Polish Zloty (EUR/PLN) – Zloty strongest since January

The Zloty market has stabilized and seems the corrective movement has extended. The Polish currency kept gaining in value as the global situation calmed down and due to rather strong local macro data publications. GDP in the fourth quarter of 2015 grew by 3.7% (lower than the preliminary reading of 3.9% but still strong). At the same time, the industrial PMI increased to 52.8 points in February (much better than expectations). Despite the fact that some analysts say there is a chance that the MPC will cut interest rates as soon as in March, it does not seem such scenario will realize. Even on of the new members of the MPC, Kamil Zubelewicz, does not see a reason for lowering the cost of money at this moment. It seems that the market has already discounted most of the bad information that could hurt the Zloty (government plans to increase spending) and now the market is going back to equilibrium. We will see how that goes. Next week will be deciding as on Thursday we have the MPC’s interest rate decision. As I have mentioned, I do not expect any surprises (no cut) but with such events one can never be sure.As we see on the daily chart, the EUR/PLN continued its corrective movement reaching a weekly low of 4.32, its lowest level since the beginning of January. The market rebounded slightly and is currently fighting at the 4.34 level, which was the support this past week. If the EUR/PLN ends up the week below 4.34, we should observe further appreciation of the Zloty, probably towards 4.30. On the other hand, the stochastic oscillator shows us the market could be oversold and that we should expect an upward move. The EUR/PLN might need to catch a breather before continuing its fall. In this case, the market could test 4.37 next week.

_20160304131355.png)

Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – Revolving door

Moody’s Investor Service will review Hungary’s sovereign debt rating today (Friday) after markets close. Last year, the credit agency changed the outlook on its “Ba1” rating from “negative” to “stable”, citing the improving medium-term forecasts of the economy and the government’s commitment to a strict fiscal policy. Hungary’s five-year credit-default swaps have stayed largely unchanged compared with the start of this year, versus a 20 basis-point surge for Poland to 94 and a four basis-point increase for Romania to 135. A rating move up by Moody’s would be the first in the region since it raised Lithuania’s credit score in May. Prime Minister, Viktor Orban, is very optimistic. Many analysts expect Hungary to return to investment grade this year, after the huge rebalancing. On the other hand, Moody's would consider upgrading Hungary's rating if the country's economic and fiscal metrics continue to improve, resulting in a further reduction of the public debt ratio. Currently, Hungary government’s debt to GDP is 75.8%.

