A few months back, I gave y’all a snapshot of how manufacturing conditions are faring among global economies. It’s about time we take a look at an updated one!

For the newbies just tuning in though, here’s a quick review of what a manufacturing PMI is all about and why it matters. A purchasing managers index(PMI) report is simply a measure of business conditions in an industry taken some time in the middle of the month. In a manufacturing PMI report, a few hundred purchasing managers from the manufacturing industry are asked about their opinions on issues such as employment, inventory levels, new orders, and state of production and supplier deliveries.

An index reading of 50.0 and above hints at optimism among the manufacturers, which could lead to industry expansion. Consequently, a reading of 49.9 and below denotes pessimism and a possible contraction in the manufacturing sector.

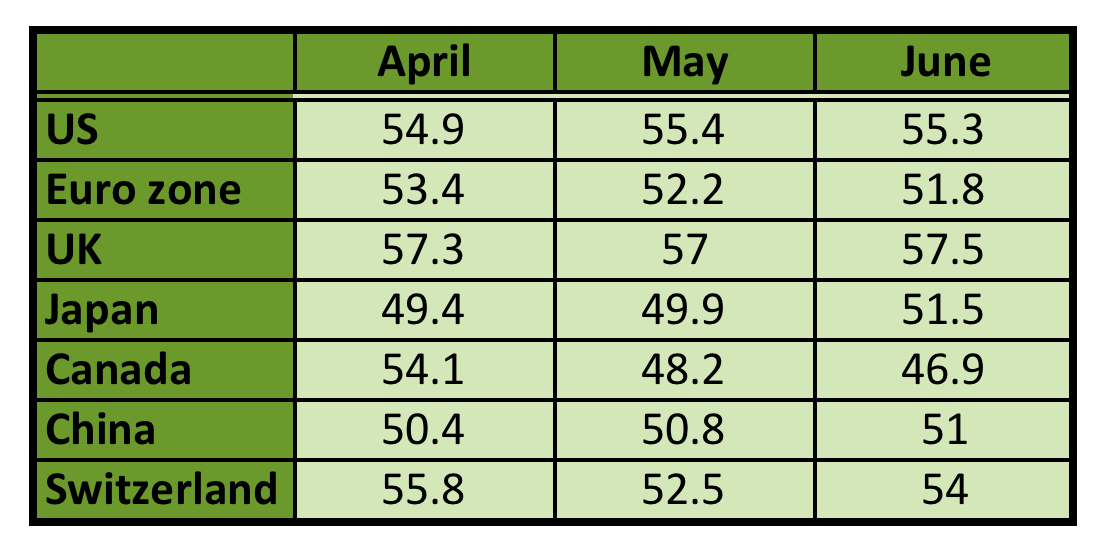

Here’s how manufacturing PMI readings turned out for most major economies in the past few months:

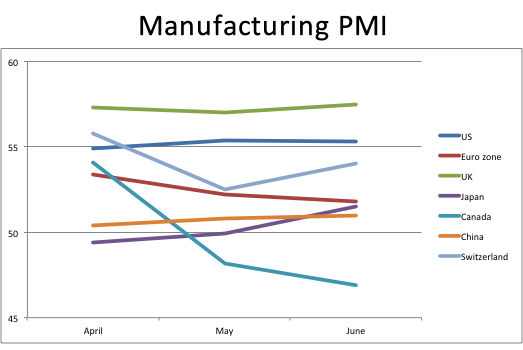

Not a fan of the table format? Here’s a line graph that might help you make better comparisons among the major economies:

As you can see, Canada’s manufacturing sector seems to have fared the worst in the past three months while the euro zone is also seeing a slowdown. Japan has marked a steady improvement in the industry despite the recent sales tax hike while China is also chalking up a recovery.

Meanwhile, the U.K.’s manufacturing sector is a cut above the rest as it has consistently shown strong expansion since April. Manufacturing conditions in the U.S. also appear to be stable.

With developments in the manufacturing sector playing a key role in supporting overall economic activity, it’s no surprise that central bank officials take these PMI into consideration when making policy decisions. Do you think these manufacturing readings are an omen of future price action?

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY extends recovery after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price (XAU/USD) struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.