Precious metals bulls question why metals prices keep falling in the face of what appears to be strong demand and great fundamental reasons for prices to move higher instead.

The bears have some answers of course. You can’t eat gold, it’s basically a pet rock, and modern financial systems are doing just fine without anything as antiquated as bullion gumming up the works.

The bears are declaring victory and saying the market has spoken. They ought to look a bit deeper into recent developments.

Outside of the price action, there is very little to support claims that gold and silver are relics of the past.

Lately, the real answer to the bulls’ question about why prices are headed lower isn’t the stuff of a lengthy philosophical debate. These days, the answer seems to be a lot simpler; huge demand for physical metal hidden behind an enormous glut in paper supply. And the actual physical metals are shifting into new hands.

Without looking, you would never know that exchange inventories are falling – a combination of demand for physical bars and a dearth of sellers willing to furnish actual metals at the current price.

The natural dynamic is for prices to move higher, but the market has been completely overwhelmed by a huge increase in leverage. Unfortunately, there is no end to the supply of paper gold and silver contracts the trading exchanges will stack atop a shrinking layer of physical bars in their vaults.

The amount of paper gold has tripled relative to “registered” stocks available for actual delivery. This has happened in just the past few months. Just one ounce of registered gold now backs nearly 300 ounces in COMEX contracts.

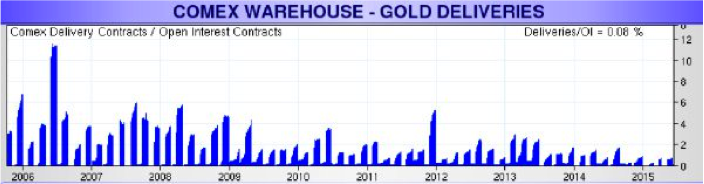

Stated another way, that’s razor thin coverage of just 0.0033. Trouble is brewing. About 1% of contract holders have been standing for delivery in recent years. So we could see requests to deliver 3 times more gold than is currently in the registered category in Exchange vaults.

To avoid default, the exchanges are going to need more registered gold. Luckily, there is another category of physical inventory available to draw against.

The vaults also hold “eligible” gold which can easily be converted to registered, provided the owners are willing. Bullion banks often move bars from the “eligible” category to “registered.” In fact, that is what they have been doing recently.

The problem is stocks of eligible gold are collapsing as well. TFMetalsReport.com reports that combined eligible and registered gold in the COMEX have fallen nearly 50% during the past 5 years.

It’s a lot worse for JPMorgan Chase and Scotia Mocatta, two of the largest bullion banks. Since March the amount of eligible and registered gold in their vaults has fallen from 3,732,915 ounces to 1,515,825 ounces. That’s a 59% drop in just the past few months. And December is historically the biggest month of the year when it comes to requests for physical delivery.

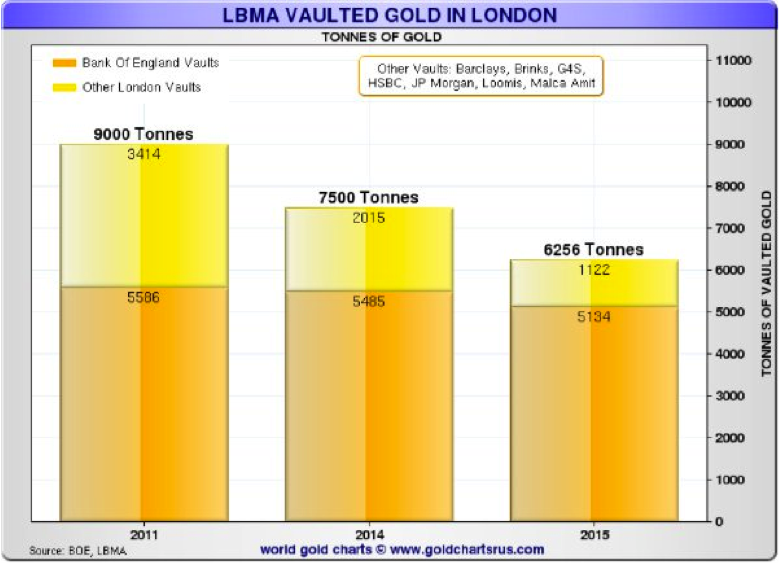

The drop in physical inventory isn’t limited to COMEX vaults. Trouble is brewing in London’s LBMA market – the world’s largest exchange – as well. Ronan Manly authored a report estimating that LBMA stocks outside the Bank of England vaults have fallen by 67% since 2011.

However, the report estimates that ETFs hold 1,116 of the 1,122 tonnes remaining, leaving only 6 tonnes – roughly 200,000 ounces – really in play for delivery.

Consider that LBMA banks often trade 1,000 times that amount – 200,000,000 ounces – in paper gold per day, and you find the same completely untenable scenario.

The price is falling because exchanges around the world are happy to let traders and banks sell more and more metal they don’t have and almost certainly can’t get. On the other side are folks busily buying the paper gold and ignoring the metastasizing counterparty risk. And behind-the-scenes inventories are vanishing as players with greater concern take delivery of bars and head for the exit.

There is no telling how this scenario will end. It could end if spot prices rise to the point that sellers with actual bars show up to sell. Or we may see exchanges engulfed and destroyed by a massive wave of delivery defaults. Who knows?

However, given the explosion in leverage over the past few months, the question of when it will end may be easier to answer. The reckoning for metals markets may not be far ahead.

Money Metals Exchange and its staff do not act as personal investment advisors for any specific individual. Nor do we advocate the purchase or sale of any regulated security listed on any exchange for any specific individual. Readers and customers should be aware that, although our track record is excellent, investment markets have inherent risks and there can be no guarantee of future profits. Likewise, our past performance does not assure the same future. You are responsible for your investment decisions, and they should be made in consultation with your own advisors. By purchasing through Money Metals, you understand our company not responsible for any losses caused by your investment decisions, nor do we have any claim to any market gains you may enjoy. This Website is provided “as is,” and Money Metals disclaims all warranties (express or implied) and any and all responsibility or liability for the accuracy, legality, reliability, or availability of any content on the Website.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.