In the middle of the week, the RBNZ opted to leave its primary interest rate unchanged at 1.75%, where the central bank expects it to remain for a “considerable period.” Governor Orr and company noted that there were both upside and downside risks to inflation; therefore, the next change to interest rates could either be higher or lower.

Given the ongoing trade tensions between China and the US (New Zealand’s largest and 3rd-largest export markets respectively, accounting for 34.5% of the island country’s total exports), traders had been expecting a much more cautious outlook from the RBNZ. The central bank’s balanced outlook therefore prompted a 100-pip rally in NZD/USD, confirming a swing low in the 0.6725 area.

The rally has only gained steam in the last 48 hours, with trade talks carrying over into the coming week and President Trump stating he is considering extending the March 1 deadline for escalating tariffs on Chinese goods. If we continue to see positive headlines from the ongoing trade talks, NZD/USD will be one of the FX market’s biggest beneficiaries.

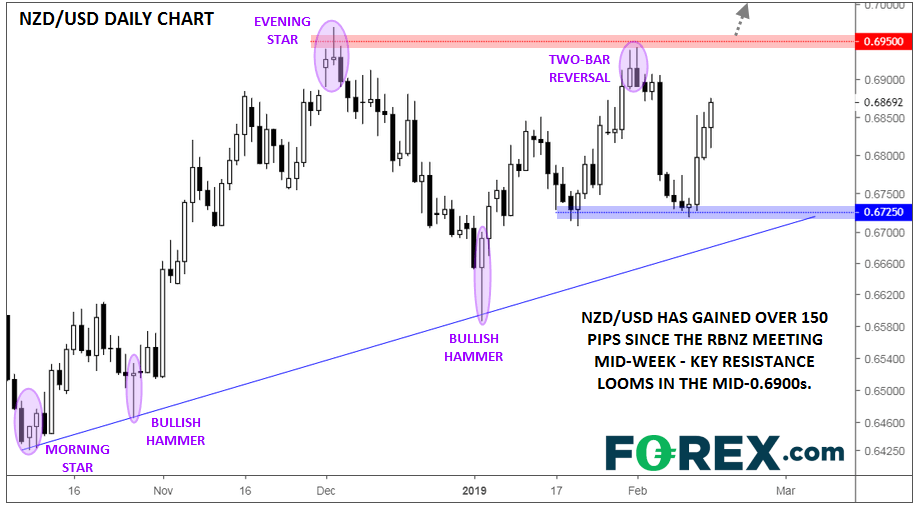

Turning our attention to the chart, there are two key features to watch. Since the middle of October, NZD/USD has formed three bullish reversal patterns at the rising trend line, which currently sits around the 0.6700 area. Meanwhile, the pair has also formed two prominent bearish reversal patterns off resistance in the mid-0.6900s.

Continued positive rhetoric over the weekend could take rates up to test resistance near 0.6950, where bulls will be hoping for a definitive break to signal a potential continuation toward the Jun highs near 0.7050 next.

Source: TradingView, FOREX.com

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.