Market Overview

Finally, after more than a week of procrastination, the S&P 500 has burst through its February resistance to post all-time highs. The move came with encouraging newsflow on COVID treatment (US FDA authorising a plasma treatment of patients with the virus) and potential use of vaccinations in the US (although this is unconfirmed). Add to that the news that phone conversations between US and Chinese top level trade delegates over the progress of phase one of the trade deal were encouraging. With Wall Street powering to new all-time highs there is a positive attitude to risk appetite across major markets. This is reflected in a move higher on US Treasury yields and a subdued outlook on gold. However, whilst the US dollar is a shade weaker today, there is a sense of consolidation across major forex pairs. Looming large this week is a speech by Fed chair Jerome Powell which could define the path of monetary policy in the months and possibly years to come. Even though there are some interesting data points in the coming days (US Consumer Confidence today), is unlikely that traders will take too much of a view ahead of such an important speech. We therefore see EUR/USD gravitating around 1.1800, Cable around 1.3100 and Dollar/Yen around 106, all of which are old pivot areas. This sense of consolidation is also across gold and silver again. Despite this though, the rally on equities looks set to continue today.

Wall Street closed decisively higher with S&P 500 +1.0% at 3430 and way into all time highs. It does not seem to be stopping there either, with futures ticking further higher today (E-mini S&Ps +0.4%). Asian markets were broadly higher with the Nikkei +1.4% but Shanghai Composite was -0.4%. European markets also look to be set fair, with FTSE futures +0.4% and DAX futures +0.7% early today. In forex, the risk positive vibe is helping EUR and GBP rebound slightly, whilst AUD is also performing well. Once more we see NZD as the main drag. In commodities, gold and silver are trading around the flat line, whilst oil is also mixed.

There is a clutch of US data points on the economic calendar today, but the key data kicks off with the German Ifo Business Climate at 0900BST. The Ifo for August is expected to improve to 92.2 (from 90.5 in July). This is expected to be driven by improvements in both the Current Conditions component (to 87.0 from 84.5) and Expectations component (to 98.0 from 97.0). Then into the US session the data begins with the S&P Case Shiller House Price Index which is expected to improve to +3.8% in June (from +3.7% in May). US Conference Board Consumer Confidence is at 1500BST and is expected to improve in August to 93.0 (from 92.6 in July). New Home Sales also at 1500BST is expected to improve by +1.3% to 785,000 in July (from 776,000 in June). The final data will be of note as regional Fed surveys have tended to falter in August and come in with negative surprises, with the Richmond Fed Composite Index expected to remain at +10 (+10 in July).

