A quick review of the U.S. dollar index reveals that the currency has been on a tear for almost an entire month, as forex traders cashed in on improving U.S. economic data and the possibility of earlier Fed rate hikes. After all, Fed Chairperson Janet Yellen did mention in her Jackson Hole Summit testimony that the U.S. central bank is open to tightening earlier if “progress in the labor market continues to be more rapid than anticipated.”

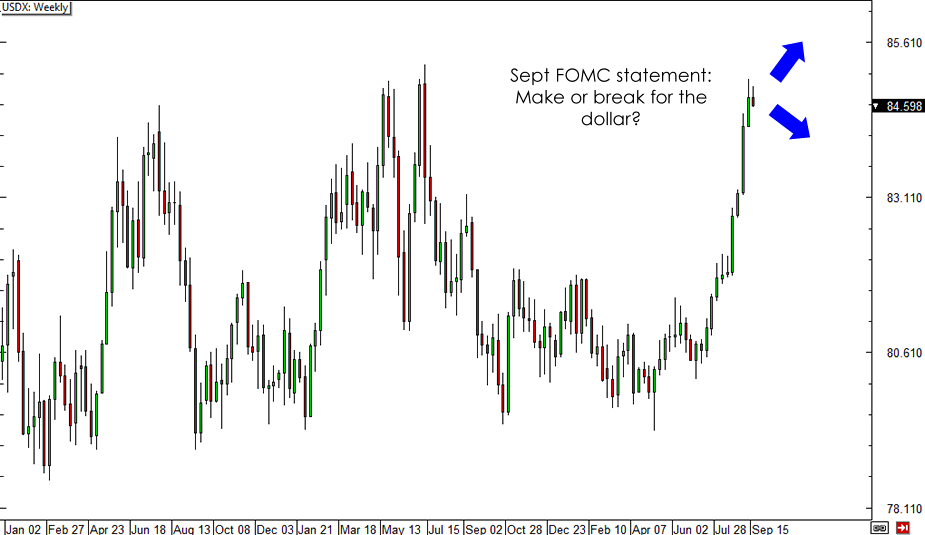

USDX Weekly Chart

However, the same chart reveals that the USDX is testing an established resistance area, which has been holdin’ like a boss over the past couple of years. With that, the upcoming FOMC statement could determine whether the Greenback can extend its rallies or if it will retreat from its current levels.

In particular, market watchers will be paying close attention to the Fed’s interest rate forecasts, as some believe that policymakers would drop the phrase on keeping rates low for a “considerable time” after easing ends. If so, dollar bulls could charge as markets start to price in rate hike expectations for the first quarter of 2015.

Bear in mind though that Yellen does have a penchant for keeping market expectations in check, which suggests that she is likely to downplay hawkish forecasts during the press conference after the actual FOMC announcement. As always, she will probably remind everyone that the U.S. economy still has a long way to go before achieving full recovery and that policy adjustments will continue to be data-dependent.

Forex market participants might also be able to draw more clues from the Fed’s economic projections, which could contain positive revisions in GDP and employment for this year and the next. Apart from that, the Fed is expected to carry on with their $10 billion monthly reduction of asset purchases and confirm that QE will officially end next month.

All in all, the sentiment for the September FOMC statement is generally upbeat, but these expectations have been priced in a long while back. Even if the Fed statement is as expected, there’s still a good chance that profit-taking could drive the dollar lower in the short term before reestablishing its longer-term trend. Are you planning on taking any dollar trades for the FOMC statement?

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.