GBP/USD spiked almost 200 pips on Monday as technical correction in the GBP/JPY pair gathered pace. The spot clocked a high of 1.4286 before trimming gains to end the day around 1.4235 levels. The latest sales monitor from the British Retail Consortium (BRC) showed yesterday retail sales were flat lined in March. Total retail sales were unchanged on March 2015, compared to a 4.7% annual increase registered in this month last year.

The spot is trading today on the front foot around 1.4245 levels and is looking to take out 1.4252 (50% of 1.4669-1.3835) levels.

Eyes CPI report

UK cost of living as measured by consumer price index (CPI) is expected to have ticked higher in March – 0.4% y/y and 0.3% m/m. Core inflation is also seen rising 1.3% y/y as opposed to February figure of 1.2% y/y. It is to be noted that a rebound in inflation may have been priced-in, given the gilt yields rallied yesterday and added to the bid tone around GBP. Hence, it would take a better-than-expected headline and core CPI figure to push Cable above and beyond yesterday’s high of 1.4286-1.43 levels. Also note that April has been a good month for Sterling for almost a decade now. Hence, a better-than-expected figure could result in a much sharper rally.

On the other hand, a weaker-than-expected figure could see the bird erase major part of its gains witnessed yesterday. Meanwhile, data printing in line with estimates could see Cable fade spike to near 1.43 levels.

Technicals – Watch out for a rejection at 1.4252-1.4257

-

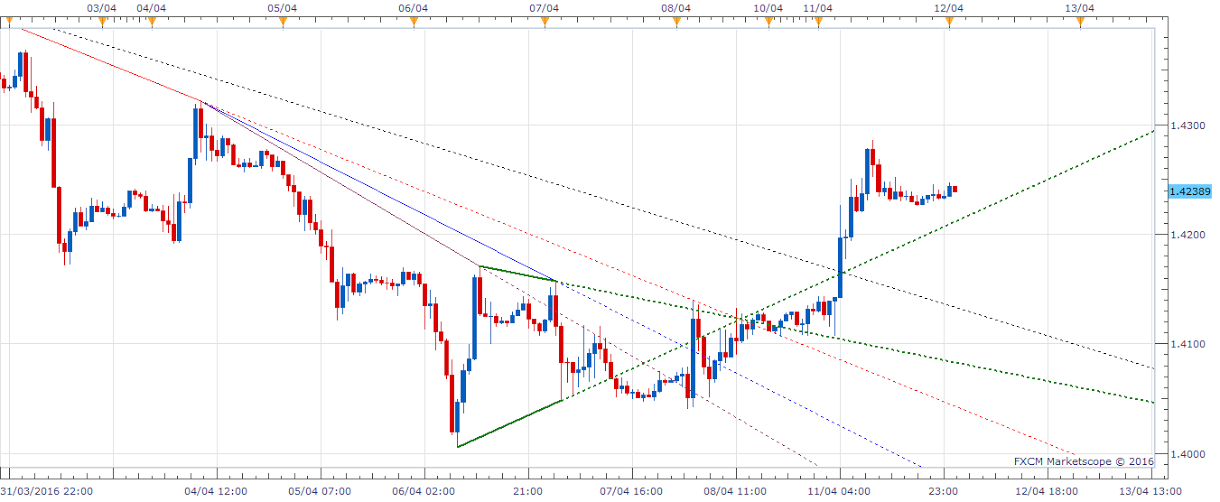

Sterling’s bullish break from a larger falling trend line indicates a short-term bottom is in place now at 1.4005 and the bullish move may gather pace if the spot manages to take out 1.4252 (50% of 1.4669-1.3835) – 1.4257 (50-DMA), in which case immediate upside appears capped around 1.43 given the hourly RSI would then head back to overbought territory.

-

On the contrary, failure to take out/sustain above 1.4252 (50% of 1.4669-1.3835) followed by a break below rising trend line hurdle (now seen around 1.4213) would open doors for a drop to 1.4170 levels.

-

Short-term bullish invalidation is seen only if the spot makes a move back inside larger falling trend line level (now seen at 1.4130).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.