Polish Zloty (EUR/PLN) – elections coming up

The previous week everybody was analyzing what the Fed will do after a worse than expected NFP reading. This past week though, the market was analyzing the possibility that global central banks (mainly the ECB) could increase monetary easing. At this time, rather not. Mario Draghi was already mentioning that the QE program in the Eurozone is working even better than the bank anticipated. How did emerging market currencies moved in this environment? The Polish Zloty was, again, rather stable. In Poland, the main topic are the upcoming parliamentary elections on October 25th. The rightist Prawo i Sprawiedliwosc (Law and Justice) party is leading the polls in front of the currently ruling, Platforma Obywatelska (Civil Platform). As before elections time, parties are promising things they will do if elected. Of course, few of them are realistic (decreasing the retirement age and social help for poor families where the money for that would earned by taxing banks and big retail chains). As with the previous elections, I expect a weakening of the Zloty in case the rightists win. As for macro data, CPI inflation (yearly basis) stood at -0.8% in September (matching forecasts). We see no improvement in this area so at this moment, we cannot the MPC to consider hiking interest rates next year. Unless of course, the Fed starts its monetary policy tightening process soon and the economic situation of the country quickly improves (no signs of this though).

If we take a look at the daily chart, we the EUR/PLN rebounded from the 4.21 support (61.8% retracement level of the last upward move) last week. It reached a weekly high of 4.24 but was unable to continue the increase. Currently, the market seems undecided about which direction to take (the stochastic oscillator also does not provide a clear signal. Breaking the 4.24 resistance should take the market to its local highs of 4.26. The closest, strong support is at 4.21 and if broken, could trigger a market move even towards 4.21.

Pic.1 EUR/PLN D1 source: xStation

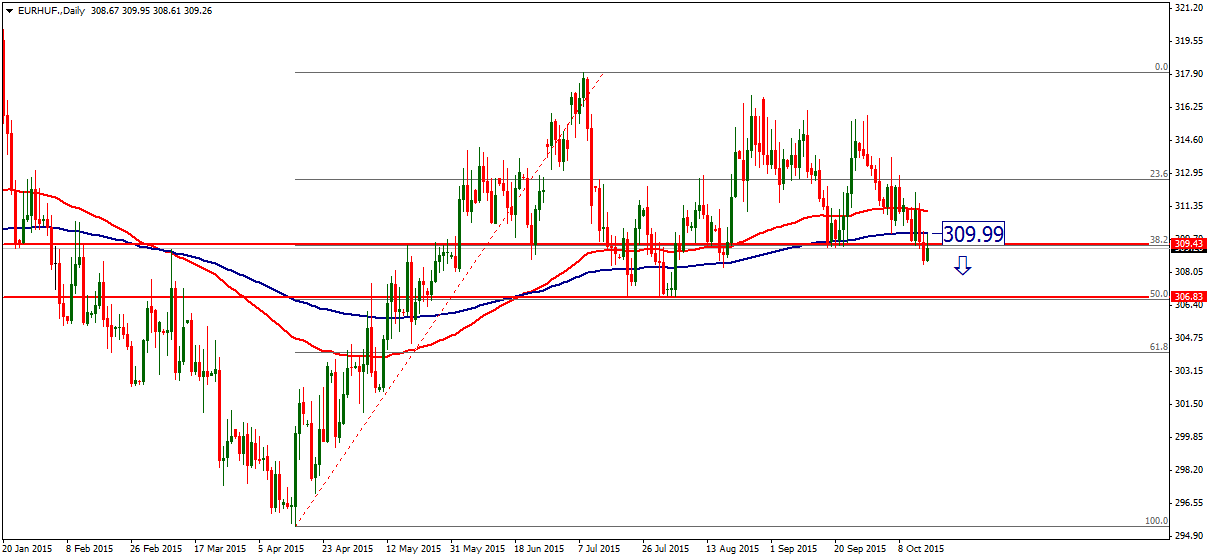

Hungarian Forint (EUR/HUF) – positive week for the Forint

Hungary’s Forint firmed to 310 versus the Euro on Monday afternoon but then it broke the support line today. Investor sentiment overseas may be impacted by comments of Fed officials. From the local view, the volume of Hungary’s construction output declined by 3.6% (monthly basis) in August. Output was 6.1% lower compared to the same month of last year. One of the main reasons for this negative trend in the last few months is that state investments cannot possibly accelerate, as the absorption of EU funds is at its peak for Hungary needs to spend the resources in the 2007-2013 programming period by the end of the year. However, this news had no major effect on the EUR/HUF Emerging markets has been focusing only on the Fed in the past few weeks.

