GBP/USD pair is trading weak around 1.4330 today ahead of the UK manufacturing PMI release. Cable rose to a high of 1.4427 levels yesterday before falling back to 1.4368 and extending losses in Asia today. The decline from 1.4427 could be blamed to a release of poll of polls which showed sentiment is slowly shifting in favor of Brexit. The immediate focus now is on the UK manufacturing PMI release, which will be followed by US average hourly earnings and non-farm payrolls figure. (Trading the average hourly earnings report (Gold and GBP/USD) - Macro Scan )

Weak PMI figure could spell trouble for Pound

Consensus estimate calls for an improvement in the PMI index to 51.2 from Feb’s figure of 50.8. The CBI total trends survey released on March 21st showed the manufacturing sector is still in recession. Factory output fell over the three months to March at the fastest pace since September 2009 due to weak demand from foreign customers and depressed demand at home.

The total orders balance improve to a three-month high of -14% in March after falling back to a four-month low of -17% in February from -15% in January and -7% in December. Though there was slight improvement, the figure stayed in the negative.

Hence, the PMI could print in line with the estimates. However, a possibility of a weaker-than-expected PMI cannot be ruled out and that could trigger a drop in the GBP/USD pair. On the contrary, a strong PMI figure could push Cable back to 1.44 levels.

Technicals – Losses seen below 1.4330

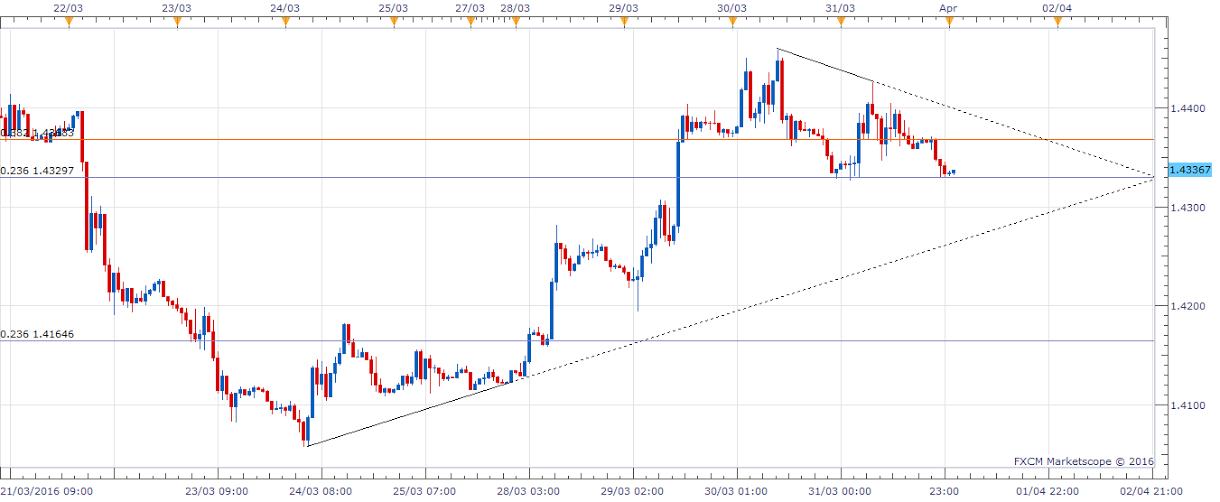

Sterling’s rally from last week’s low of 1.4057 to 1.4426 levels resulted in a loss of momentum owing to which prices drifted lower to near 1.4330 (23.6% of 1.5930-1.3835) levels today.

Acceptance below 1.4330 is unlikely on the hourly chart, given the daily RSI stays above 50.00. Nevertheless, a drop could expose the rising trend line support seen on the hourly chart at 1.4265.

Conversely, a rebound from 1.4330 would expose 1.4390-1.44 handle. A violation there could result in a re-test of 1.4426-1.4475 levels.

Bullish invalidation is seen only below 1.4284 levels.

Check out Non-farm payrolls report and its impact on EUR/USD and USD/JPY -Nonfarm Payrolls Forecast

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.