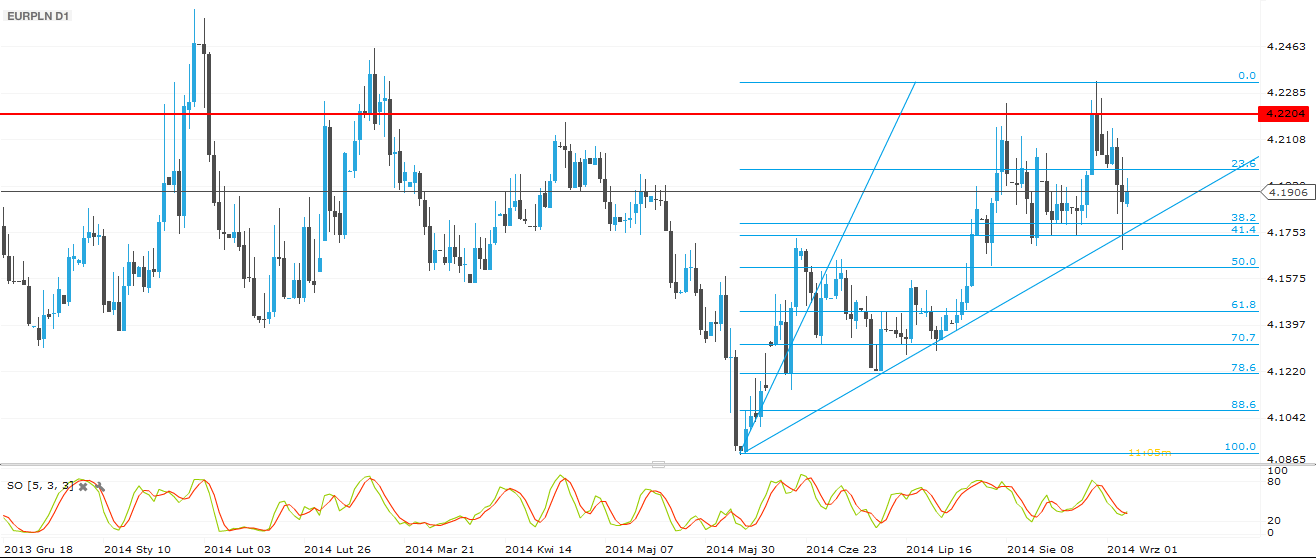

So, Mario Draghi made it happen. The interest rate cut by ECB surprised market participants and moved currency prices. More surprisingly, the reaction on the EUR/USD was much stronger than on emerging market currencies. Still, we are observing interesting situation on the graphs. In Poland, the market was also awaiting the MPC interest rate decision. The outcome was expected – interest rates were kept unchanged at 2.5%. What was said in a more straightforward manner was that the MPC will start cutting interest on the next meeting. At least it sounded straightforward. The reaction of the market was not so strong as all the economic data indicated such move should be expected. The only macro data published this week, the Manufacturing PMI, remained at 49 points. Projected inflation also remains well below the target. I am only surprised the MPC is waiting so long to cut rates, again. Of course, we will see if this will happen on the next meeting. What also helped Zloty bulls were the news that Russia and Ukraine are working on how to stop the fight and possible peace.

On the daily chart we see the EUR/PLN retreated from levels above 4.20. The downward move continued until reaching 4.17 but the support of 4.1750 (41.4% retracement of the last upward move) was not broken. If the PLN bullas want to pull the market further down, the support will be attacked again next week. If broken, the next target should be 4.1450 (61.8%). For an upward move, 4.22 remains the barrier to be broken.

