Polish Zloty (EUR/PLN) – dangerous position for the Zloty

The Polish Central Bank has maintained the main policy rate at 1.5%, in an unsurprising move given the inflation landscape. Further cuts are not warranted, and if the economy remains resilient, they may even not be needed. A new MPC member also balances what could have been otherwise a dovish leaning position. Apart from the monetary policy issues, the market is however focused on the rating decision next week, when Moody’s may decide to cut the country’s rating. The fight between the Government and the Constitutional Court has drawn (unwanted) international attention, and the accusations of interfering with the constitutional status quo have not helped. The zloty has been losing ground steeply on the back of such worries, and the landscape ahead seems quite volatile. May 13th is the day to watch, when the rating decision is made.

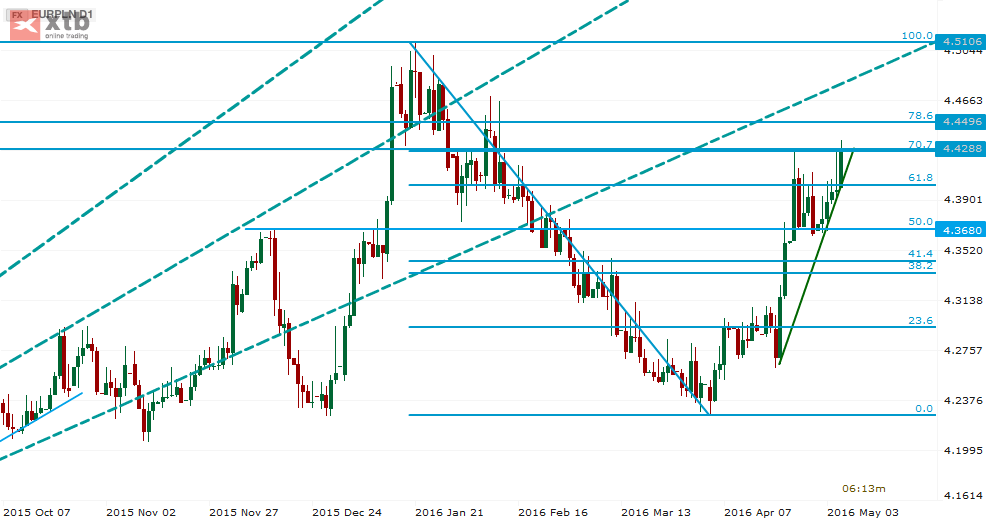

The chart points to a potential breakout of the 70.7% retracement at 4.4288. While a close above this has not happened yet, we believe there is still room for this, on Friday or Monday. Next resistance would be at around 4.5000 and 4.5100. The uptrend has been steep so although we see it likely to continue, any break below would possibly do significant damage. First support is at 4.3680 and then 4.3344.

Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – Forint is standing on the edge again

According to the latest forecast of the EU Commission, Hungary’s economy will grow by 2.5% this year and 2.8% in 2017. The Commission sees a deceleration to 2.5% this year mainly due to the decrease in EU fund absorption also seen in external demand. The Hungarian government has presented to Parliament on Tuesday a new tax package for 2017. Entrepreneurs will be granted additional allowances, the excise tax on cigarettes will be hiked by 29% and e-cigarettes will be subject to excise duty. The taxation of motor fuels will also change. It seems that the government is preparing for the 2018 election. KIVA (small business tax) and KATA (itemized tax for enterprises with a small tax base) will change for the better and developments in these types of taxes will be recognisable. National Bank of Hungary is still working on their easing programme. Now NBH is paying the state budget 50 billion forints worth of dividends from its 2015 profits.

