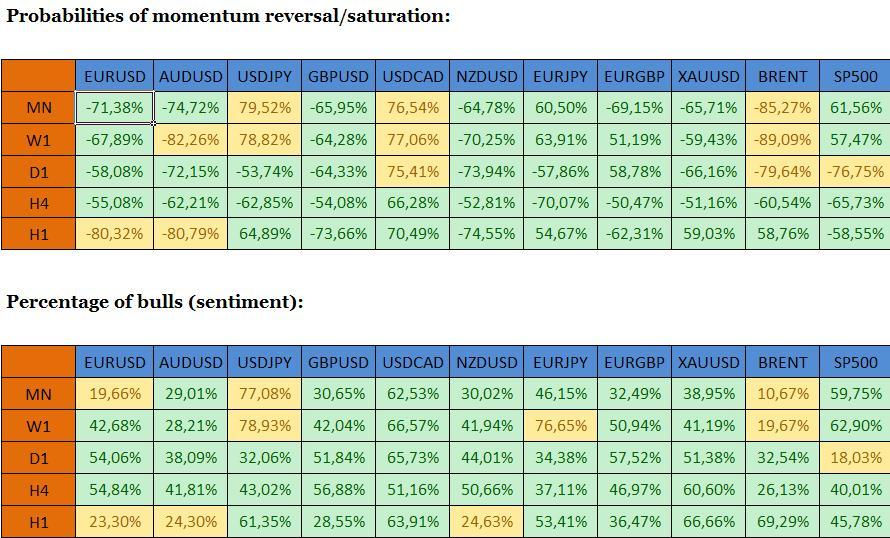

BETA – Propareos levels (areas where probabilities of price action reversal or saturation reach 90%; valid till 09:00 GMT):

EURUSD: 1.2585 -1.2600 on the upside, 1.2345-1.2360 on the downside.

AUDUSD: 0.8285-0.8300 on the upside, 0.8065-0.8080 on the downside.

USDJPY: 119.55-119.70 on the upside, 114.55-114.70 on the downside.

GBPUSD: 1.5825-1.5840 on the upside, 1.5560-1.5575 on the downside.

USDCAD: 1.1720-1.1735 on the upside, 1.1535-1.1550 on the downside.

NZDUSD: 0.7825-0.7840 on the upside, 0.7645 – 0.7660 on the downside.

EURJPY: 148.40-148.55 on the upside, 144.40-144.55 on the downside.

EURGBP: 0.7995-0.8010 on the upside, 0.7820-0.7835 on the downside.

XAUUSD: 1230.00-1240.00 on the upside, 1160.00-1170.00 on the downside.

BRENT: 65.00-66.00 on the upside, 57.00-58.00 on the downside.

SP500: 2030.00-2040.00 on the upside, 1930.00-1940.00 on the downside.

Warning! Propareos levels do not take into account fundamental developments. Their validity is reduced on days when the NFP is released and when Central Banks change their interest rate.

Recommended Content

Editors’ Picks

EUR/USD manages to hold above 200-hour SMA ahead of Eurozone CPI, FOMC

EUR/USD meets with some supply during the Asian session on Tuesday and erodes a part of the previous day's gains amid the emergence of fresh US Dollar buying. Spot prices, however, remain in a familiar range held over the past week or so and currently trade around the 1.0700 round-figure mark.

GBP/USD consolidates its gains above 1.2550, investors await Fed rate decision

GBP/USD consolidates its gains near 1.2560 after flirting with the key 200-day SMA and three-week highs in the 1.2550-1.2560 zone during the early Tuesday. Investors reduce their bets on BoE rate cuts, which support the Cable.

Gold price traders remain on the sidelines ahead of FOMC decision on Wednesday

Gold price remains confined in a narrow range as traders prefer to wait on the sidelines. Reduced Fed rate cut bets revive the USD demand and act as a headwind for the metal. Investors now await the FOMC decision and US macro data before placing directional bets.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

Data fuels China optimism

China's factory activity has expanded for a second consecutive month, marking the best streak in over a year and fueling optimism for the sustainability of the world's second-largest economy's recovery.