Compared to the previous weeks, this past one was really boring on the Zloty market. The Polish currency has been trading very close to the 4.40 level with moves not extending beyond 100 pips from that quote. The situation on global financial markets have calmed down and now the PLN is waiting for a strong impulse. The government passed the “500+” bill, which will give each family 500 PLN for their second (and 500 PLN for each next) child but this has already been discounted. The FOMC minutes were not controversial and the reaction of the market was really mediocre. Also, the rather negative data from the local economy has not hurt the Zloty so badly. Average wages in January increased by 4% (yearly basis) and those were the good news. The bad ones included worse than expected increase in industrial production in January (only 1.4%, also yearly basis) and a -2% PPI reading. Despite that, the Zloty stayed stable. Is it a sign that the market is ignoring (or has already discounted) the bad news? Maybe, but there are still danger ahead. Moody’s is warning Poland that increasing expenses, introducing the Swiss Franc aid program, and the bank tax, could endanger the stability of the financial system. So there is still a chance for a major depreciation of the local currency.

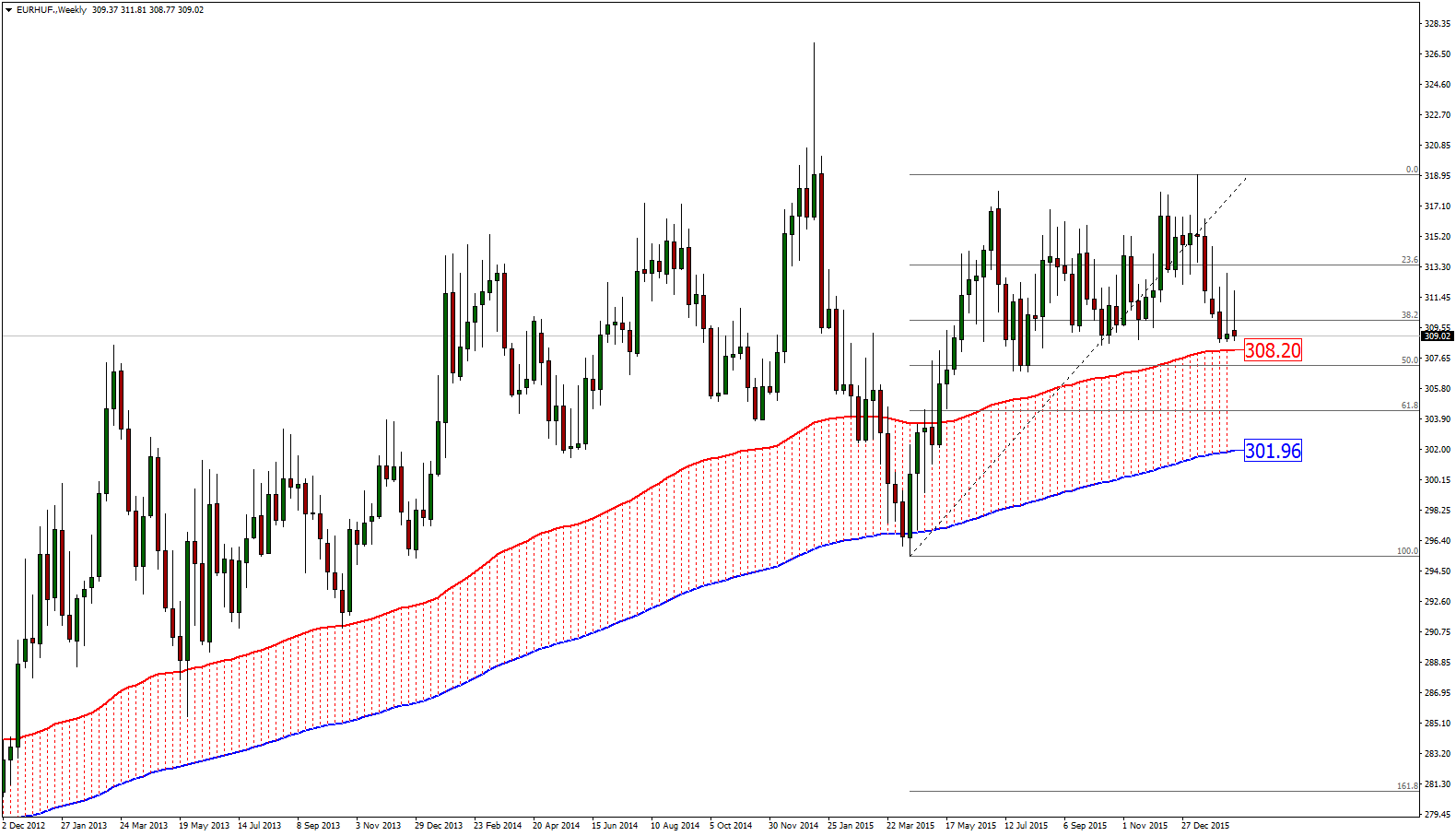

As we see on the daily chart, the market is approaching the crucial support of 4.37. Only breaking it could trigger a major downward move towards 4.30. If this does not happen, we should be observing the end of the corrective movement and a rebound of the EUR/PLN. The stochastic oscillator suggests the market is oversold so it confirms the upward movement scenario. If so, the EUR/PLN will be targeting 4.45, the 61.8% retracement level of the last downward corrective movement..

_20160219160622.png)

