If you’re planning on trading the news this week, then the Bank of England monetary policy statement might be something worth looking at. Although analysts are expecting no change in asset purchases or interest rates, BOE Governor Carney’s bias might be crucial in setting the longer-term direction for the British pound.

What happened in the past?

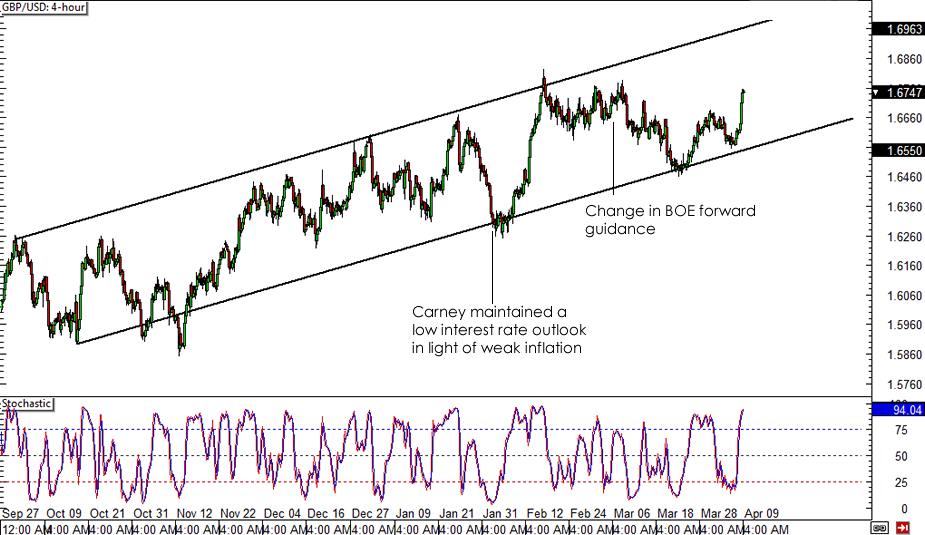

Before anything, let’s have a quick review of the most recent BOE rate statements. In their January rate statement, Carney and his men decided to maintain their upbeat economic outlook as the U.K. showed progress in hiring and inflation. However, BOE policymakers emphasized their low interest rate outlook in their February statement, as inflationary pressures started to weaken. Their March statement included a change in forward guidance, as the jobless rate dipped close to 7% and Carney saw the need to point out that a rate hike isn’t automatic even if unemployment reaches their target level.

GBP/USD Daily Forex Chart

Despite these changes in monetary policy bias though, GBP/USD has carried on with its long-term uptrend as seen on the pair’s daily forex chart. Price even got a good strong boost earlier this month when Carney hinted that the U.K. central bank might be able to hike interest rates before the general elections take place next year.

What’s expected this time?

Thanks to Carney’s hawkish remarks, several market analysts are expecting to hear more upbeat comments and perhaps an actual time frame of when the BOE will tighten monetary policy. For this week though, the BOE is still likely to keep asset purchases unchanged at 375 billion GBP and interest rates on hold at 0.50%.

In case Carney sounds a little more dovish than expected, pound bulls might be extremely disappointed. This could be a chance for bears to hop in and push GBP/USD back to the previous support area around the 1.6500 major psychological level. As you can see from the chart above, the pair is approaching a significant resistance area at its yearly highs near the 1.6800 mark.

How can you trade this event?

Well, this depends on your forex trading style. If you’re a scalp trader who thrives in volatile market conditions, then you can go for a straddle setup by setting orders a few minutes before the actual announcement is made. This pair tends to consolidate and form an Asian box setup on the day of the BOE decision so you can set your buy and sell orders outside the box.

If you’re a medium to long-term trader though, you might want to sit tight during the announcement and take positions depending on how it turns out. If you’re looking to short, the 1.6800 area and the top of the rising channel might be good areas to jump in. If you think the statement is strongly bullish for the pound, you can opt to go long on a quick pullback or the break of the 1.6800 resistance.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.