NZD/USD: Buying opportunity at 0.7170

AUD/USD, NZD/USD, AUD/JPY

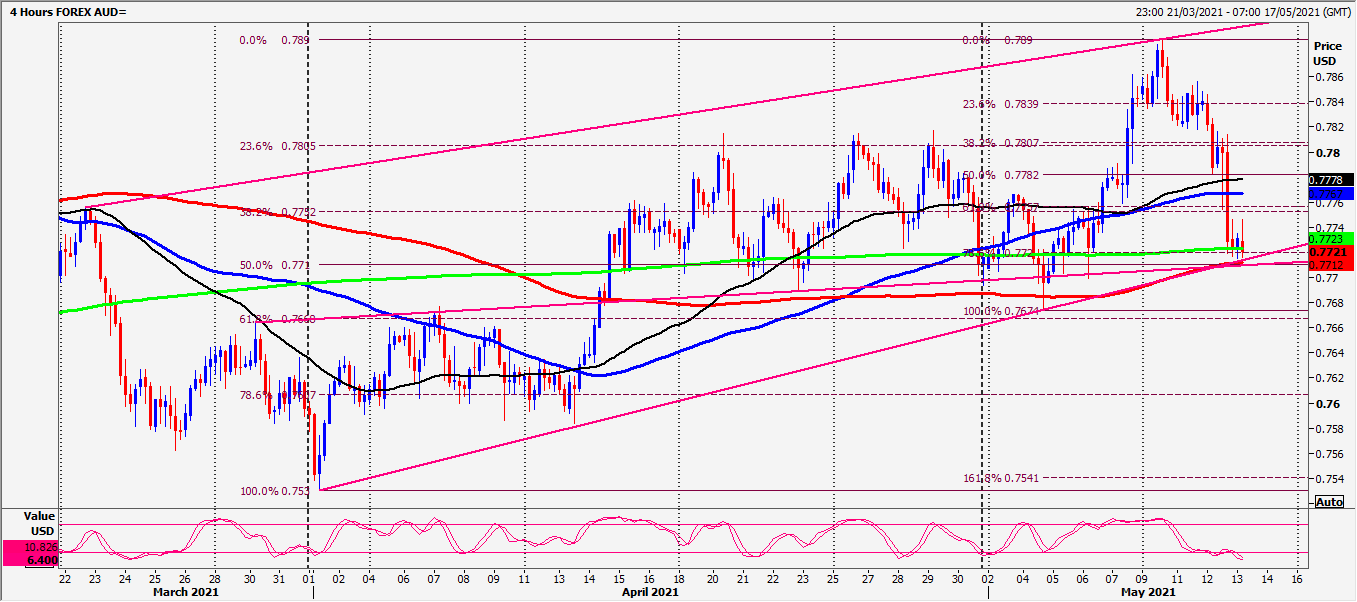

AUDUSD collapsed on the CPI number breaking support at 7760/50. The pair is holding very strong support at 7725/15. A good chance of a low for the week here.

NZDUSD crashed from the 500 weeks moving average at 7300/10 & broke strong support at 7220/10 for a buying opportunity at 7170/60.

AUDJPY tests strong support at 8480/40. Longs need stops below 8410.

Daily analysis

AUDUSD has very strong support at 7725/15. A low for the week possible. Longs need stops below 7700. A break lower to is a sell signal targeting 7675/65, perhaps as far as 7625/20.

Longs at 7725/15 target 7750/60, perhaps as far as 7800/10.

NZDUSD buying opportunity at 7170/60 & a good chance of a low for the week, stop below 7140. A break lower to is a sell signal targeting 7120/10, perhaps as far as7080/70.

Longs at 7170/60 target 7185/90 & first resistance at 7210/20. Above here look for7245/50.

AUDJPY has unexpectedly collapsed to strong support at 8480/40. Longs need stops below 8410.

If we can hold the 500-week moving average support at 8480/40 look for 8515/25 &8560/80.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk