The Bank of Japan's lack of action on Thursday confounded market expectations that the central bank would announce additional stimulus to boost country's economy and combat lower inflation. The surprising BoJ inaction triggered a knee-jerk reaction in the USD/JPY pair, which nosedived to register its largest single day drop since mid-March 2009. Sharp USD weakness against JPY spilled over to other major currencies as well. The GBP/USD pair managed to close above 1.4600 handle for the first time since Jan. 7 and the EUR/USD continued to build on to its recent gain.

The greenback remained under pressure even during the US session after a government report showed US economy growing at the slowest pace in two years. The US economy recorded an annualized growth of 0.5% in the first three months of 2015 as compared to 1.4% growth in the last quarter of 2015 and against expectations of 0.7% growth.

On Friday, the GBP/USD pair continued climbing higher and is now trading at the highest level since February. The EUR/USD pair, too, has now moved closer to the very important 1.1400 handle. With relatively lighter economic calendar, featuring the release of Chicago PMI and revised UoM Consumer Sentiment index from the US, the greenback might continue to sulk lower for the rest of the trading day.

Technical Outlook

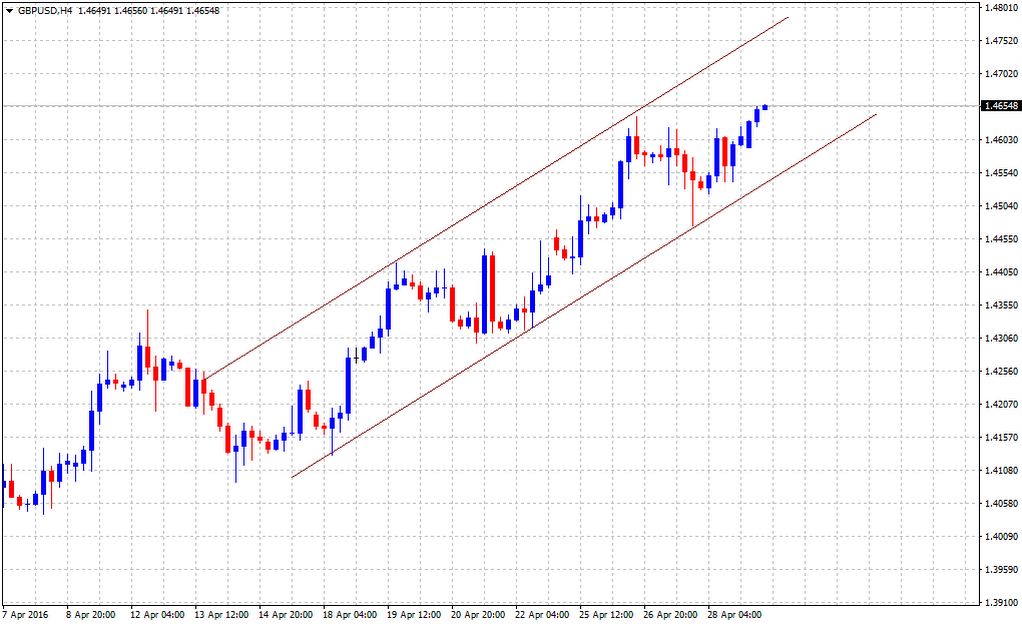

GBP/USD

After testing a short-term ascending trend-channel support on Thursday, the pair rebounded smartly and is now trading above 1.4650 level. From current levels, a more above Feb. high (1.4665-70) is likely to boost the pair toward testing the trend-channel resistance, currently near 1.4750-60 area. 1.4700 round figure mark could be seen as an intermediate resistance.

On the downside, previous strong resistance near 1.4620 level now seems to act as immediate support for the pair. Dip below this immediate support could be short-live and is likely to get bought into near 1.4600-1.4590 region. However, a sustained weakness below 1.4600 handle could be the first signs of some near-term profit taking move, dragging the pair back towards testing the trend-channel support, currently near 1.4550-45 zone.

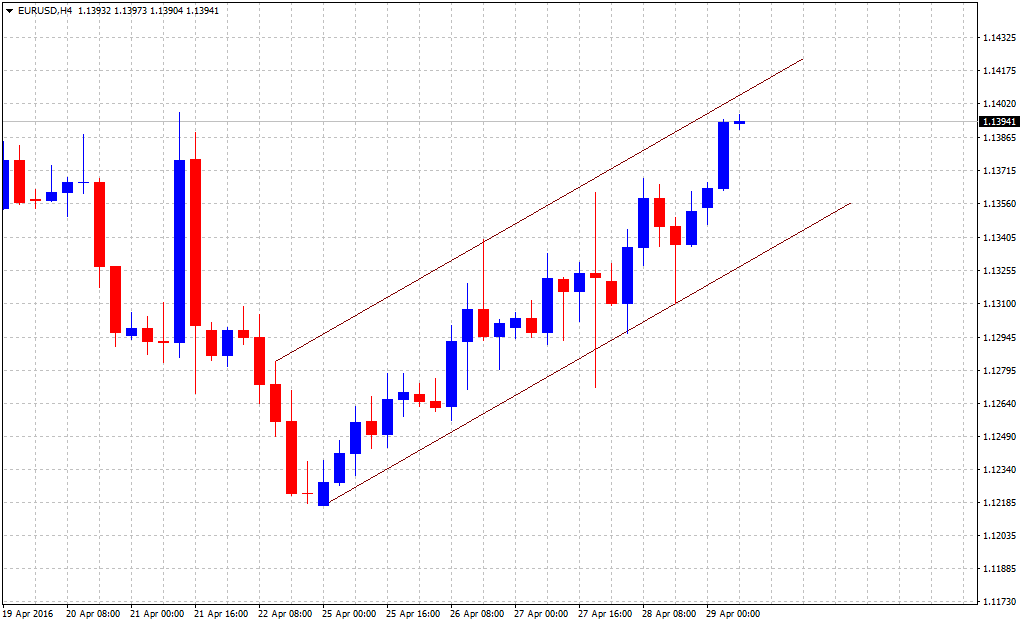

EUR/USD

The EUR/USD pair, too, has been inching higher within a short-term ascending trend-channel and is trading close to the trend-channel resistance near the very important handle resistance near 1.1400 level. A convincing break-through this 1.1400 resistance zone might is likely to accelerate the gains immediately towards April highs resistance near 1.1460-65 zone.

Alternatively, inability to conquer a strong resistance and a subsequent reversal might drag the pair back towards 1.1360-50 support, which if broken could lead to a further downside pressure towards testing the trend-channel support near 1.1330 area. A sustained weakness below the trend-channel support might force traders to unwind their short-term bullish bets and thus, opening room for further downslide in the near-term.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.