The GBP/USD pair rose as high as 1.4363 on Friday, before trimming gains to end the day moderately higher at 1.4262 levels. The UK retail sales figure released on Friday was way below estimates. However, the UK public sector net borrowing number dropped sharply and hence triggered a much needed corrective rally in the air.

GBP extremely oversold

Usually, the public sector net borrowing number is not a market moving figure. But on Friday, the data single handedly pushed the GBP/USD pair higher; that too in face of a weaker-than-expected UK retail sales number. This tells us that traders are looking for reasons – even remotely positive - to take profits on GBP shorts.

Eyes CBI total trends survey figure

The survey figure is expected to show the manufacturer’s orders book declined in January. The traders would also keep an eye on the details – domestic orders, export orders, and employment. The manufacturing sector has slowed down considerably in last two quarters and hence a weaker print would not be a surprise for the oversold GBP. Nevertheless, it may make a bullish break from the falling channel difficult.

Technicals- Stuck at falling channel resistance

The hourly chart shows, Sterling is witnessed a fake bullish breakout on Friday and ran into offers closer to falling channel resistance in Asia today.

The spot may fall back to its 5-DMA seen today at 1.4213 if the pair fails to take out the falling channel resistance of 1.4316 in early Europe.

On the other hand, a bullish break would expose Friday’s high of 1.4363. The outlook would turn bullish only if the pair sees a break above 1.4363.

EUR/USD Analysis: could re-test falling trend line resistance

The EUR/USD pair fell to 1.0792 levels on Friday as the rally in oil prices and Draghi’s strong hint at more easing in March stabilized the risk sentiment in the markets. Softer Eurozone PMI figures also weighed over the single currency. Manufacturing and service-sector PMI slowed in January bringing the Eurozone's composite index down to 53.5 from 54.3. The pair has found bids around 1.0788 (50% of 1.0517-1.1060) and now trades around 1.0815.

Eyes German IFO and Bundesbank report

The German IFO readings could surprise on the downside amid slowdown in the private sector activity (as highlighted by the PMIs on Friday) and financial market instability. A weaker number could push the EUR lower. Meanwhile, the Bundesbank’s monthly report may not receive much attention from the markets. However, hawkish tone would mean the Germany and the ECB are not on the same page and this may reduce the probability of more easing in March.

The macro data and the Bundesbank’s report may be ignored by the markets if the oil prices resume the downtrend, dragging the equities lower. In this case, EUR would head higher.

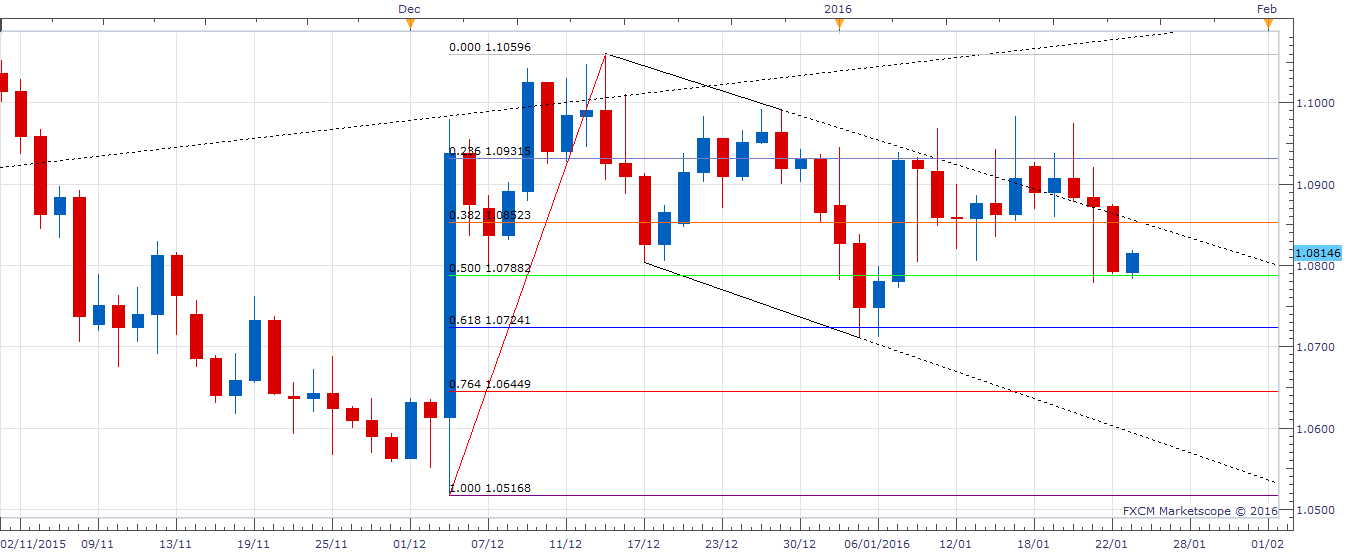

Technicals – Falling channel intact

- Euro’s sharp fall on Friday kept the falling channel formation on the daily chart intact.

Prices rebounded from around 1.0788 (50% of 1.0517-1.1060) and may head higher to 1.0860 (falling channel resistance). A break higher would expose 1.0890 (38.2% of 1.1495-1.0517).

On the other hand, a failure to take out 1.0860 could send the pair back to 1.0788 (50% of 1.0517-1.1060).

A daily close below 1.0788 would mean a short-term top at 1.0985 is in place and the pair is now heading towards the channel support at 1.0590.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700 as USD struggles ahead of data

EUR/USD is posting small gains above 1.0700 in the European session on Thursday. The pair remains underpinned by a sustained US Dollar weakness, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD stays firm above 1.2500 amid US Dollar weakness

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair's uptick is supported by a broadly weakness US Dollar on dovish Fed signals. A mixed market mood could cap the GBP/USD upside ahead of mid-tier US data.

Gold price trades with modest losses amid positive risk tone, downside seems limited

Gold price edges lower amid an uptick in the US bond yields, though the downside seems cushioned. A positive risk tone is seen as another factor undermining demand for the safe-haven precious metal.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.