The U.S. Fed and the RBNZ released their respective monetary policy statements yesterday, and traders reacted by ignoring or dumping the Greenback while loading up on the Kiwi. So, what did the two central banks say? Well, time to find out!

The U.S. Fed

The Fed voted to maintain the target range for the federal funds rate at 1/4 to 1/2 percent, with the sole dissenter being Kansas City Fed President Esther L. George who voted for a rate hike then and there, just like last time.

As for the details of the official FOMC press release, the Fed hinted that “growth in economic activity appears to have slowed,” likely because “growth in household spending has moderated” despite higher consumer sentiment and rising real income. Also, business investment and net exports have been softer. This could be a heads up that Q1 2016 GDP grew at a slower pace than in Q4 2015, so keep that in mind if you’re planning to trade the U.S. GDP report later (read my Forex Trading Guide for that event here).

Moving on, the Fed also removed its earlier statement that “global economic and financial developments continue to pose risks,” but they then placed that very same statement in their watch list, saying that the Fed “continues to closely monitor inflation indicators and global economic and financial developments,” so the risks from global developments have subsided, but they’re still a risk nonetheless and worth keeping an eye on.

With regard to growth and inflation expectations, the Fed still expects that:

“[E]conomic activity will expand at a moderate pace and labor market indicators will continue to strengthen. Inflation is expected to remain low in the near term, in part because of earlier declines in energy prices, but to rise to 2 percent over the medium term as the transitory effects of declines in energy and import prices dissipate and the labor market strengthens further.”

In short, no major downgrades or upgrades for its outlook, so there’s still probably room for two rate hikes within the year.

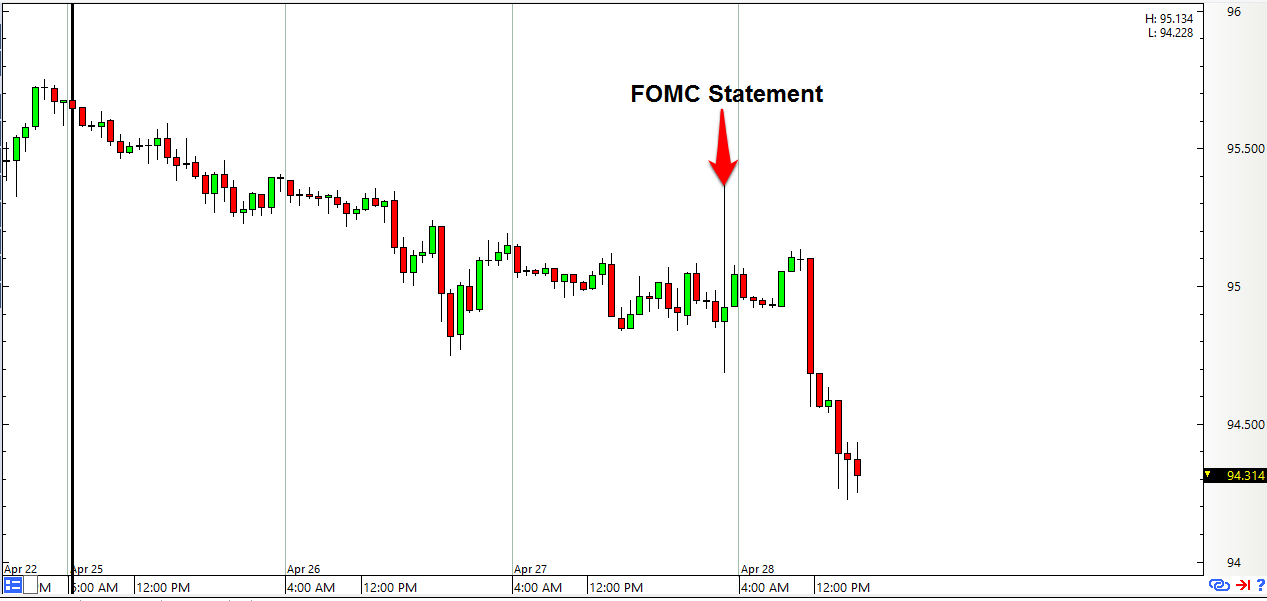

Overall, the Fed had a rather neutral tone, aside from the warning that economic growth appears to have slowed down, which is obviously dovish. This neutral tone (with hints of dovishness) and lack of forward guidance on when the next rate hike will likely be probably disappointed the interest rate junkies who were looking forward to a June rate hike since the Greenback began falling back against most of its peers shortly after the FOMC statement was released.

Although it’s also possible that forex traders were acting on the Fed’s hints that U.S. economic growth slowed down by opening preemptive positions ahead of the Q1 2016 U.S. GDP report.

The RBNZ

As widely expected, the Reserve Bank of New Zealand (RBNZ) decided to maintain its official cash rate at 2.25%. The RBNZ via RBNZ Governor Graeme Wheeler’s official statement also repeated its usual mantras that “a lower New Zealand dollar is desirable” and that “monetary policy will continue to be accommodative” and “further policy easing may be required,” so nothing really new there.