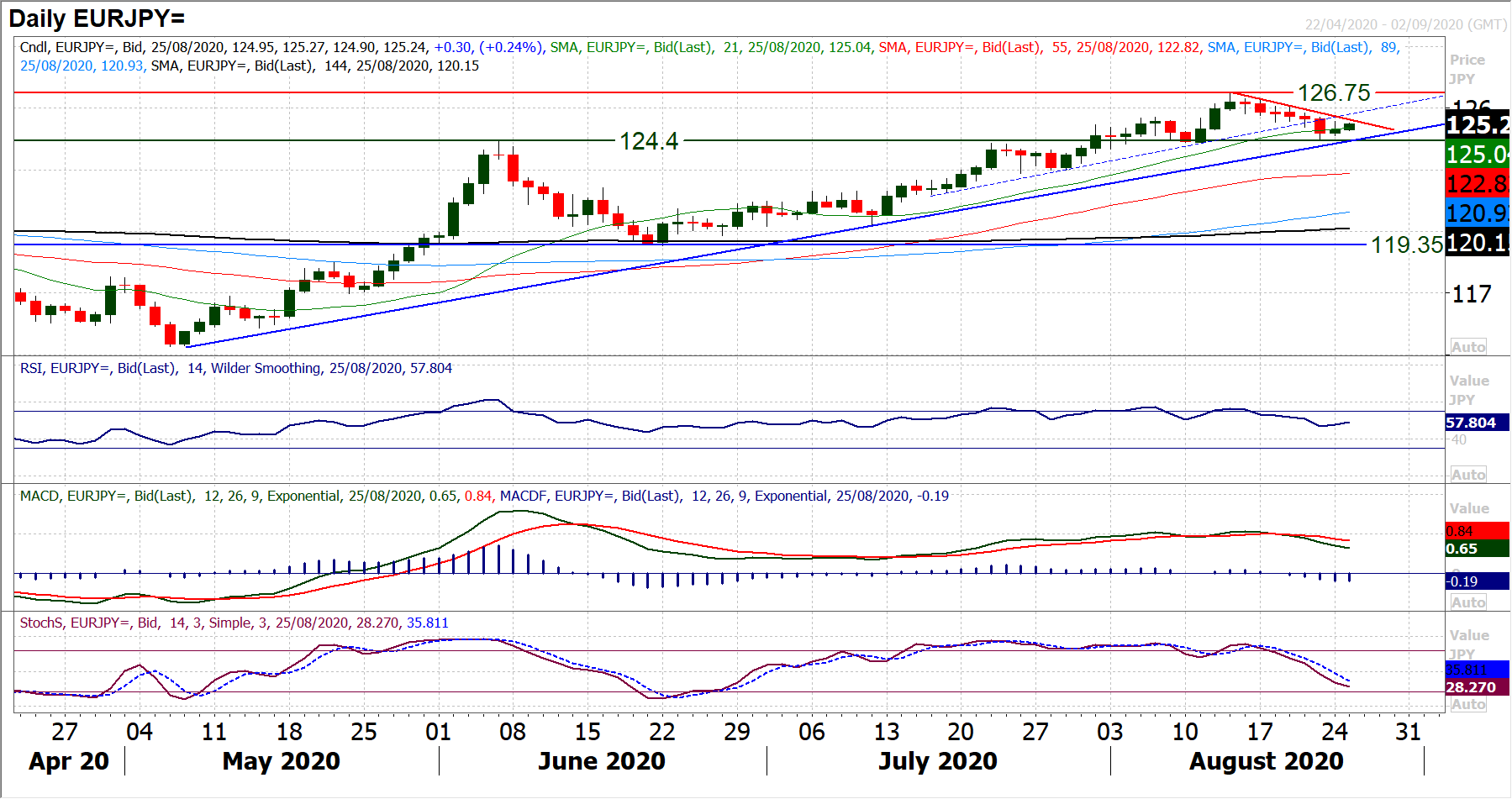

Chart of the Day – EUR/JPY

The outlook for the euro rally has reached an important inflection point and this is reflected well on Euro/Yen. After six consecutive sessions of losses, Friday’s low was almost to the pip of the old key breakout level of 124.40. However, this appears to have been supportive and building on this yesterday with a (mild) positive candlestick the basis of support between 124.30/124.40 is holding for now. The bulls may have been disappointed that a five week uptrend has been broken, but a bigger 15 week uptrend that originated in early May is still intact (today at 124.25) and adds to the support around 124.40. The bulls need to work hard though, as a mini two week downtrend is intact (at 125.45 today) and near term momentum indicators are mixed. Stochastics and MACD lines are pulling lower whilst the RSI needs to hold above 50 to sustain otherwise the corrective outlook with gather force. For now, this is a near term correction within a medium term bull trend. However, how the market reacts around 124.25/125.40 in the coming days will be key as to whether this is a buying opportunity or not. For now we still hold a positive view of the euro but the bulls need to work hard now. A decisive close under 124.25 opens a move back towards 122/123 and seriously question the bull control. Holding 124.40 is important and a decisive move above 125.55 would help to regain bull confidence for a retest of 126.75.