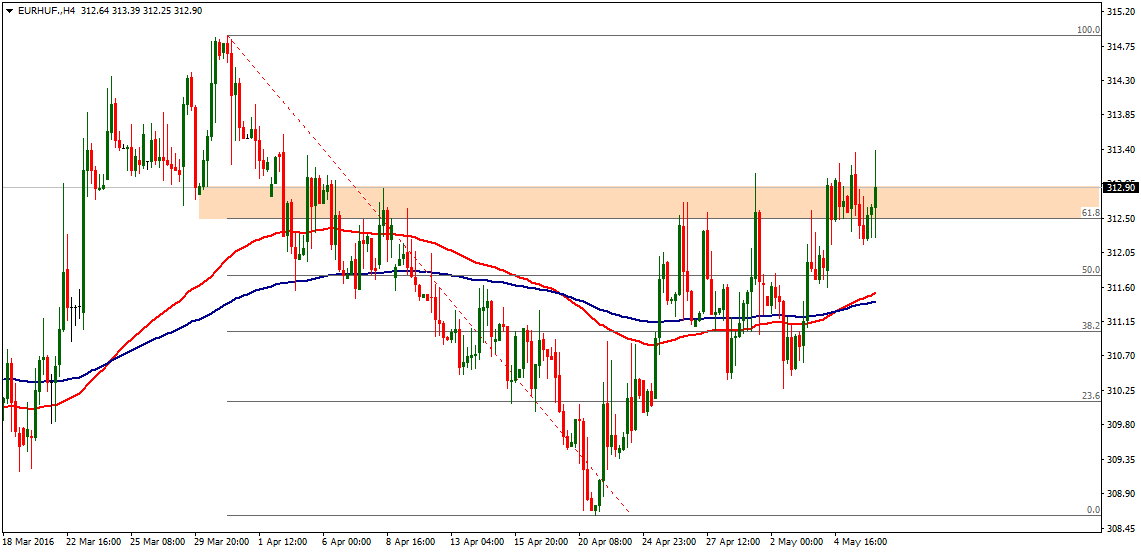

The forint is trading at 312.84 to the euro on the interbank market today. It is stable versus the EUR but softening relative to USD. EURHUF has been trading higher on the 4-hour time frame, moving above the 61.8 Fibonacci level. Price looks ready for another test of this zone soon and technical indicators are also suggesting that the resistance line could break.

Pic.2 EUR/HUF H4 source: Metatrader

Romanian Leu (EUR/RON) – A more balanced level after the slide

The National Bank kept rates in Romania as well, but unlike Poland, there is a clear focus on hiking later in the year. The generous public policies that added an increase in the minimum wage to the previous public wage raises and VAT cuts are being frowned upon by the Central Bank. The RON has not yet fully reflected the negative effect of the new bank law, but at 4.50 we see it more balanced than it was a few days before, when it traded closer to 4.46. In the week ahead we get industrial production and CPI data on Thursday. Until now macro data has been shiny, with a 18.5% y/y increase in core retail sales in March, yet celebration is not in order given the pre-election stimulus. Oscillations around 4.50 may be in the store over the next few sessions.

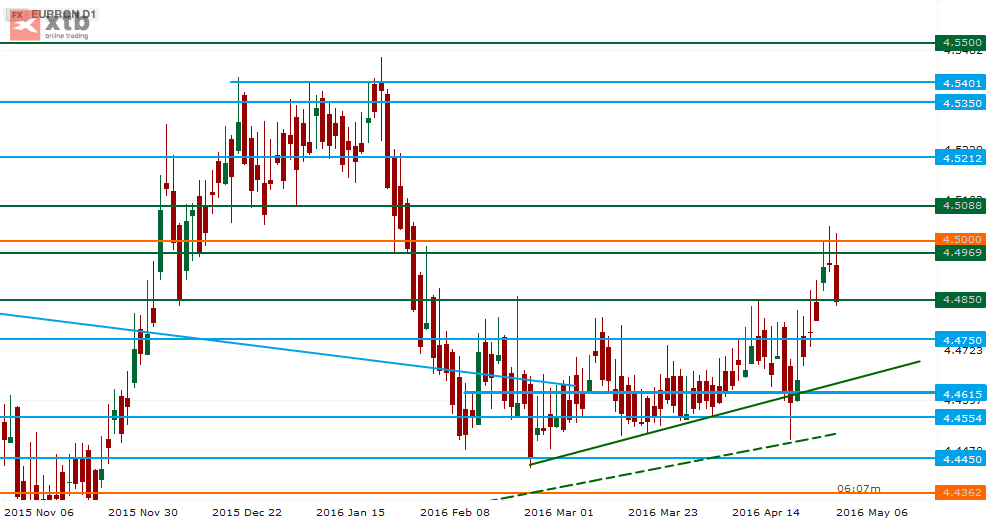

From a technical perspective, now that the market has pushed higher towards 4.50 and come back a little, there is a support at 4.4850 that becomes interesting. Below that lies the 4.4750 level, but a return to 4.5000 may be envisaged. The trend is still up, however there is need for some regrouping before a push towards 4.5088 or even 4.5212 tests the bulls’ determination.

Pic.3 EUR/RON D1 source: xStation

X-Trade Brokers Dom Maklerski S.A. does not take responsibility for investment decisions made under the influence of the information published on this website. None of the published information can be treated as a recommendation, disposition, promise, or guarantee that the investor will achieve a profit or will minimize risk using the information published on this website. Transactions including investment instruments, especially derivatives using leverage, are in its nature speculative and can provide both profits and losses that can exceed the initial deposit engaged by the investor.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.