In today's in-depth analysis, I'd like to draw your attention to gold's current market dynamics, which exhibit a robust and convincing buy signal. This recent surge in gold prices can be primarily attributed to the weakening American dollar. However, the movement aligns perfectly with an exemplary technical pattern observed on the chart, reinforcing the strength of this upward momentum.

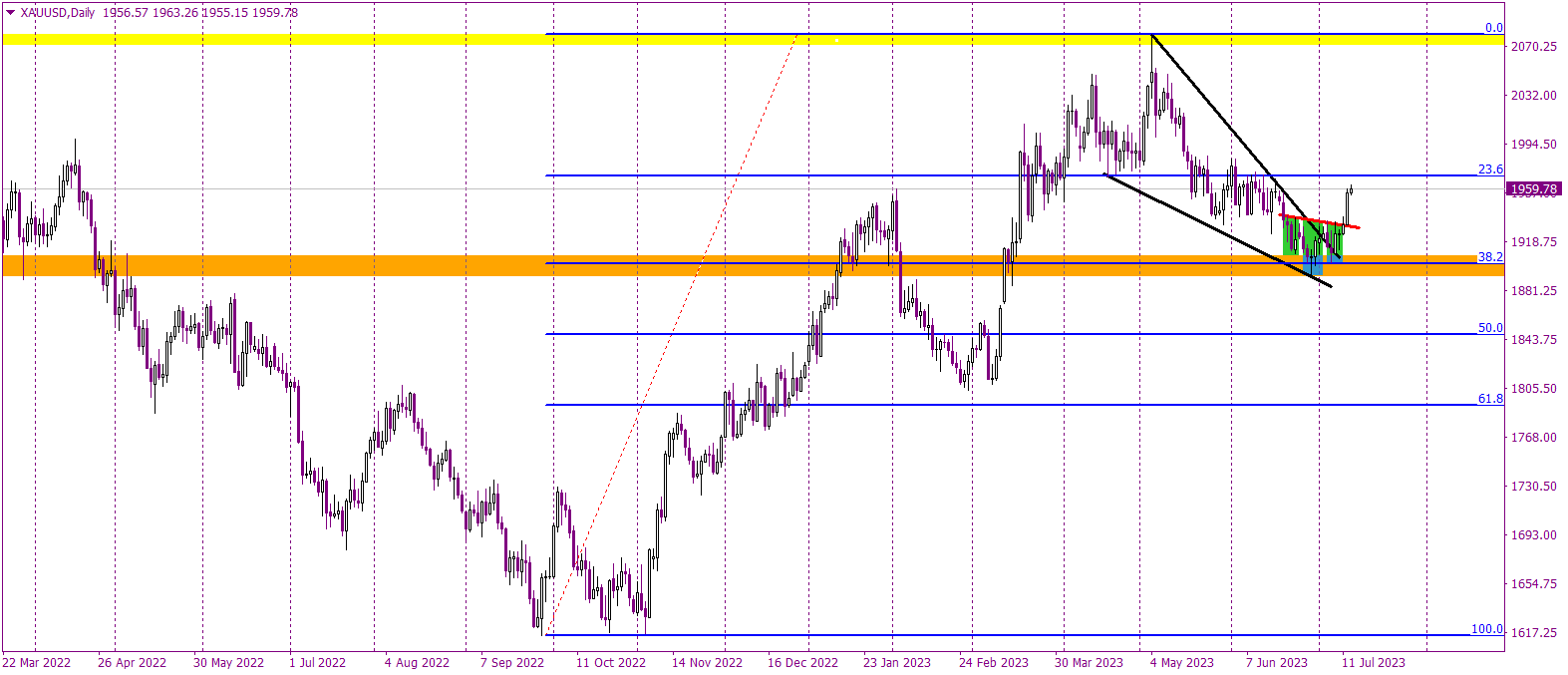

Recently, we've been following gold closely and highlighting a wedge pattern, outlined with black lines on the chart. This pattern was crucial in identifying key support levels, particularly the 38.2 Fibonacci level, which gold has consistently bounced off.

The most recent development in this evolving scenario has been the formation of an inverse head and shoulders pattern. This is a bullish sign in technical analysis and is illustrated with green on the chart. This pattern has seen the price break through the formation's neckline, marked in red. As per technical analysis theory, this breach triggers a buy signal.

So it's no surprise that following this neckline breakout, we've witnessed a substantial rise in the gold price. Therefore, the current sentiment for gold is undeniably positive and will remain so, provided we continue to hover above the 38.2 Fibonacci level.

That said, it's crucial to consider all potential scenarios. A fall in the price below the 38.2 Fibonacci level would issue a sell signal. However, the likelihood of this occurring currently appears minimal. In conclusion, gold's current market position is highly promising, offering excellent opportunities for buyers to capitalize on this positive trend. As always, it's crucial to keep an eye on these technical patterns, as they serve as vital guides in the ever-changing world of market trading.

Trading FX/CFDs on margin bears a high level of risk, and may not be suitable for all investors. Before deciding to trade FX/CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. You can sustain significant loss.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price (XAU/USD) struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.