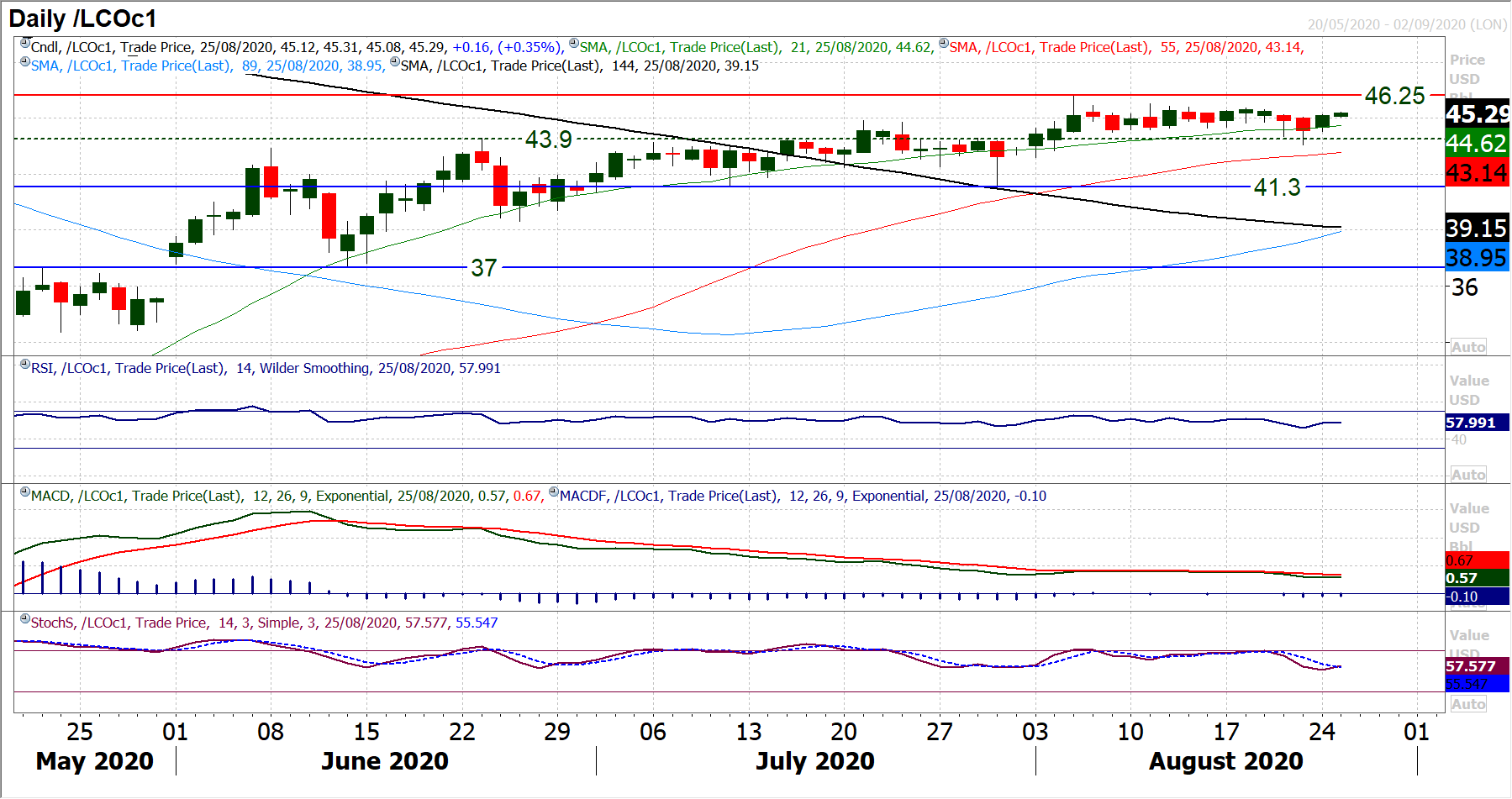

Brent Crude Oil

After a run of disappointing closes on Brent Crude, a decisive and solid session of gains has started the week off on the right note for the bulls. A move which has strengthened support at $43.60/$43.90 has helped to improve failing momentum as Stochastics and MACD stabilise and RSI holds in the mid/high 50s. It also seems to be stabilising what had threatened to be a corrective drift that had threatened to drag the market decisively below the 21 day moving average which has been a basis of support for the recovery (rising today around $44.60). The bulls now need to put together a run of positive sessions to get their confidence fully restored, and an early tick higher today is a good start. They will therefore be eying last week’s reaction high of $45.55 as initial resistance to test. Beyond that the barrier of the $45.80/$46.25 resistance remains the key move still. The hourly chart shows initial support at $44.30/$44.75.

