The risk-off in the equity markets and the resulting drop in the UK Gilt yields pushed the GBP/USD pair to a low of 1.4351 (23.6% of 1.5230-1.4079), before a sudden rise in the USD selling interest saw the pair trim losses to end the day around 1.4429 levels. As of now, the spot is trading around 1.4410 levels.

Eyes UK trade deficit

UK trade deficit figure for December is due for release later today. Sterling’s sharp fall began in December, hence could result in an uptick in exports. However, if J-curve theory is anything to go by, then we may see a drop in exports and a spike in trade deficit. The trade deficit with non-EU nations is seen rising and that will not be good news for Sterling. Meanwhile, goods trade deficit is seen largely unchanged above GBP 10 billion.

A sharp rise in trade deficit could strengthen the offered tone around GBP. On the other hand, a sharp drop in the trade deficit is likely to strengthen Sterling. The move could be similar to the one we had seen after the release of an upbeat public sector net borrowing figure (along with horrible retail sales figure).

Apart from the data, the risk-off in equities would continue to weigh over sterling. The data may receive little/no attention from the traders if the risk-off is severe.

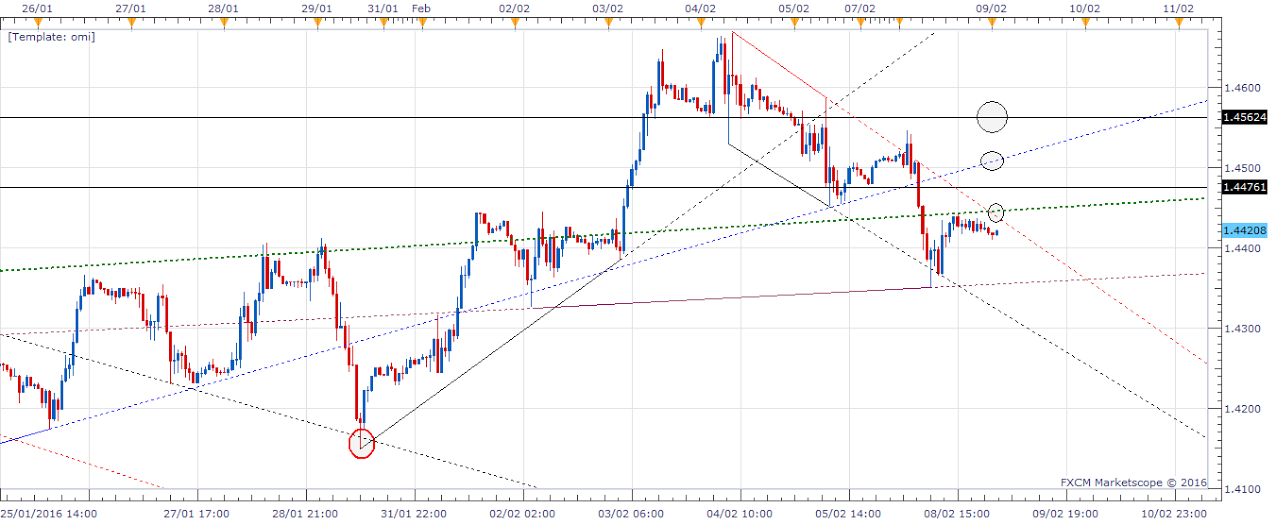

Technicals – Falling channel on the hourly, could re-test Monday’s low

Sterling’s failure to take out 1.4443 (38.2% of 1.4079-1.4668) coupled with falling channel formation on the hourly and bearish hourly and daily RSI indicates the currency pair could revisit 1.4351 (Monday’s low + 23.6% of 1.5230-1.4079).

On the other hand, a break above 1.4447 (falling channel resistance) could open doors for a re-test of 1.4476-1.45 levels.

An hourly close below 1.4351 would mark a head and shoulder breakout; while a daily close above 1.4519 (38.2% of 1.5230-1.4079) could cheer the bulls.

EUR/USD Analysis: Rebounds from 50% Fib, offered again at 38.2% Fib

The EUR/USD pair fell to a low of 1.1088 (50% of Mar low-Aug high) despite the risk-off tone in the markets, before running into offers again around 1.1236 (38.2% of Mar low-Aug high) in Asian session today. The drop in the EUR was somewhat surprising as the common currency failed to strengthen despite the carry unwind amid risk aversion. Greek bond yields spiked again as there were reports that Greece bailout review stalled.

Focus on Greek bond yields

Greek issue is making a comeback again! The issue may flare up again; hence, traders should keep an eye on the Greek bond yields. A rise in the Greek bond yields is a red signal for the EUR bulls. In past we have seen, the Greek crisis news usually leads to rise in Greek and periphery bond yields along with a drop in core bond yields and a drop in the EUR. The rise in Greek yields could be an early sign of upcoming EUR weakness.

Domestic data – industrial production and trade balance – may be ignored if the markets get caught up between rising Greek yields and risk-off in the equities.

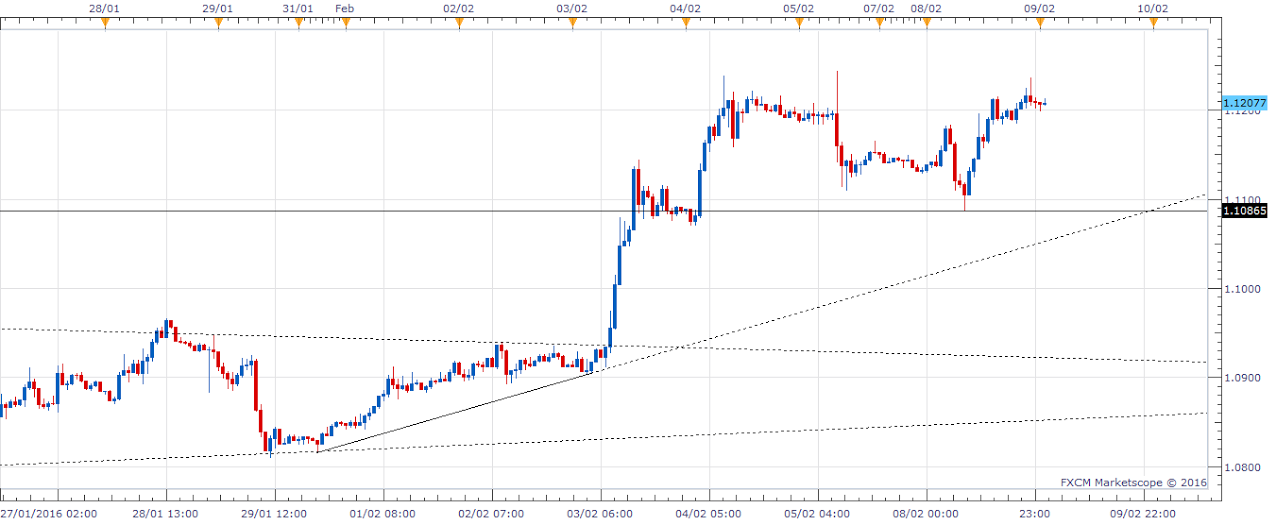

Technicals – Double top on the hourly chart?

Euro’s failure to take out 1.1236 (38.2% of Mar low-Aug high) in Asia today has raised prospects of a double top formation with neckline support at 1.1088 (50% of Mar low-Aug high).

A break below the immediate support of the hourly 50-MA at 1.1163 would shift risk in favor of a drop to the double top neckline at 1.1088.

On the other side, a break above 1.1236 would mean the bullish move has resumed and the pair is heading to 1.13 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.