Polish Zloty (EUR/PLN) – fighting at the 4.19 support

Russia annexed Crimea and after that a hurricane on currencies market was expected. Nothing like that happened although the soft “cold war” between Russia and the European Union is closely followed by traders. So far, only sanctions on individuals were introduced. Economic sanctions? Possible but those will hurt many economies, including Poland. Our attention this past week was focused on the Fed, which, as expected, cut the QE3 program by another 10bln USD. Interesting info was given by Janet Yellen, who stated that next year the Fed will hike interest rates 3 times (previously it was supposed to do it twice). Such statement boosted the dollar, which gained against major currencies. The Polish Zloty was also under the influence of the Fed’s decision. Investors ignored local macro data although it is worth mentioning that the CPI inflation in January dropped to 0.4% (from the previous 1%, yearly basis) while the PPI declined to -1.4% in February. Also in February, industrial production picked up some speed and increased by 5.3%. Nevertheless, this year we should forget about any changes to monetary policy. Taking into account some possible export problems in the near future (Russia is a big business partner), the economy is still not ready for higher interest rates. So as this past week, the PLN will be much strongly influenced by external factors.

After reaching 4.2450, the EUR/PLN retreated reaching the support at 4.19, where currently the market stands. This support is pretty important to traders – it is the 50% retracement level of the last upward move, and the point where the short-term trendline runs. If broken, reaching 4.18 will be the matter of couple of hours with a target being 4.17. That scenario is possible although I am taking the opposite side. I rather expect the market will try to test the resistance levels again. The stochastic oscillator also suggests the market is currently oversold. The rebound could take the EUR/PLN to 4.22 and if broken, it should be attacking the local highs of 4.2450 again.

Pic.1 EUR/PLN D1 Chart

Hungarian Forint (EUR/HUF) – Time to get ready for rate decision

Another week has passed and the Hungarian Forint situation has not changed. Investors have similar feelings about it and all are waiting for next week’s National Bank of Hungary. According to most analysts, the NBH will cut the base rate by 10 basis points. At the last meetings the Monetary Policy Council decreased rates by 15 basis points. At that point, the EUR/HUF was trading close to 307. What happened afterwards, we can see on the chart. From other news, the staff team from the International Monetary Fund (IMF) concluded a two-week visit to Budapest and summed up its findings in a statement on Thursday. The IMF projects a 2% GDP growth for Hungary for 2014 and they would welcome a slowdown with interest rate cutting. All depends on the NBH and the following meeting might be more difficult than the last one because inflation is still low. The Forint’s depreciation during the last couple of months also needs to be taken into consideration.

From the technical analysis point of view, the 315.40 level could save the Hungarian currency and keep back the Euro bulls from the historical low (324). Another possible scenario is that till Tuesday the EUR/HUF could attack resistances at 315 and by the end of the week we could expect the market calming down. The EUR/HUF is moving in a strong upward trend again so Forint bulls (if the NBH would not cut the rate) can only hope the market will retreat to supports at 307. That scenario is only possible if the NHB leaves interest rates unchanged.

Pic.2 EUR/HUF H4 Chart

Romanian Leu (EUR/RON) – A change for the better?

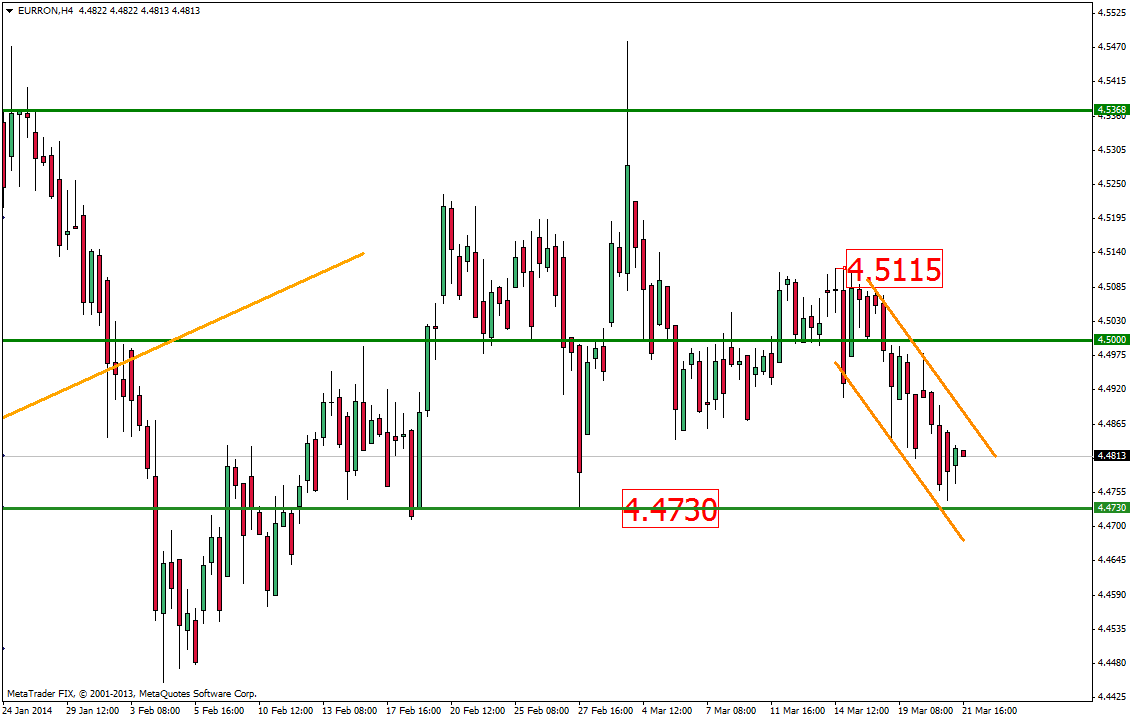

EUR/RON decided to move below 4.50 after a brief journey some 100 pips above the balanced leve in the first part of the week. The pair now looks ”heavy”, as Ukraine fears of a military setup faded, and the macro data posted some encouraging data, such as a current account surplus (albeit 0.388 bn. EUR in Jan) and a better tone in consumer energy, with a calmer political scene. Yet it remains to be seen how the economy will fare after the rise in tax that will add about 0.8% to gas prices, and ripple through the people’s already „austere” wallets. The challenges for the economy would be overcome if the Eurozone manages to develop the burgeoning signs of recovery, but the currency may be, after a short-term relief next week, be poised for a bit of stress in April.

The technical perspective is somewhat balanced with a slighly bearish flavor to it. Resistance of 4.50 is of moderate importance in what may develop as a short-term downward move, as depicted by the trend channel. This move may lead to a push toward 4.46, with interim support at 4.4730. Resistance is good at 4.5115 and then stronger at 4.5368.

Pic. 3 EUR/RON Daily Chart

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold price turns red below $2,320 amid renewed US dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is Securities and Exchange Commission (SEC) filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.

_20140321153227.png)

_20140321153352.png)