Think the second version of the U.S. GDP report doesn’t have much of an impact on forex price action? Think again!

For the newbie traders just tuning in, you should know that the U.S. economy typically releases three versions of its GDP report: advanced, preliminary, and final. While the advanced GDP release tends to have the strongest market impact since it provides the first glimpse of how the economy fared in the reporting period, revisions for the second and third releases also usually have an effect on long-term dollar movement.

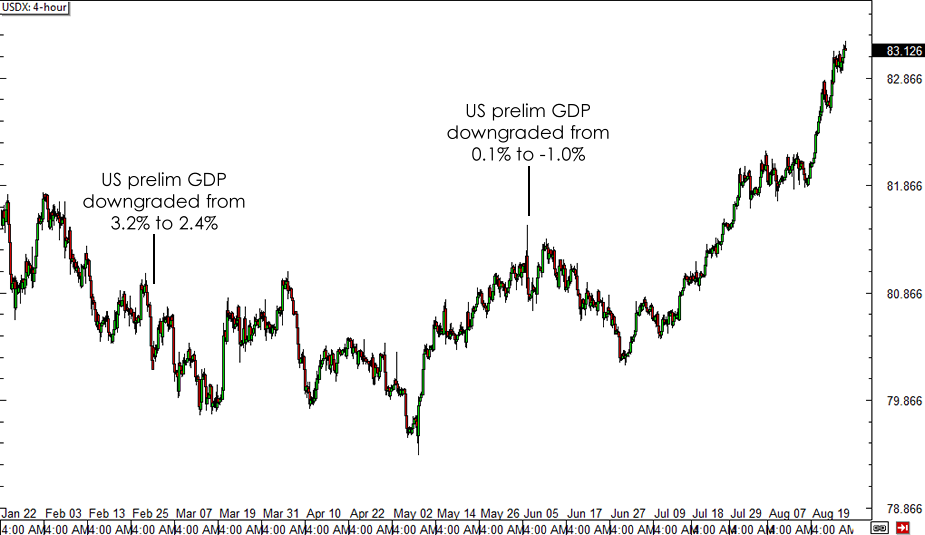

A quick review of past releases on the economic calendar reveals that the U.S. preliminary GDP report happens to contain significant revisions from the initial release. Heck, the GDP reading was dramatically downgraded from 0.1% to -1.0% in the previous quarter! Prior to that, the Q4 2013 GDP reading was revised from 3.2% to 2.4% while the Q3 2013 figure was upgraded from 2.8% to 3.6% during the second release.

With that, market participants are probably bracing themselves for a potential revision on the latest U.S. GDP reading, which showed a 4.0% expansion for Q2 2014. Economic experts predict that only a small downgrade to 3.9% might be seen for now, as retail sales figures have been lowered. Some expect to see upgrades in business investment and net exports, which might be enough to keep the GDP reading steady.

Another sharp downgrade could force the Greenback to return some of its recent losses, as previous downward revisions have resulted to dollar weakness in the weeks that followed.

On the other hand, no revisions or an upgrade could allow the U.S. dollar to extend its gains against its forex counterparts, as many are already taking a bullish dollar bias in anticipation of a rate hike next year. Strong growth figures could add support to these speculations, which might then lead to better business and consumer confidence. Eventually, this could lead to higher spending and investment, adding more fuel to growth prospects and potential Fed tightening.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.