Hungarian Forint (EUR/HUF) – Still on the edge

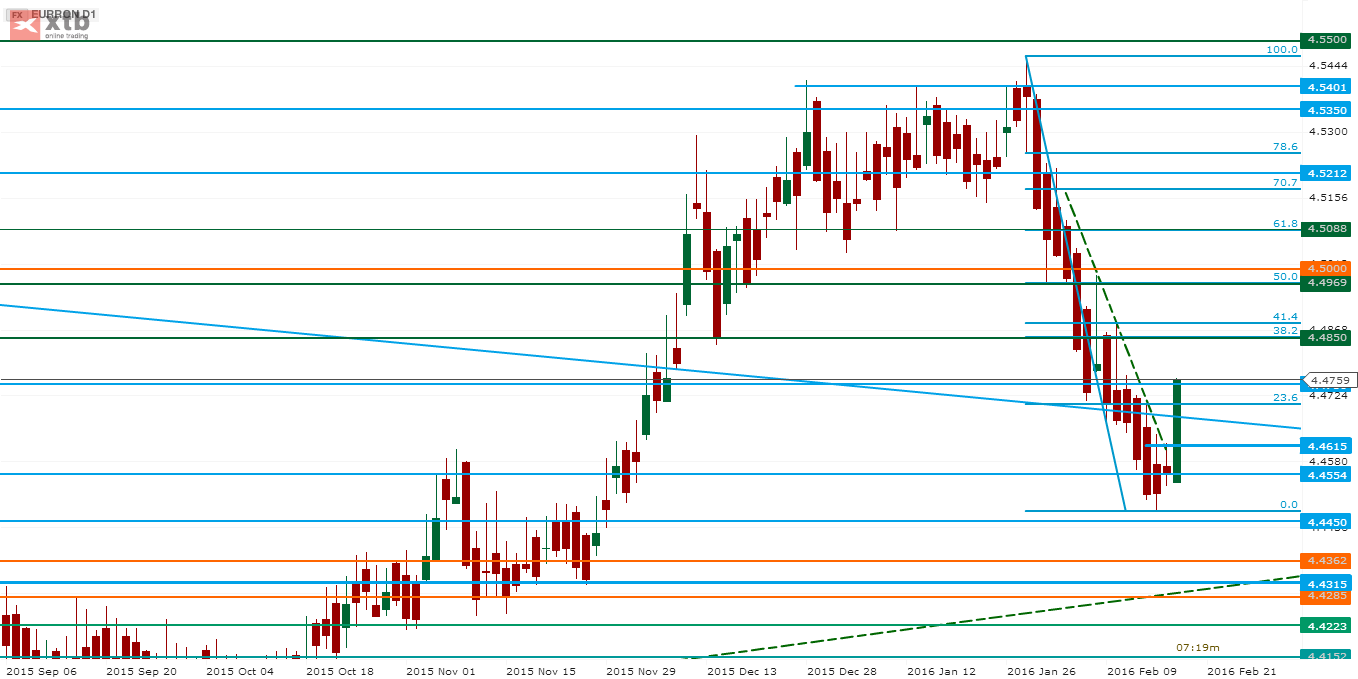

Real wages rose 4.4% yr/yr on average last year, driven mainly by wage hikes in the public sector. The number of people employed in the public sector rose to over 200,000 by the end of December, which is greatly above the base period’s figure. Net earnings in the business sector also went up, but by only 2.4% y/y in December. We have only seen good news for the Hungarian currency this week. The International Monetary Fund (IMF) said in a statement that the Hungarian economy is performing very well and its vulnerability to shocks has declined substantially. National Bank of Hungary will hold an interest rate decision meeting next week. Probably the NBH event will determine EURHUF moves in the next few days. We are not expecting changes from the NBH, but remember that inflation surprisingly slowed down last time it was reported.

The forint was trading at 310.30 to the euro at 5:30pm on Thursdayʼs interbank forex market, down from 309.77 late on Wednesday. The EURHUF is still dacing on the edge at 309. We are a little scaptical about a breakdown anyway if the 308 support will fall the Forint has got a freeway to the 200 weekly EMA (blue line).

Romanian Leu (EUR/RON) – Time for a break

On the back of a surprise reversal and speculative capital inflow (coming partly as the economy is set to record a very good growth this year and partly to offset some of the turmoil in Ukraine and other regional worries) the Romanian Leu performed very well in the first month and a half, gaining a bit over 1.3% from Jan 1st to Feb 18th. We have seen a stronger Leu on days with weaker equities. Data this week pointed toward a bit of a surprising performance in inflation, still in negative territory, but at -2.1% significantly less than otherwise seen with such deep tax cuts.. The consumer is rebounding strongly, and although this may be the joy of retailers and push the economy towards a 4% growth this year (after a jump by 1.1% q/q in Q4, and 3.7% for all of 2015), it is not of the structure most desirable in the long run. The risks of a deeper deficit given possible slippage on a double elections year and the worries that a new law would inflict losses onto banks, with one version opposed by the NBR going to the Parliament next week have however finally pushed EURRON sharply higher. We view this only as a return to values closer to “normality”, a trend that may continue next week. The one risk factor to watch is the vote on the law that could force banks to take back their real estate collateral if debtors decide so, placing them in a position to directly face large, though uncertain losses, as house prices have collapsed by 30% - 50% from the lending boom of the pre-2007 era. Another thing to watch next week: whether the RON becomes the bellwether of a larger move in the CEE currencies area.

In the technical perspective a strong breakout of the otherwise not very sustainable trend may take us higher, with initial suport at 4.4850, which is also the 38.2% retracement of the last down move, and 4.5000 further ahead (also in the vicinity of a retracement, 50% for that matter). There may be room to venture to the upside, given the longer term trend. Support is at 4.4450 and then around 4.4300 where the previous trend meets previous local lows.

X-Trade Brokers Dom Maklerski S.A. does not take responsibility for investment decisions made under the influence of the information published on this website. None of the published information can be treated as a recommendation, disposition, promise, or guarantee that the investor will achieve a profit or will minimize risk using the information published on this website. Transactions including investment instruments, especially derivatives using leverage, are in its nature speculative and can provide both profits and losses that can exceed the initial deposit engaged by the investor.

Recommended Content

Editors’ Picks

EUR/USD manages to hold above 200-hour SMA ahead of Eurozone CPI, FOMC

EUR/USD meets with some supply during the Asian session on Tuesday and erodes a part of the previous day's gains amid the emergence of fresh US Dollar buying. Spot prices, however, remain in a familiar range held over the past week or so and currently trade around the 1.0700 round-figure mark.

GBP/USD consolidates its gains above 1.2550, investors await Fed rate decision

GBP/USD consolidates its gains near 1.2560 after flirting with the key 200-day SMA and three-week highs in the 1.2550-1.2560 zone during the early Tuesday. Investors reduce their bets on BoE rate cuts, which support the Cable.

Gold price traders remain on the sidelines ahead of FOMC decision on Wednesday

Gold price remains confined in a narrow range as traders prefer to wait on the sidelines. Reduced Fed rate cut bets revive the USD demand and act as a headwind for the metal. Investors now await the FOMC decision and US macro data before placing directional bets.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

Data fuels China optimism

China's factory activity has expanded for a second consecutive month, marking the best streak in over a year and fueling optimism for the sustainability of the world's second-largest economy's recovery.