Hungary's Forint briefly visited territories below 310, which corresponds to a 0.4-0.5% gain compared to its late Friday level. If 310 remains as the resistance, the EUR/HUF's target next week could be the 306 support. Under the 200 DEMA we can see more Forint power in the future.

Pic.2 EUR/HUF D1 source: Metatrader

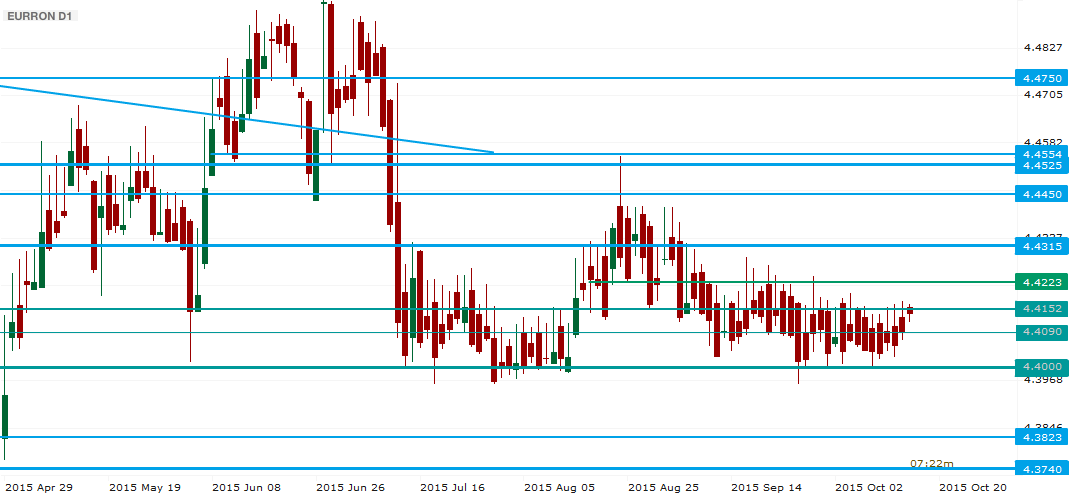

Romanian Leu (EUR/RON) – Insulated from the “madding crowd”

Has any of the European or global noise reached out towards EUR/RON? Not yet, as it seems that the current economical path leads higher, and provides a shield against the stress of more lax fiscal environment. Data from the constructions sector pointed to a large 10.6% jump in August 2015 vs. August 2014, while retail sales jumped by 0.6% y/y (seasonal and fiscal factors led to a 4.9% m/m decrease). The possible ending of the IMF deal that provided protection during the aftermath of the last crisis does not rattle the investors’ nerves now. We see a bit of risk to the upside next week, as the descending trend in interbank rates reduces appetite, and global factors begin to weigh in more heavily, pushing EURRON above 4.42 or even 4.43 in the week(s) ahead.

In the technical approach there has been a clear range within a larger lateral path. As of now, it appears to be leaning to the upside, while only a push above 4.4220 would allow the chart to get some jitters, and the next stop would be 4.4315. Will the market gain enough strength to do that? It may need some more time, and a re-test of 4.4000 in the mean time is possible. Action would be interesting to watch if there is a breajout below 4.4000, leaving 4.3823 exposed to the desire of traders eagerly waiting for some more volatility.

Pic.3 EUR/RON D1 source: xStation

X-Trade Brokers Dom Maklerski S.A. does not take responsibility for investment decisions made under the influence of the information published on this website. None of the published information can be treated as a recommendation, disposition, promise, or guarantee that the investor will achieve a profit or will minimize risk using the information published on this website. Transactions including investment instruments, especially derivatives using leverage, are in its nature speculative and can provide both profits and losses that can exceed the initial deposit engaged by the investor.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.