Polish Zloty (EUR/PLN) – same stories affect the PLN

The Polish Zloty has been in a depreciating mood for almost a month. This past week it regained some ground but it is hard to say if this is just a corrective movement or a change of trend. The main topic on the Polish market remains the problem of CHF mortgage holders and the aid the government is expected to provide to them (described by me last week). Now it seems the project might not go through Senate as it might be unconstitutional and the banks’ foreign shareholders might have a strong claim if they decide to go to court against the Polish government. The issue remains if such aid will not create a moral hazard in the future. The other issue are the promises given by the new President, Andrzej Duda. Those promises looked really nice during the presidential campaign (although many economists warned they cannot be realized as the country’s budget will not sustain them) but now the President is pushing them over to the government (opposing party, the Civil Platform). This could mean that Duda has been promising he might not deliver unless the ruling party goes along with him. From the local macro side, CPI inflation in July (yearly basis) stood at -0.7% which was slightly better than expectations. Core CPI was 0.4%, which matched forecasts. Of course, these reading does not change anything in the MPC’s monetary policy. External factors also played a role on the Zloty market. There are talks about the problems in the Chinese economy and this is affecting all emerging markets currencies, including the PLN.As we see on the daily chart, the EUR/PLN continued its upward move from the previous week but was unable to break the 4.21 resistance. The market turned around and the Zloty is being traded at around 4.18 – 4.19 against the Euro. The recent strong upward movements suggest this could be just a corrective movement and that the EUR/PLN will attack the 4.21 resistance again next week. The stochastic oscillator also suggests the market is oversold and that an upward move could be expected. For the record, is the resistance is broken, we should see the market at July’s highs of 4.24. For a continuation of the corrective downward movement, the EUR/PLN needs to break the 4.17 support in order to test 4.14.

