GBP/USD: Near team uncertainty continues on Cable's outlook [Video]

![GBP/USD: Near team uncertainty continues on Cable's outlook [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/iStock-1178148633_XtraLarge.jpg)

GBP/USD

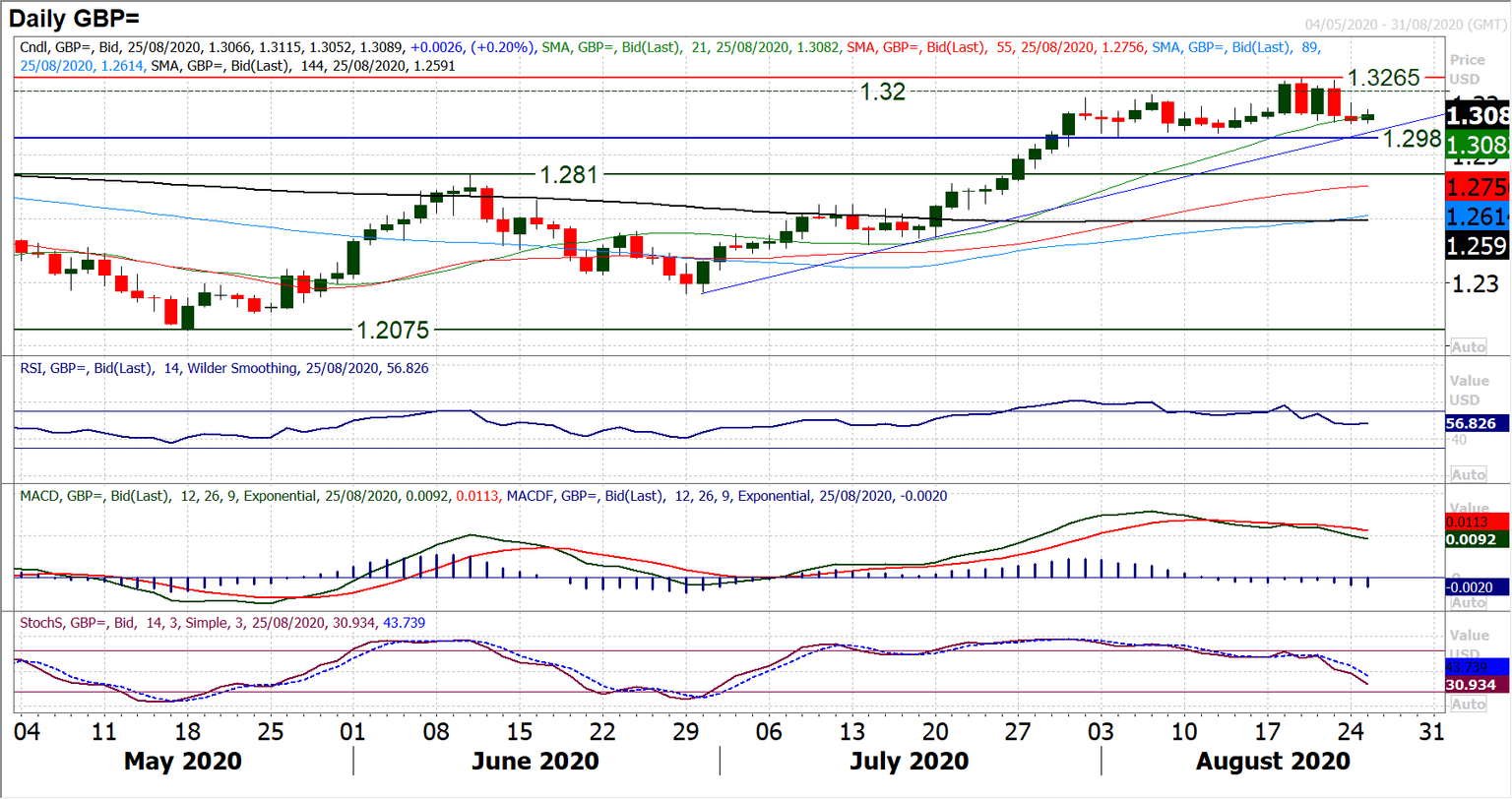

The uncertain near term outlook continues on Cable. The incredible run of four huge but contradictory candlesticks has come to an end, but yesterday’s bull failure, which lost -85 pips from the day high to close lower, again reflects the near term fluctuation still in the market. Even this morning, with the market ticking back higher again, we cannot say with conviction that the bulls are in a solid position. The lack of decisive trend over the past week has weighed on momentum indicators, which are faltering on MACD and Stochastics, but at least RSI is holding in the mid/high 50s. For now, we still favour Cable longs, with the dollar rebound unable to gain decisive ground. This still looks to be a pullback within the positive trend, but support at 1.2980/1.3000 needs to hold for this to continue. Initial support is now at 1.3050 and the bulls will be looking to push through resistance of a pivot band (shown on the hourly chart) between 1.3120/1.3150 to regain their lost control.

Author

Richard Perry

Independent Analyst