However, the RBNZ’s overall tone was not as dovish as expected. For instance, if you compare the April statement with the March statement, you’ll notice that the RBNZ is now less worried about financial market volatility, saying that it “has eased in recent weeks.”

With regard to New Zealand’s economy, the RBNZ said in its earlier statement that:

“The dairy sector faces difficult challenges, but domestic growth is expected to be supported by strong inward migration, tourism, a pipeline of construction activity and accommodative monetary policy.”

But in the April statement, the RBNZ only said that:

“The economy is being supported by strong inward migration, construction activity, tourism, and accommodative monetary policy.”

The RBNZ then added that dairy prices “have improved slightly, but are below break-even levels for most farmers.” This heavily implies that the dairy sector, which is the main driver of New Zealand’s exports, is no longer as beleaguered as before.

The RBNZ also removed its earlier statement that headline inflation will “take longer to reach the target range” and replaced it with “we expect inflation to strengthen as the effects of low oil prices drop out and as capacity pressures gradually build,” which is noticeably more upbeat.

Moreover, the RBNZ was now even more worried about the Auckland housing market. In its March statement, the RBNZ said that “house price inflation in Auckland has moderated in recent months, but house prices remain at high levels.” In the April statement, the RBNZ sounded more worried, saying that “there are some indications that house price inflation in Auckland may be picking up. House prices remain at very high levels and additional housing supply is needed.” This is bad for Kiwi shorts who are betting on another rate cut as soon as the June meeting since lowering rates further would only help to exert more pressure on the housing market from the demand side of the equation.

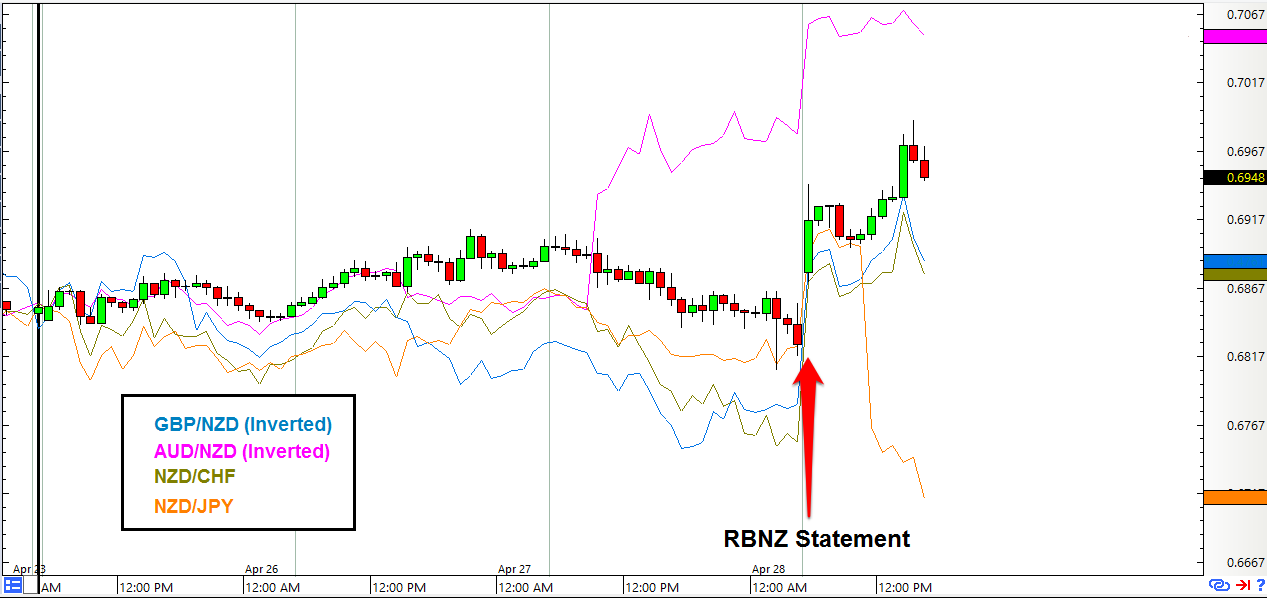

Overall, the RBNZ’s overall less dovish tone and concerns over the housing market probably convinced many forex traders that a June rate cut is now less likely since the Kiwi pretty much skyrocketed across the board after the RBNZ released its statement.

BabyPips.com does not warrant or guarantee the accuracy, timeliness or completeness to its service or information it provides. BabyPips.com does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading at their own risk and BabyPips.com shall not be responsible under any circumstances for the consequences of such activities. Babypips.com and its affiliates will not, in any event, be liable to users or any third parties for any consequential damages, however arising, including but not limited to damages caused by negligence whether such damages were foreseen or unforeseen.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.