Pic.1 EUR/PLN D1 source: xStation

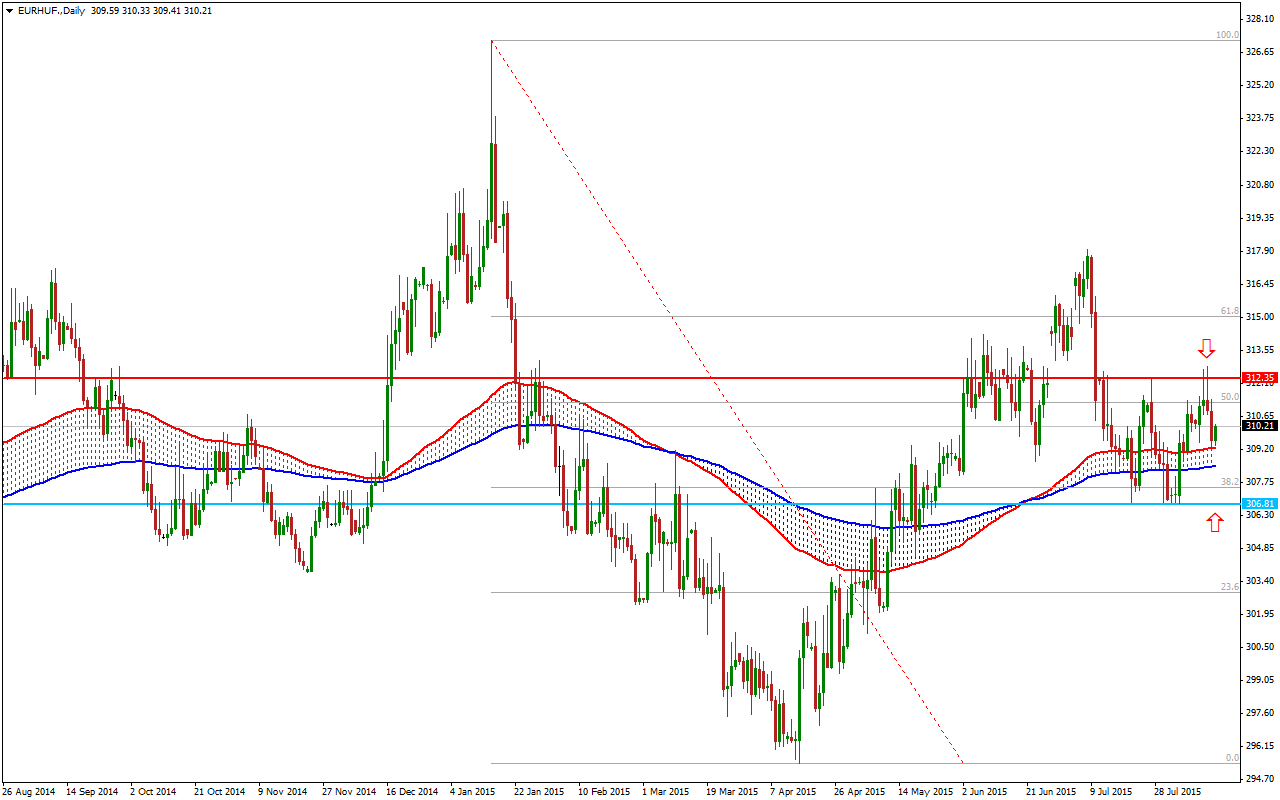

Hungarian Forint (EUR/HUF) – Still between the lines

The Central Statistical Office (KSH) is expected to report on Tuesday that inflation dropped to 0.5% (yearly basis) in July from 0.6% in June. July’s price index could have been dragged lower primarily by the fall in the price of gasoline. What this means is that the National Bank of Hungary is still far from the 2% inflation target. János Lázár, minister at the helm of the Prime Minister’s Office, said on Thursday, he will propose a meeting of the Hungarian government next Tuesday to invite tenders in the 2014-2020 programming period for cc. HUF 12 trillion worth of European Union funds by June 30th 2017. Now, the plan is to bring forward all tenders by June 30th 2017, which will redraw the entire map of Hungary’s macroeconomic scene in the following years. Looking at today's GDP data, we also see a small slowdown in the economic growth. Hungary’s gross domestic product was 2.7% in Q2, which is lower than the Q1 3,5% number. Probably, there is some connection between János Lázár's announcement and the slowdown.From rom the technical point of view, Forint buyers activated their funds few days ago at the 312 levels and pulled back the EUR/HUF into the rectangle again. As we mentioned last week, the EUR/HUF will probably stay in the 307 - 312 range for a longer time especially with an agreement between the Eurogroup and the Greek parliament.

Pic.2 EUR/HUF D1 source: Metatrader

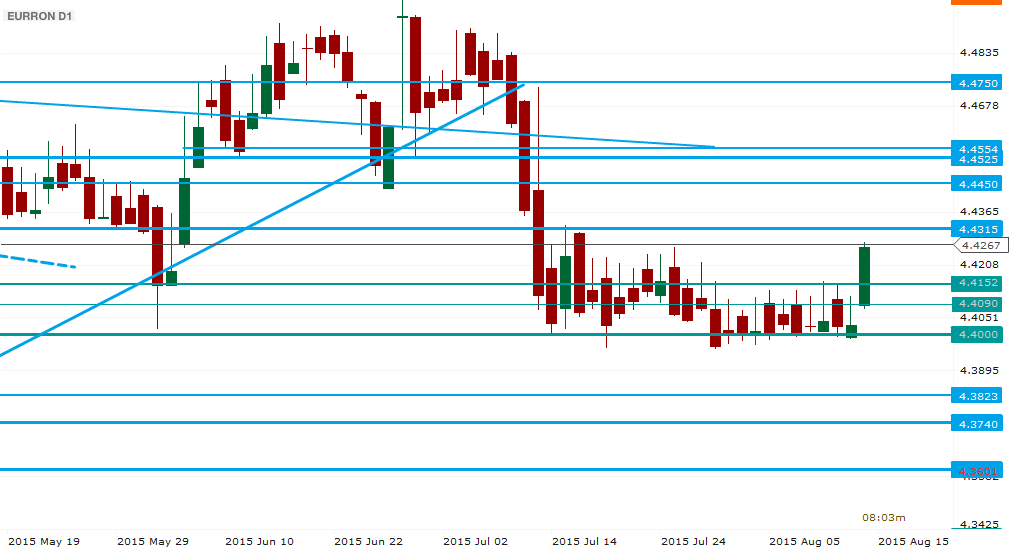

Romanian Leu (EUR/RON) – A miss by one GDP report does that to a currency

The week has been full of decent and/or good macro data (+2.5% m/m jump in core retail, better construction intensity and a slightly lower CPI, due to one-off tax cuts for the food sector), and the RON stayed close to 4.4000, but one GDP report on Friday was particularly bad. Well, not in itself, as a 3.7% q/y GDP growth is not to be moaned about, but the estimates were sky-high, some in the very high 4.5 to 5%, so some (speculative) funds were up for a ”disappointment” trade. The report may imply that the fiscal space is not as large as to provide room for the massive tax cuts and wage rises the government has in mind, and therefore justify a push for EUR/RON, or maybe the Leu backpedal may be due to some re-surfaced worries about the political determination to provide Greece funding, especially in Germany. This, if confirmed, would define an interesting ”bellwether” status for the RON. We view the market largely settling above 4.42 but below 4.45 in the week ahead.Technical perspective provides a clear breakout above the previous range. Now everyone is wondering whether this means a new range, or a strong uptrend. We tend to lean towards the former: a resistance level at 4.4315 may hold, and the defense of 4.4150 would define the new range. However, if we break 4.4315 the momentum may be strong enough to set a classic trend, with the usual 38.2% retracements possibly occurring near 4.4450 level.

Pic.3 EUR/RON D1 source: xStation

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.