The GBP/USD pair jumped as high as 1.4649 levels before trimming gains slightly to end the around 1.4602. The British Pound was buoyed by a better-than-expected UK services PMI, but major part of the gains were triggered by the broad based USD selling seen in the NY session. The US ADP figure highlighted slowdown in the private sector job growth. Meanwhile, the US ISM non-manufacturing also weakened more than expected and showed job losses. However, the real pain for the USD began after Fed’s Dudley expressed concerns about market and global downturn.

Dudley fired first warning shot on behalf of Fed

The risk-off in the markets that began in the early January received little/no attention from the Fed officials. On the other hand, the financial markets pushed out the rate hike bets to June, indicating that Fed and markets were not on the same page. Moreover, policymakers maintained were sure the overall outlook remained unchanged from Dec rate hike.

However, Dudley fired the first warning shot yesterday and rocked the USD bulls. His dovish comments are not surprising since the risk-off looks serious as markets even failed to sustain the BOJ led rally. Hence, the weak tone around USD may persist or strengthen further if the risk-off continues. Still, caution is advised as it is Super Thursday again. The various scenarios and their anticipated effect on Sterling could be viewed here (Macro Scan).

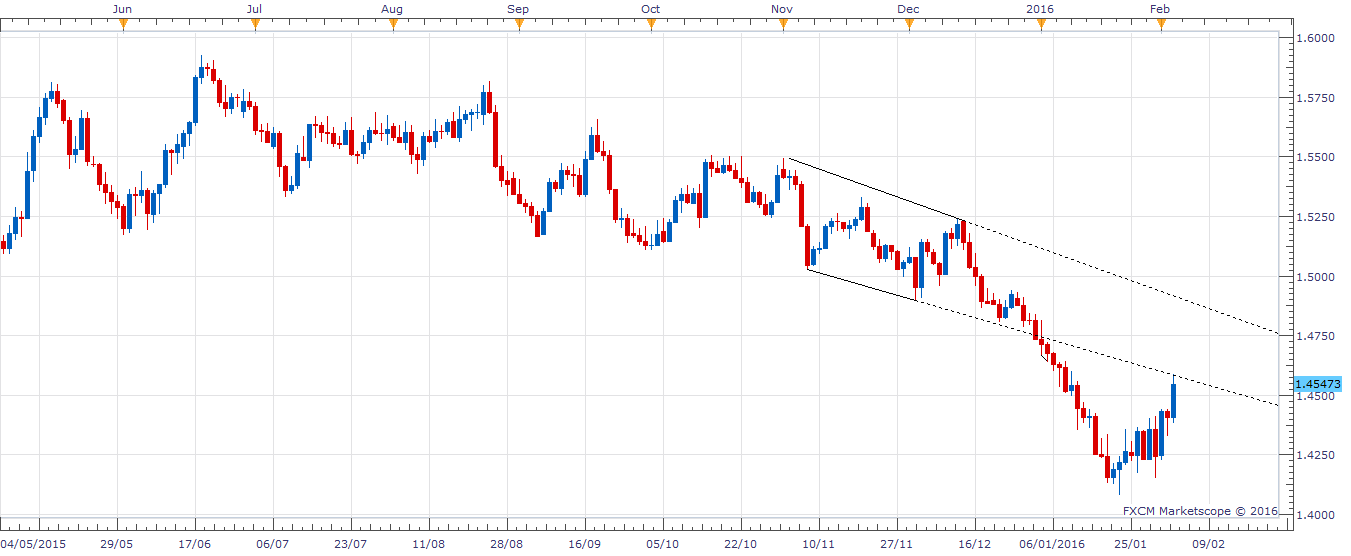

Technicals – Flirting with key resistance

The daily chart shows Sterling closed well above the falling channel resistance.

Plus, we also see an expanding triangle breakout on the 4-hour.

Hence, odds appear stacked against the bears, but technical are likely to take a back seat today.

Moreover, BOE/central banks can easily turn around the charts.

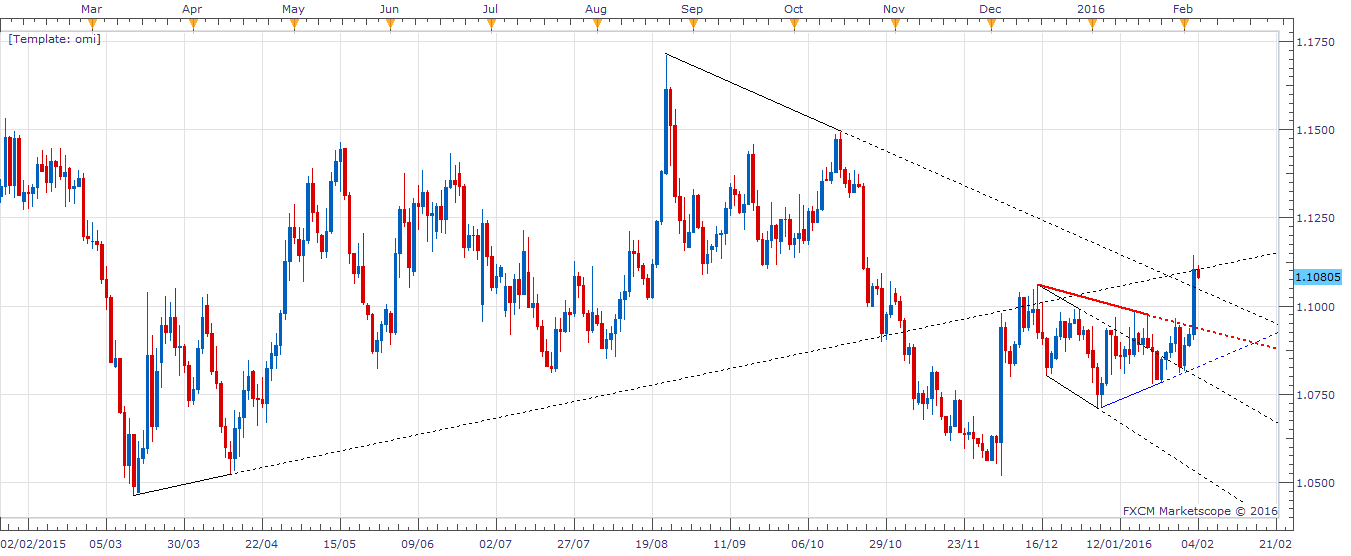

EUR/USD Analysis: Strong support at 1.1048

The EUR/USD pair witnessed a bullish break from the larger falling trend line (Aug High-Oct high). The pair closed at 1.1102 as the USD selling gathered pace in NY session following dovish comments from Fed’s Dudley.

Technicals – Bullish above 1.1102

Euro’s witnessed a bullish daily closing on Wednesday, but still needs to take out the long-term rising trend line resistance (March low to April low and extended) seen at 1.1102.

Pair was rejected at the same in Asia today and fell back to trade around 1.1080 levels.

A rebound from the larger falling trend line support seen at 1.1048 could see the pair take out 1.1102 levels and rise towards 1.12 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Australian Dollar maintains ground amid subdued US Dollar, US Nonfarm Payrolls awaited

The Australian Dollar rises on hawkish sentiment surrounding the RBA prolonging higher interest rates. Australia’s central bank is expected to maintain its current rate at 4.35% until the end of September. US Nonfarm Payrolls is expected to print a reading of 243K for April, compared to 303K prior.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold bears take action on mixed signals from US economy

Gold price fell more than 2% for the second consecutive week, erased a small portion of its losses but finally came under renewed bearish pressure. The near-term technical outlook points to a loss of bullish momentum as the market focus shifts to Fedspeak.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.