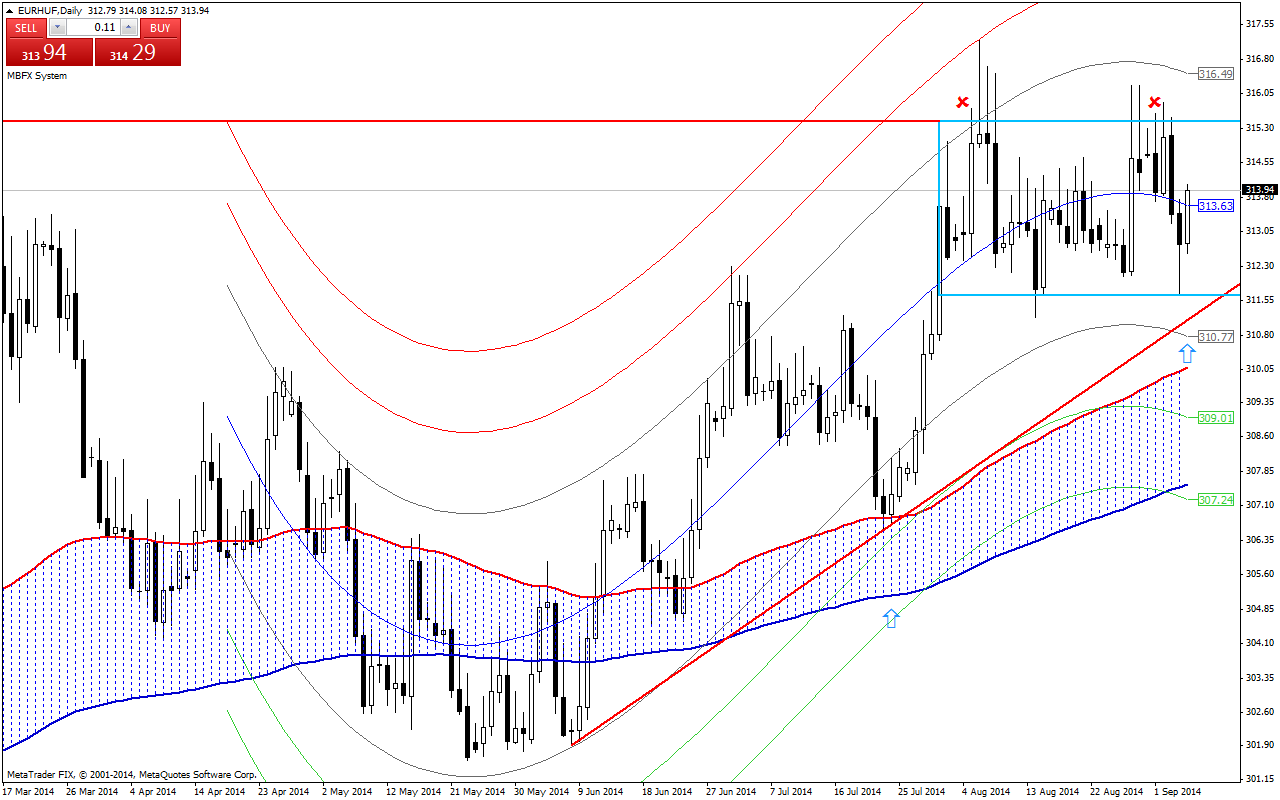

Hungarian Forint (EUR/HUF) – Super Mario saved the Forint

It seems the Hungarian government will rethink levies to be implemented on the financial sector. On Tuesday, Economy Minister Mihály Varga said the government will start the conversion of foreign currency loans into Forints next year. Good news for the Hungarian currency and less fights between the banking sector and the government could bring more peaceful times for the equity and bond markets.

Furthermore, the possible Ukraine-Russia ceasefire and the positive Hungarian GDP data helped the Forint to regain value in the last couple of days. Based on the Central Statistical Office’s (KSH) final report, the gross domestic product increased by 3.9% in the second quarter of 2014. We see some backsliding in the agricultural sector due to worse weather. On the other hand, the construction and industrial sector are getting stronger and stronger. We have only one crucial macro publication coming up next week - the National Bank of Hungary's Meeting minutes where we will get to know how many members voted to keep the main interest rate at 2.10%.

As we see on the daily chart, it is visible the EUR/HUF closed the last week at March highs but the ECB stimulus pushed it back into the blue rectangle. We do not expect much volatility next week on the Forint, which should move in a 311 – 315 range. Still, the situation in Ukraine will be the main determinant of major moves.

Romanian Leu (EUR/RON) – Not so worried from a 'merely technical' recession

Romania’s economy has been confirmed to have entered a technical recession in Q2, with a 1% q/q contraction, however the RON managed to maintain its temper. That may be because observers see this as a temporary blip, led by conjunctural low (rather drastically) public investment and weaker relative agricultural performance, to be at least partially reversed later in the year. At the same time, very low inflation and the NBR mild preference for a weaker RON may have been balanced by improving outlook for a ceasefire in Ukraine and then the new Mario show. Therefore next week may deliver moderate (at most) fluctuations around 4.4000.

From a technical point of view, a triangle appears even better formed at present conditions. Any move in the 4.3850 – 4.4350 range contributes to the definition of the pattern, and the current suggestion is room may be simplier used upwards. In the short-term, a break of 4.4000 at the daily level may mean first one to watch is 4.4200. Any break below 4.3850 may easily prove worthy of note for traders having in mind the support at 4.3720 and then 4.3600.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.