In today’s edition of my Forex Trading Guide, let’s take a look at the upcoming monthly GDP release from Canada and how we can make pips off this event.

Now Canada’s monthly GDP report doesn’t usually trigger a strong reaction from the Loonie unless it’s for the last month of the quarter. In other words, even though Canada prints it growth figure on a monthly basis, traders often save their reaction for the summed up quarterly reading!

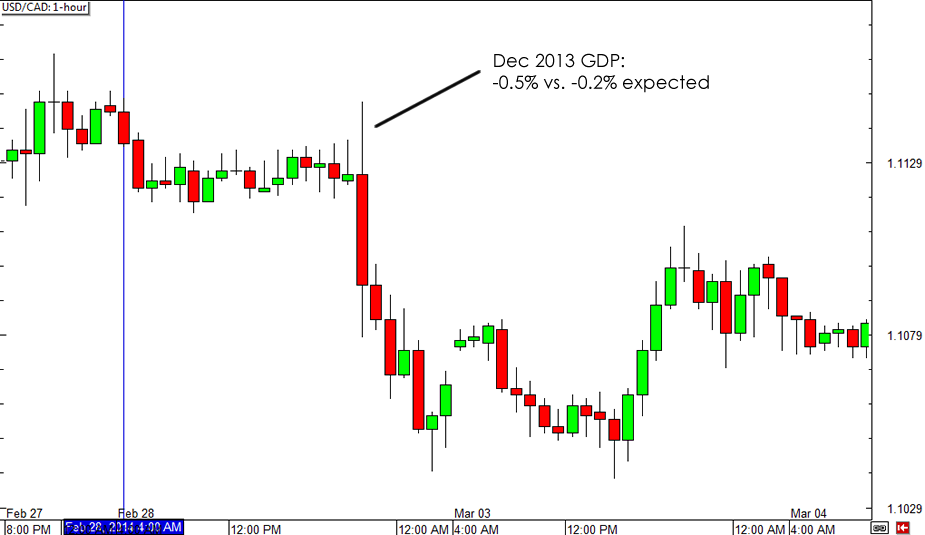

Take a look at the reaction to the December 2013 GDP figure, for instance. For that month, the Canadian economy contracted by 0.5%, worse than the estimated 0.2% GDP decline. However, as you can see from the chart below, the Loonie still reacted positively to the report since it effectively led to a 0.7% quarterly GDP Figure for Q4 2013, the same pace of growth recorded for the previous quarter.

USD/CAD initially spiked higher as traders reacted to the negative monthly reading but soon switched to long CAD positions upon finding out that Canada sustained its quarterly economic expansion.

For tomorrow’s GDP release, Canada is expecting to see a mere 0.1% uptick for March, following the previous month’s 0.2% expansion and January’s 0.5% growth figure. Analysts estimate that Q1 GDP could be up by 1.7% to 1.9%, mostly due to a pickup in oil and gas mining. If the Canadian economy winds up printing strong GDP readings, the Loonie might be in for another rally against its forex counterparts.

Keep in mind that the Canadian dollar has been surprisingly resilient in the past few trading weeks despite a few disappointments in Canada’s economic data here and there. This suggests that the Loonie might be strong enough to shrug off a weaker than expected GDP reading as it appears to be drawing support from other market factors, such as the surge in oil prices or the positive sentiment for the U.S. economy.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.