Can’t get enough of ’em news reports to trade? Here’s another top-tier economic release coming your way in the form of Australia’s retail sales report for May! Hey, that rhymes!

This report is up for release in tomorrow’s Asian trading session and usually generates a strong forex reaction among Aussie pairs then. If you’re looking to grab quick pips off this event, let’s go through our usual Forex Trading Guide routine, shall we?

What is this report all about?

The Australian retail sales report is basically a measure of whether our mates from the Land Down Under are spending or not. Every surfboard, bottle of sunblock, and boomerang that is purchased will be tallied under retail sales. With that, it gives a picture of how the consumer sector is faring and if they made a positive contribution to overall economic growth.

In Australia, consumer spending accounts for roughly 50% of the country’s GDP. Apart from that, an increase in local consumption tends to encourage businesses to step up their production to meet rising demand, eventually translating to a pickup in hiring. Better employment conditions are good for consumer confidence, which then keeps spending and growth supported.

How did the previous releases turn out?

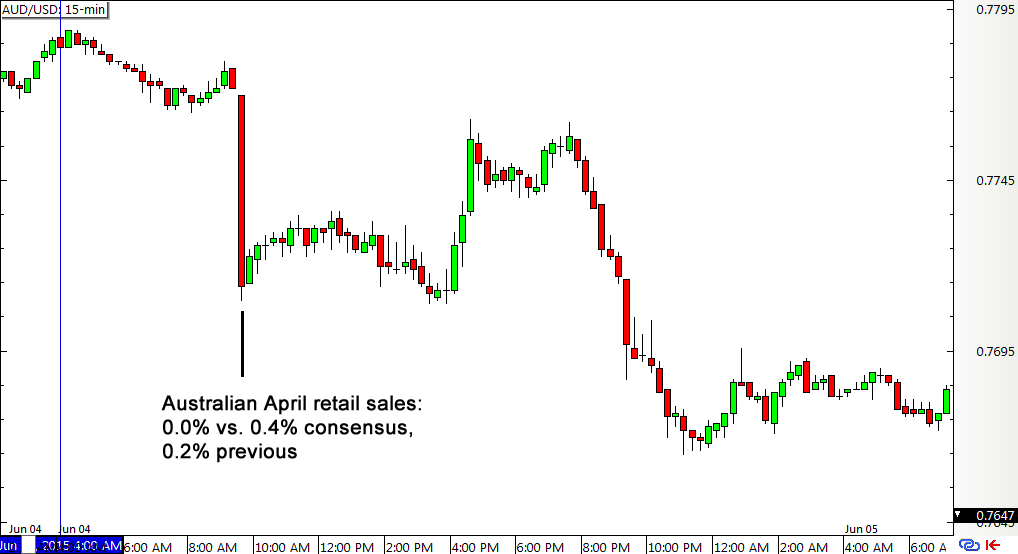

Unfortunately for the Land Down Under, the past couple of retail sales figures didn’t turn out so well. The report printed a measly 0.2% uptick versus the projected 0.4% gain in March, followed by a flat reading in April. AUD/USD sold off sharply upon the release of weaker-than-expected results for April, as analysts were expecting to see a 0.4% rise then.

On a more upbeat note, consumer spending was still up 4.4% in April compared to the same month a year ago. Components of the report indicated that clothing and footwear sales increased by 1.3% on a monthly basis while online purchases picked up by 3%, which suggests that Australians didn’t really hold back on their shopping sprees then. However, department store sales logged in a 0.7% decline while purchases in the “other retailing” category showed a 1.0% drop.

What’s expected this time?

Forex market analysts are expecting to see a 0.5% increase in retail sales for May, which might suggest that the standstill during the previous month was just a temporary setback. Take note, though, that employment data was significantly weaker than expected in May so Australians probably decided to take it easy with their purchases back then.

Consumer confidence remained pretty strong in May, as indicated by the 6.4% jump in the Westpac consumer sentiment index for that month. Aside from that, the start of the winter season in the country (Yep, this is Australia we’re talking about!) probably boosted sales of boots, leather jackets, gloves, and hot cocoa.

How might AUD/USD react?

Since strong retail sales figures support economic growth prospects, a higher-than-expected read could spur Aussie appreciation. In contrast, weaker-than-expected consumer spending data could lead to weaker economic performance and currency depreciation.

As you’ve probably noticed in the forex chart I posted above, AUD/USD typically has a strong initial reaction to the headline figures during the actual release. However, this move is barely sustained in the next few hours, as profit-taking usually takes place right around the end of the Asian trading session. This pattern has been going on for most of the previous releases also, even for reports with stronger-than-expected results.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price (XAU/USD) struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.