 102.80 will turn the daily chart positive again..

Strategy: I favor shorts at 101.60 against 102.90.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

AUD/USD drops below 0.6600 after RBA policy announcements

AUD/USD stays under bearish pressure and trades deep in negative territory slightly below 0.6600. The RBA left the policy settings unchanged as expected but Governor Bullock said that there was no necessity to further tighten the policy.

Gold price turns red amid the renewed US dollar demand

Gold price trades in negative territory on Tuesday amid the renewed USD demand. A downbeat US jobs data for April prompted speculation of potential rate cuts by the Fed in the coming months.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.