Pic.2 HU Debt to GDP source: www.tradingeconomics.com

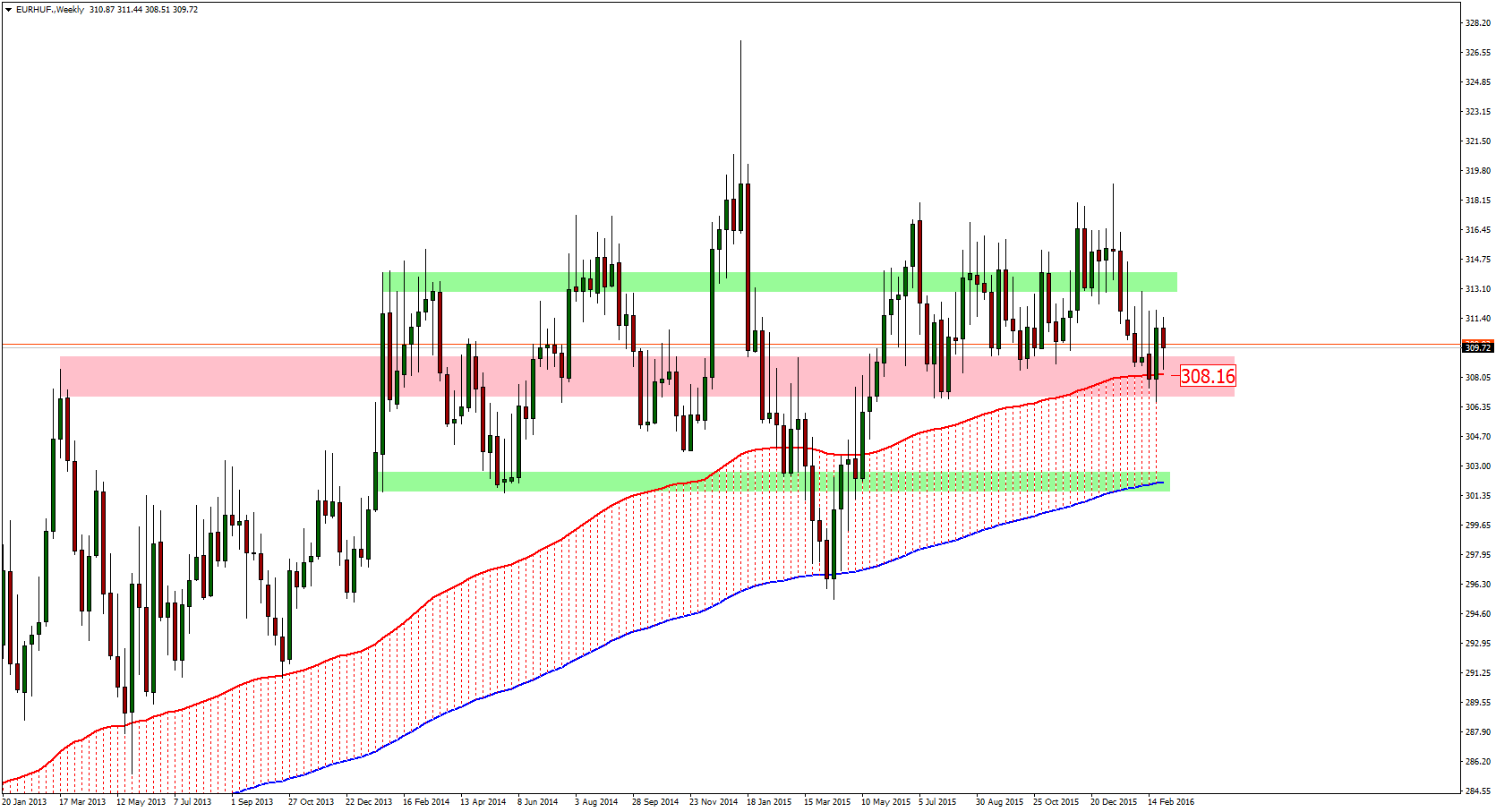

The Forint traded at 309.20 against the euro a little after 5:30pm in the evening on Thursday. Now, the EUR/HUF is standing in front of a revolving door, under the 100 weekly EMA. The Forint could go to heaven (in order for this to happen, Hungary needs to get out from the junk debt rating category). Otherwise, if Hungary stays in the lower (junk) rating group, the EUR/HUF could rise back again to the 312 zone.

Pic.3 EUR/HUF W1 source: Metatrader

Romanian Leu (EUR/RON) – Do not get complacent

Next week is the most important for the bank law. The industry association warned that if Parliament pushes through the current form the costs will only initially be paid by banks. Later on, it would be on the consumers shoulders. Yet the currency and even bank stocks do not seem very much worried. Actually 2015 results have been so good for some names that shares went up recently. At the same time, consumption jumped strongly in January, helped by tax cuts and public pay rises: a fabulous 15.6% y/y jump in January. Given the favourable outlook, some financial institutions see a stronger RON ahead. We sense however there may be risks given that the year may bring a larger trade deficit especially on the goods side due to demand unbalanced by local output. Inflation as posted by the PPI data fell by 0.6% m/m but the current developments are above estimates, so we may prepare for a shift from neutral to hawkish in a few months. With the uncertainty surrounding the bank law and possible volatility ahead of the ECB meeting, the RON may have some room to adjust, so this may not be the time to get complacent.The technical perspective appears lateral again. Yet it is an original version of a consolidation, with margins boundaries still in the process of becoming more clearly defined. Will the longer-term trend continue? The technical factors suggest so, pointing at 4.4450 as a strong support. The trendline is not much below that, for another layer of protection, but should that get penetrated, we may have in mind the 4.4223 area as decent support. For now the upper limit of the fluctuations should be around 4.4750 or, higher, at 4.4850.

_20160304131619.png)

Pic.4 EUR/RON D1 source: xStation

X-Trade Brokers Dom Maklerski S.A. does not take responsibility for investment decisions made under the influence of the information published on this website. None of the published information can be treated as a recommendation, disposition, promise, or guarantee that the investor will achieve a profit or will minimize risk using the information published on this website. Transactions including investment instruments, especially derivatives using leverage, are in its nature speculative and can provide both profits and losses that can exceed the initial deposit engaged by the investor.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.