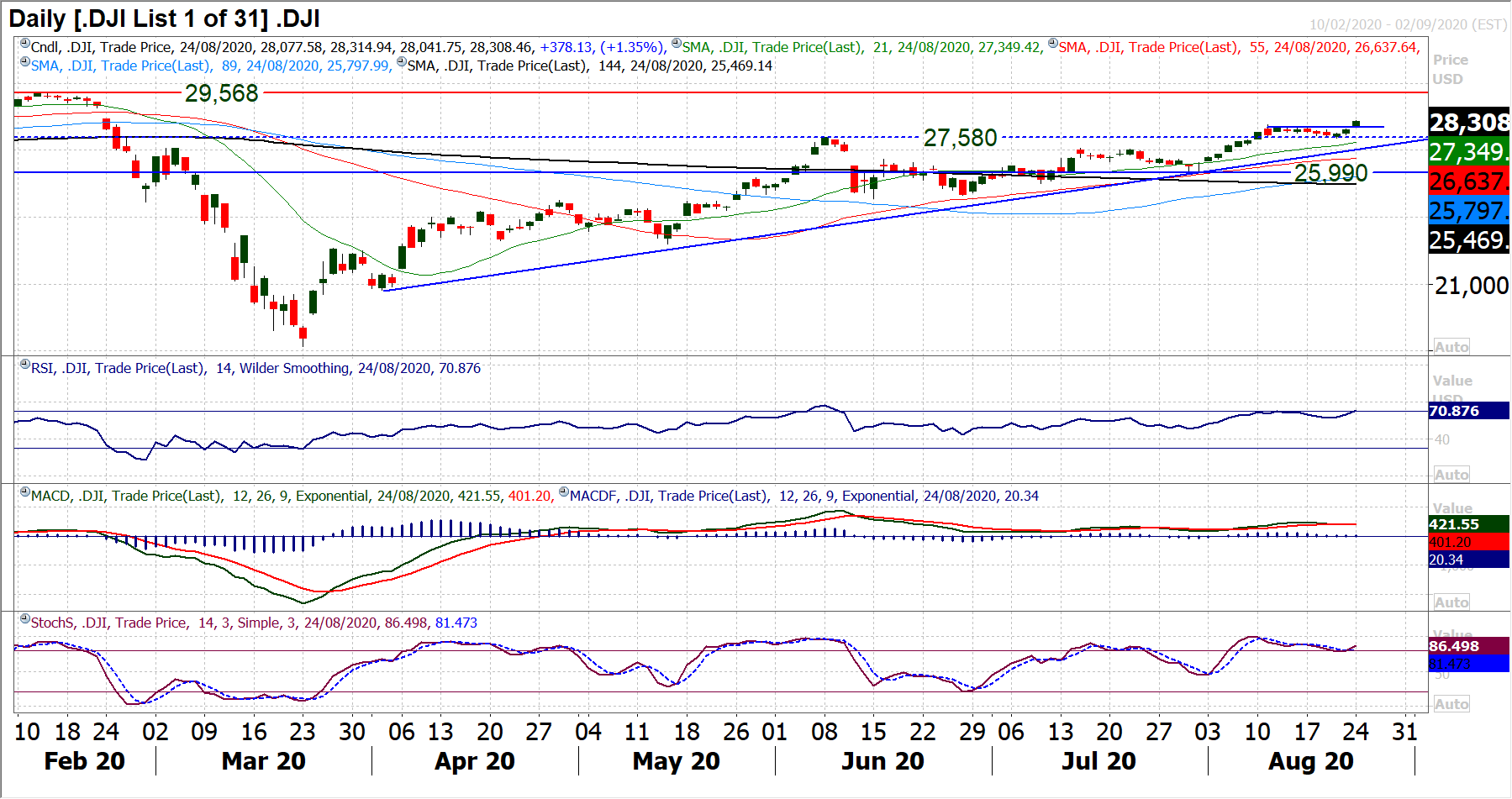

Dow Jones Industrial Average

Breakout across the major Wall Street markets. With the S&P 500 bursting to new all time highs, we see the Dow accelerating higher. A third positive close in a row and a decisive move through resistance at 28,155 takes the Dow to its highest level since February. The move looks strongly configured technically, with the use of the June breakout support around 27,580 leaving good support now in a band 27,525/27,580. Momentum is strong with the Stochastics crossing higher and RSI into the 70s to reflect a strength of the trend. The next test is to finally “close” the old February bear gap at 28,400/28,890. This move has similar hallmarks to the previous early August rally which came after a period of slight consolidation drift lower. That move posted a run of seven decisive positive closes. We look to use intraday weakness as a chance to buy. Initial breakout support comes in at 28,000/28,155. The all-time high of 29,568 should not be ruled out in due course, although there is likely to be another corrective phase prior to that.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.