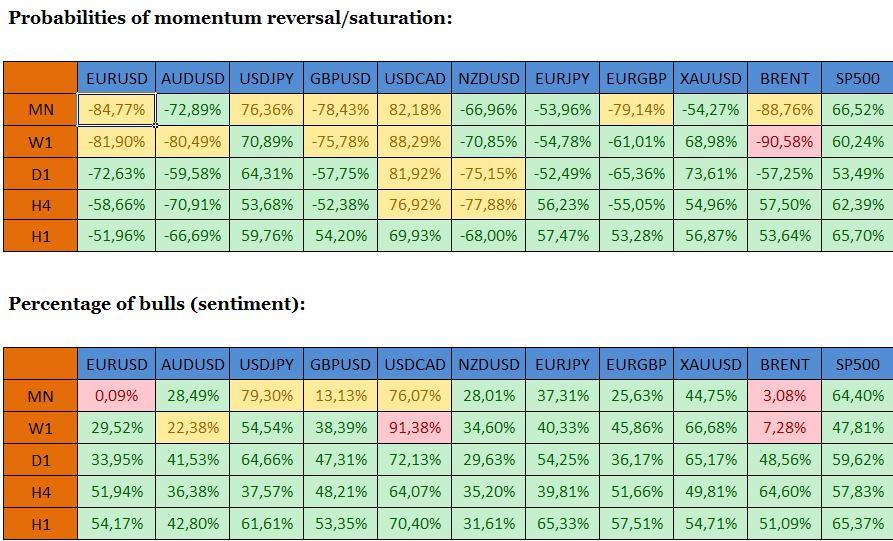

BETA – Propareos levels (areas where probabilities of price action reversal or saturation reach 90%; valid till 09:00 GMT):

EURUSD: 1.1665 -1.1680 on the upside, 1.1425-1.1440 on the downside.

AUDUSD: 0.8655-0.8280 on the upside, 0.7955-0.7970 on the downside.

USDJPY: 119.35-119.50 on the upside, 117.40-117.55 on the downside.

GBPUSD: 1.5220-1.5235 on the upside, 1.5045-1.5060 on the downside.

USDCAD: 1.2550-1.2565 on the upside, 1.1800-1.1815 on the downside.

NZDUSD: 0.7845-0.7860 on the upside, 0.7455 – 0.7470 on the downside.

EURJPY: 137.85-138.00 on the upside, 134.90-135.05 on the downside.

EURGBP: 0.7735-0.7750 on the upside, 0.7550-0.7565 on the downside.

XAUUSD: 1320.00-1330.00 on the upside, 1255.00-1265.00 on the downside.

BRENT: 49.50-50.50 on the upside, 45.00-46.00 on the downside.

SP500: 2050.00-2060.00 on the upside, 1965.00-1975.00 on the downside.

Warning! Propareos levels do not take into account fundamental developments. Their validity is reduced on days when the NFP is released and when Central Banks change their interest rate.

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold price turns red below $2,320 amid renewed US dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.