Heads up, forex fellas! Geopolitical tension may be dominating the newswires recently, but we’ve got a potential market-mover this week. Here’s my forex trading guide on the upcoming RBNZ interest rate decision.

What is this event all about?

As discussed in the School of Pipsology lesson on monetary policy, central bank statements tend to have a strong impact on forex price action since these influence the rate of return on holding the local currency.

When the economy is doing well, the central bank can tighten monetary policy by hiking interest rates, thereby boosting demand for the currency. On the other hand, when the economy is performing poorly, policymakers can ease monetary policy by cutting rates or implementing quantitative easing, leading to lower demand for the currency.

What happened last time?

In their June rate statement, the RBNZ decided to hike interest rates for the third time in a row this year. This was enough to bring their benchmark rate to 3.25%, the highest among major central banks and offering a large positive interest rate differential for buying the Kiwi against other major currencies.

Aside from that, RBNZ Governor Wheeler also hinted that more rate hikes are in the cards. After all, policymakers agreed that economic growth has gained strong momentum and that inflationary pressures need to be contained.

What’s expected this time?

With that, almost everyone is expecting another 0.25% rate hike from the RBNZ in this week’s rate decision. Despite the weaker than expected quarterly GDP reading for Q2 and the consecutive declines in dairy exports and prices, most market analysts still believe that the RBNZ will not waver from its hawkish stance.

However, there’s a good chance that the RBNZ might place a little more emphasis on the recent weaknesses in the New Zealand economy and caution that they could pause from their rate hike streak.

How might NZD/USD react?

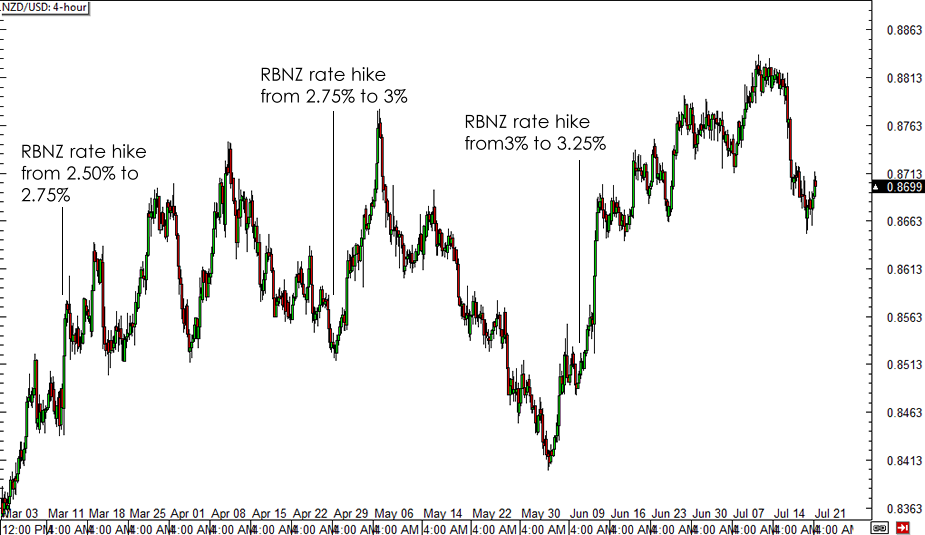

A quick look at how NZD/USD reacted to the past three rate hikes indicates that the impact has gotten stronger each time:

NZD/USD 4-hour Forex Chart

While another rate hike could give the Kiwi more upside, a less hawkish tone from the RBNZ might prevent any potential rallies from being sustained. Bear in mind that geopolitical risks are still weighing on overall market sentiment after all, which means that traders might not be too keen on parking their money in riskier higher-yielding currencies for now.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

The EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 on Monday during the early Asian trading hours. The softer US Dollar provides some support to the major pair.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.